Question

Can anyone please breakdown the calculations done for each row? And how to calculate in a similar way using the following data: Suppose a company

Can anyone please breakdown the calculations done for each row?

And how to calculate in a similar way using the following data:

Suppose a company has an IT asset to protect security. The company is considering 2 different security methods A and B for selection. Your task is to determine which security method is better to use.

You are given the following numbers for a company asset:

Asset Value $250000

Exposure Factor

No security method: 90%

Security method A: 70%

Security method B: 50%

Annualized Rate of Occurrence

No security method: 60%

Security method A: 40%

Security method B: 30%

Annualized Cost of Method

Security method A: $30000

Security method B: $40000

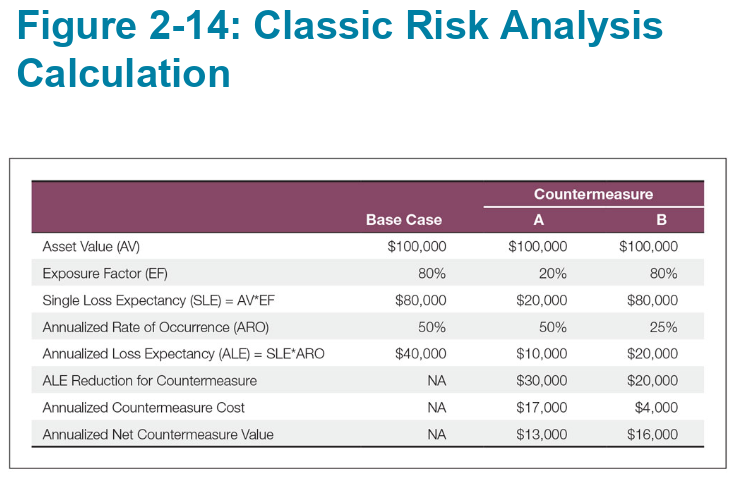

Figure 2-14: Classic Risk Analysis Calculation Asset Value (AV) Exposure Factor (EF) Single Loss Expectancy (SLE) = AV*EF Annualized Rate of Occurrence (ARO) Annualized Loss Expectancy (ALE) = SLE*ARO ALE Reduction for Countermeasure Annualized Countermeasure Cost Annualized Net Countermeasure Value Base Case $100,000 80% $80,000 50% $40,000 NA Countermeasure A B $100,000 $100,000 20% 80% $20,000 $80,000 50% 25% $10,000 $20,000 $30,000 $20,000 $17,000 $4,000 $13,000 $16,000 NA NAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started