Answered step by step

Verified Expert Solution

Question

1 Approved Answer

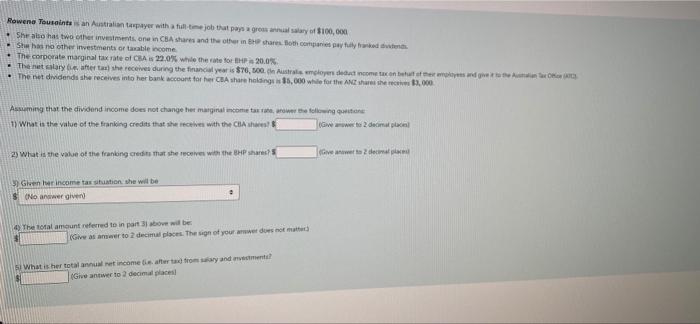

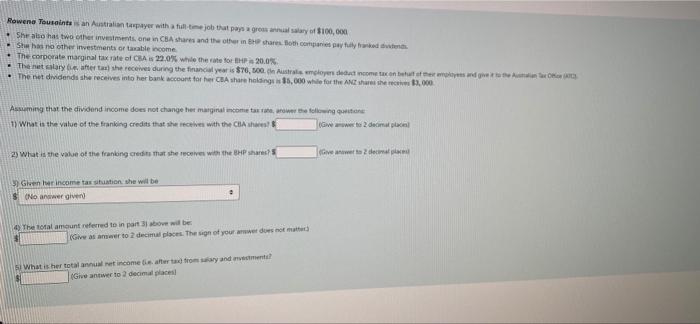

can anyone please help me !!! Rowena Tourcintaan Australian taxpayer with full job that paysay of $100,000 Shebe has two other investments, one in CA

can anyone please help me !!!

Rowena Tourcintaan Australian taxpayer with full job that paysay of $100,000 Shebe has two other investments, one in CA shares and the other in the shares oth companies and des She has no other investments or table income The corporate marginal tax rate of CBA 22,0% while the vote for HP 20.0% - The nut salary after she receives during the financial year is $70,000. In Australia moyens de come can be oferind to The ne dividends she receives into her bank account for her CBA shareholding is $5,000 while for the Ashes the 33.000 Asuming that the dividend income does not change her marginal income tax mara we following 1) What is the value of the firanking credits that she receives with the CHA we we to 2 decimal 2) What is the value of the franking credits that she receives with the Br? Gewete decom ) Givenler income tax shton she will be (No answer giver 4 The total amount referred to in part 3 bove will be (Gamwer to 2 decimal places. The sign of your awwe does not matter What is ber total anu et income altura tomary and mental Give awer to 2 decimal places! Rowena Tourcintaan Australian taxpayer with full job that paysay of $100,000 Shebe has two other investments, one in CA shares and the other in the shares oth companies and des She has no other investments or table income The corporate marginal tax rate of CBA 22,0% while the vote for HP 20.0% - The nut salary after she receives during the financial year is $70,000. In Australia moyens de come can be oferind to The ne dividends she receives into her bank account for her CBA shareholding is $5,000 while for the Ashes the 33.000 Asuming that the dividend income does not change her marginal income tax mara we following 1) What is the value of the firanking credits that she receives with the CHA we we to 2 decimal 2) What is the value of the franking credits that she receives with the Br? Gewete decom ) Givenler income tax shton she will be (No answer giver 4 The total amount referred to in part 3 bove will be (Gamwer to 2 decimal places. The sign of your awwe does not matter What is ber total anu et income altura tomary and mental Give awer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started