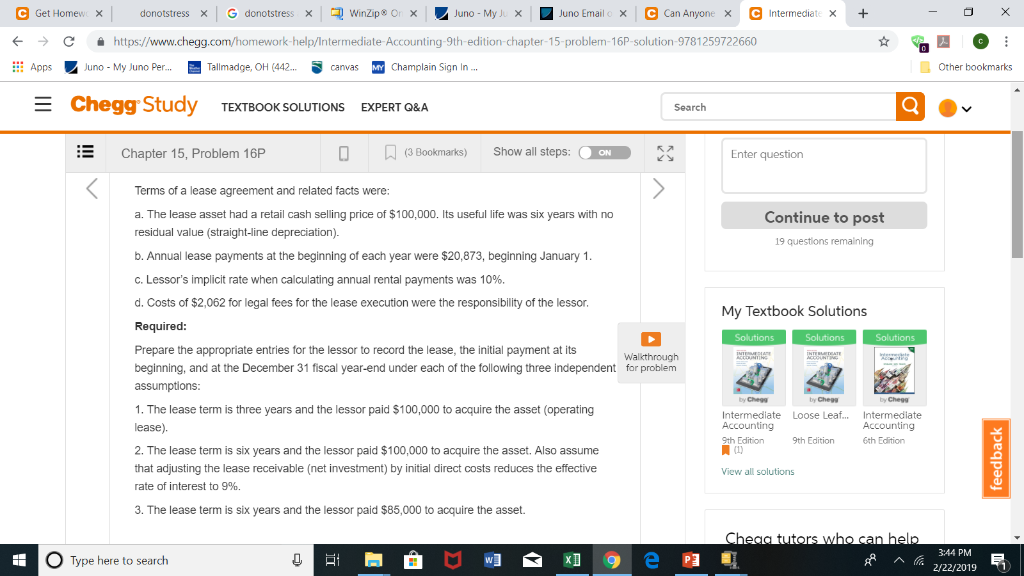

Can anyone provide the answer with explanation to Intermediate Accounting Ch 15 P16, David Spiceland 9th edition? Thanks

https://www.chegg.com home work help Intermediate Accounting 9th edition chapter 15 problem 16P-solution 9781259722660 Apps Juno- My Juno Per....Tallmadge, OH (442.canvas Y Champlain Sign In. Other bookmarks E Chegg Study TEXTBOOK SOLUTIONS EXPERT Q&A Search Chapter 15, Problem 16P (3 Bookmarks) Show all steps: Enter question Terms of a lease agreement and related facts were a. The lease asset had a retail cash selling price of $100,000. Its useful life was six years with no residual value (straight-line depreciation). b. Annual lease payments at the beginning of each year were $20,873, beginning January 1 C. Lessor's implicit rate when calculating annual rental payments was 10%. d. Costs of $2,062 for legal fees for the lease execution were the responsibility of the lessor Required: Continue to post 19 questions remaining My Textbook Solutions Prepare the appropriate entries for the lessor to record the lease, the initial payment at its beginning, and at the December 31 fiscal year-end under each of the following three independent for problenm assumptions by Chegg by Chegg by Chegg 1. The lease term is three years and the lessor paid $100,000 to acquire the asset (operating lease). 2. The lease term is six years and the lessor paid $100,000 to acquire the asset. Also assume that adjusting the lease receivable (net investment) by initial direct costs reduces the effective rate of interest to 9%. Intermediate Loose Leaf... Intermediate th Edition A u) 9th Edition th Edition View all solutions 3. The lease term is six years and the lessor paid $85,000 to acquire the asset. Cheaa tutors who can help 3:44 PM O Type here to search 2/22/2019 1 https://www.chegg.com home work help Intermediate Accounting 9th edition chapter 15 problem 16P-solution 9781259722660 Apps Juno- My Juno Per....Tallmadge, OH (442.canvas Y Champlain Sign In. Other bookmarks E Chegg Study TEXTBOOK SOLUTIONS EXPERT Q&A Search Chapter 15, Problem 16P (3 Bookmarks) Show all steps: Enter question Terms of a lease agreement and related facts were a. The lease asset had a retail cash selling price of $100,000. Its useful life was six years with no residual value (straight-line depreciation). b. Annual lease payments at the beginning of each year were $20,873, beginning January 1 C. Lessor's implicit rate when calculating annual rental payments was 10%. d. Costs of $2,062 for legal fees for the lease execution were the responsibility of the lessor Required: Continue to post 19 questions remaining My Textbook Solutions Prepare the appropriate entries for the lessor to record the lease, the initial payment at its beginning, and at the December 31 fiscal year-end under each of the following three independent for problenm assumptions by Chegg by Chegg by Chegg 1. The lease term is three years and the lessor paid $100,000 to acquire the asset (operating lease). 2. The lease term is six years and the lessor paid $100,000 to acquire the asset. Also assume that adjusting the lease receivable (net investment) by initial direct costs reduces the effective rate of interest to 9%. Intermediate Loose Leaf... Intermediate th Edition A u) 9th Edition th Edition View all solutions 3. The lease term is six years and the lessor paid $85,000 to acquire the asset. Cheaa tutors who can help 3:44 PM O Type here to search 2/22/2019 1