Can anyone please solve? Target Marketing Strategy Accounting

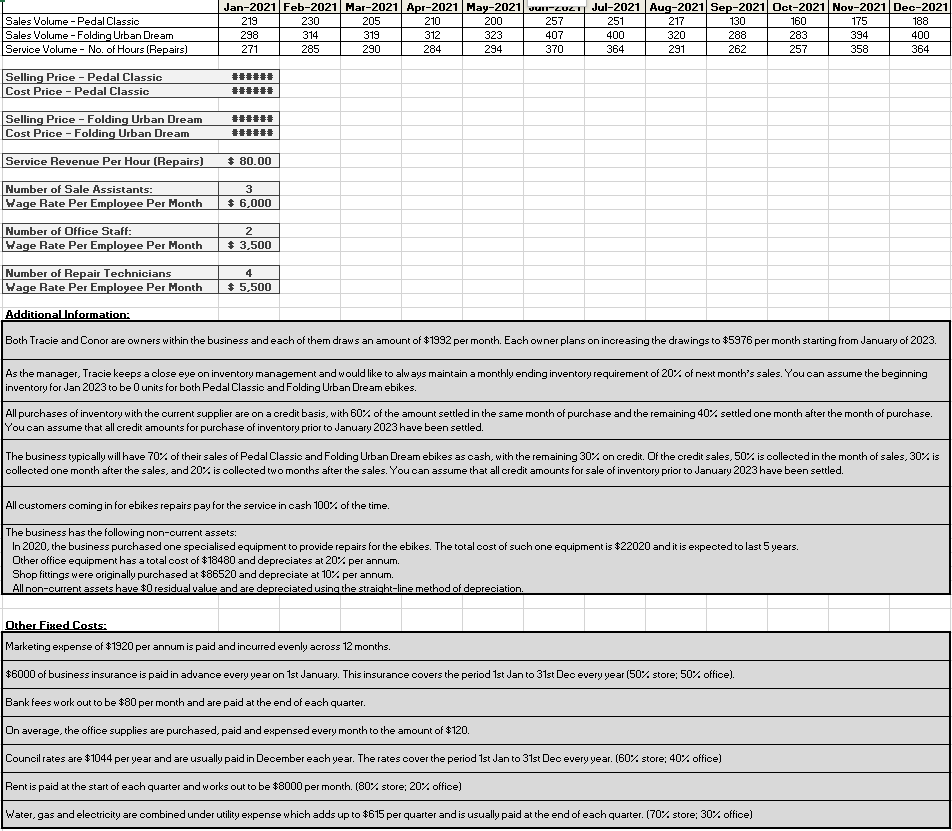

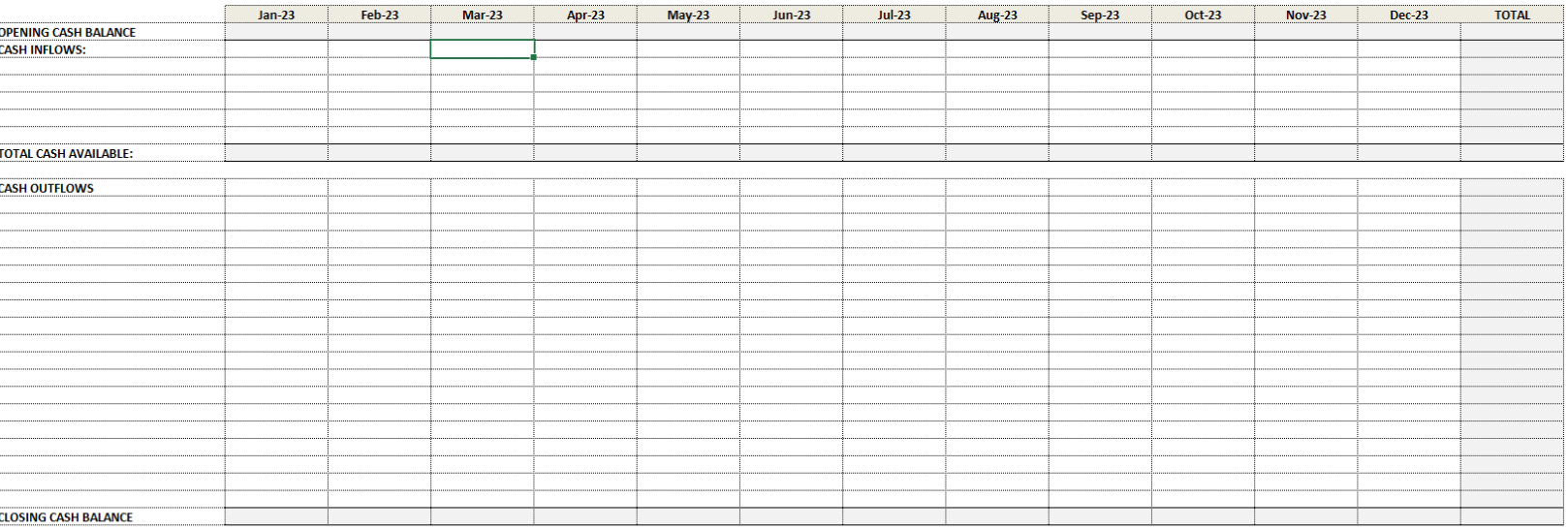

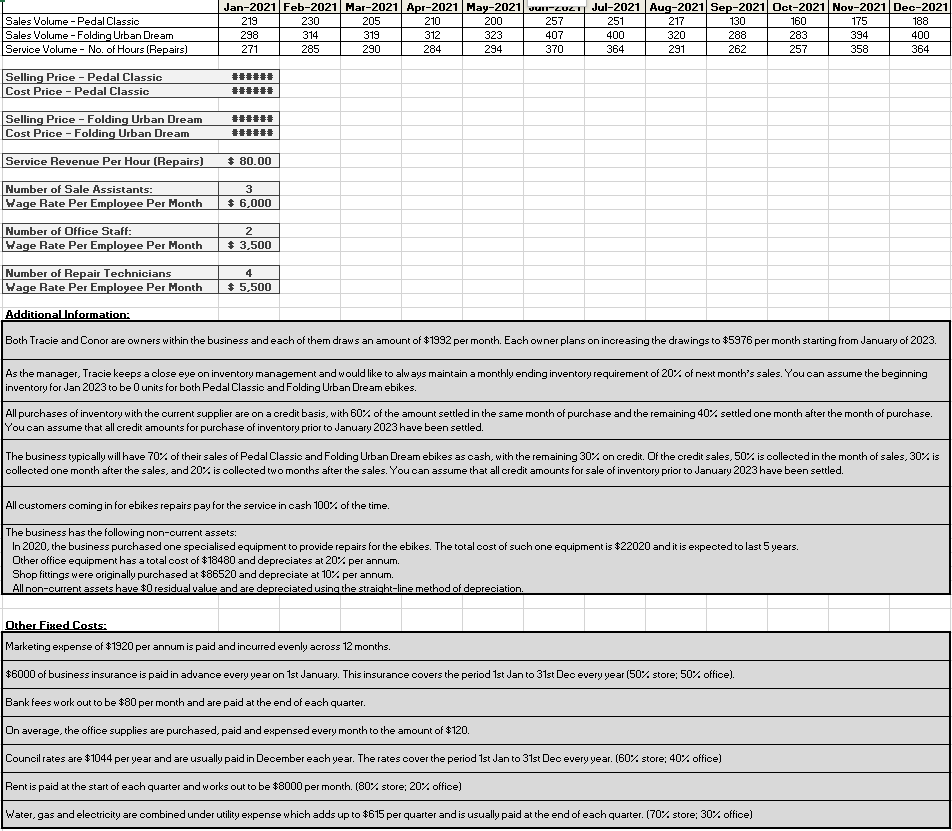

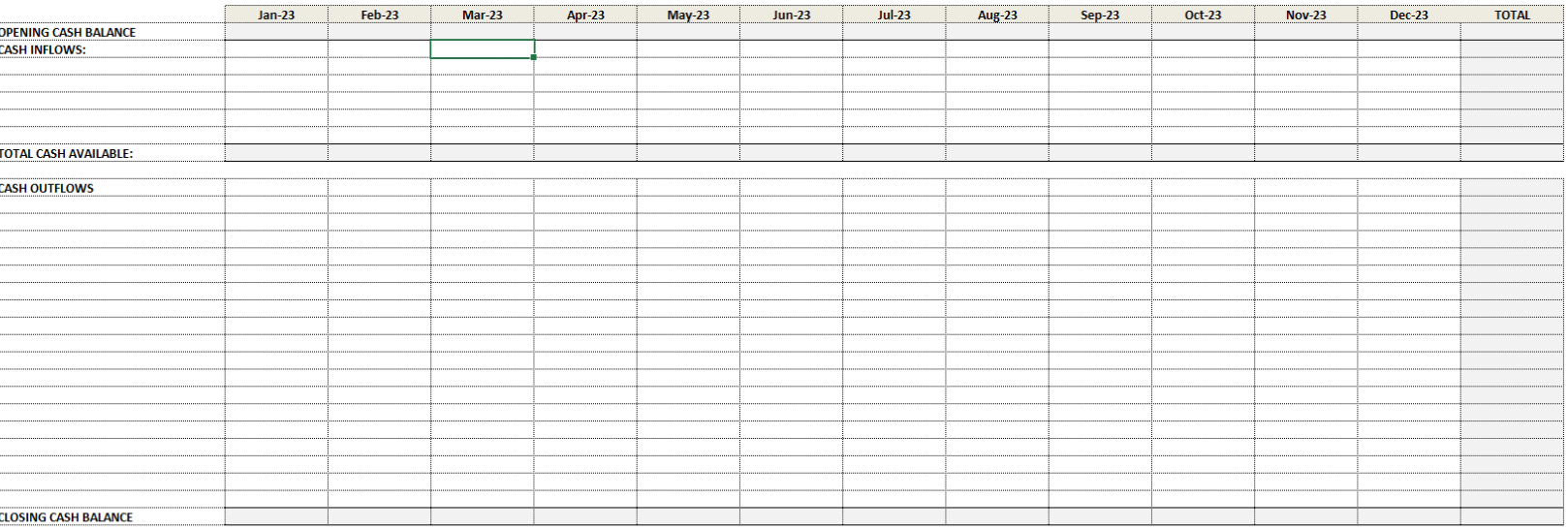

\begin{tabular}{|l|c|} \hline Number of Office Staff: & 2 \\ \hline Hage Rate Per Employee Per Month & $3,500 \\ \hline \end{tabular} \begin{tabular}{|l|c|} \hline Number of Repair Technicians & 4 \\ \hline Hage Rate Per Employee Per Month & $5,500 \\ \hline \end{tabular} Additional lnformation: Both Tracie and Conor are owners within the business and each of them draws an amount of $1992 per month. Each owner plans on increasing the draw ings to $5976 per month starting from January of 2023. As the manager, Tracie keeps a close eye on inventory management and would like to alw ays maintain a monthly ending inventory requirement of 20% of next month's sales. You can assume the beginning inventory for Jan 2023 to be 0 units for both Pedal Classic and Folding Urban Dream ebikes. All purchases of inventory with the current supplier are on a credit basis, with 60% of the amount settled in the same month of purchase and the remaining 40% settled one month after the month of purchase. You can assume that all credit amounts for purchase of inventory prior to January 2023 have been settled. The business typically will have 70% of their sales of Pedal Classic and Folding Urban Dream ebikes as cash, with the remaining 30% on credit. Df the credit sales, 50% is collected in the month of sales, 30% is collected one month after the sales, and 20% is collected wo months after the sales. You can assume that all credit amounts for sale of inventory prior to danuary 2023 have been settled. All customers coming in for ebikes repairs pay for the service in cash 100% of the time. The business has the following non-current assets: In 2020 , the business purchased one specialised equipment to provide repairs for the ebikes. The total cost of such one equipment is $22020 and it is expected to last 5 years. Other office equipment has a total cost of $18480 and depreciates at 20% per annum. Shop fittings were originally purchased at $86520 and depreciate at 10% per annum. All non-current assets have $0 residual value and are depreciated using the straight-line method of depreciation. Gther Fired Costs: Marketing expense of $1920 per annum is paid and incurred evenly across 12 months. $6000 of business insurance is paid in advance every year on 1 st January. This insurance covers the period 1 st Jan to 31 st Dec every year (50% store; 50% office). Bank fees work out to be $80 per month and are paid at the end of each quarter. On average, the office supplies are purchased, paid and expensed every month to the amount of $120. Council rates are $1044 per year and are usually paid in December eachyear. The rates cover the period 1 st dan to 31 st Dec every year. (60\% store; 40% office) Rent is paid at the start of each quarter and works out to be $8000 per month. ( 80% store; 20% office) Water, gas and electricity are combined under utility expense which adds up to $615 per quarter and is usually paid at the end of each quarter. (70% store; 30% office) TOTAL CASH AVAILABLE: CASH OUTFLOWS \begin{tabular}{|l|c|} \hline Number of Office Staff: & 2 \\ \hline Hage Rate Per Employee Per Month & $3,500 \\ \hline \end{tabular} \begin{tabular}{|l|c|} \hline Number of Repair Technicians & 4 \\ \hline Hage Rate Per Employee Per Month & $5,500 \\ \hline \end{tabular} Additional lnformation: Both Tracie and Conor are owners within the business and each of them draws an amount of $1992 per month. Each owner plans on increasing the draw ings to $5976 per month starting from January of 2023. As the manager, Tracie keeps a close eye on inventory management and would like to alw ays maintain a monthly ending inventory requirement of 20% of next month's sales. You can assume the beginning inventory for Jan 2023 to be 0 units for both Pedal Classic and Folding Urban Dream ebikes. All purchases of inventory with the current supplier are on a credit basis, with 60% of the amount settled in the same month of purchase and the remaining 40% settled one month after the month of purchase. You can assume that all credit amounts for purchase of inventory prior to January 2023 have been settled. The business typically will have 70% of their sales of Pedal Classic and Folding Urban Dream ebikes as cash, with the remaining 30% on credit. Df the credit sales, 50% is collected in the month of sales, 30% is collected one month after the sales, and 20% is collected wo months after the sales. You can assume that all credit amounts for sale of inventory prior to danuary 2023 have been settled. All customers coming in for ebikes repairs pay for the service in cash 100% of the time. The business has the following non-current assets: In 2020 , the business purchased one specialised equipment to provide repairs for the ebikes. The total cost of such one equipment is $22020 and it is expected to last 5 years. Other office equipment has a total cost of $18480 and depreciates at 20% per annum. Shop fittings were originally purchased at $86520 and depreciate at 10% per annum. All non-current assets have $0 residual value and are depreciated using the straight-line method of depreciation. Gther Fired Costs: Marketing expense of $1920 per annum is paid and incurred evenly across 12 months. $6000 of business insurance is paid in advance every year on 1 st January. This insurance covers the period 1 st Jan to 31 st Dec every year (50% store; 50% office). Bank fees work out to be $80 per month and are paid at the end of each quarter. On average, the office supplies are purchased, paid and expensed every month to the amount of $120. Council rates are $1044 per year and are usually paid in December eachyear. The rates cover the period 1 st dan to 31 st Dec every year. (60\% store; 40% office) Rent is paid at the start of each quarter and works out to be $8000 per month. ( 80% store; 20% office) Water, gas and electricity are combined under utility expense which adds up to $615 per quarter and is usually paid at the end of each quarter. (70% store; 30% office) TOTAL CASH AVAILABLE: CASH OUTFLOWS