Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can anyone solve this problem? 1. The Black-Scholes formula (a) Suppose for t I. The Black formula (a) Suppose for t T, a Stock that

Can anyone solve this problem?

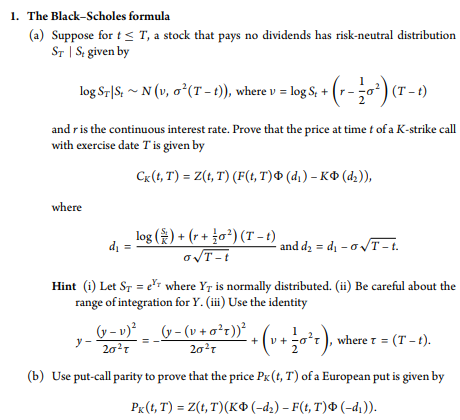

I. The Black formula (a) Suppose for t T, a Stock that pays no dividends has risk-neutral distribution given by log N (v, Where v log + r 2 -a (T-t) and r is the continuous interest rate. Prove that the price at time Of a K -strike call With exercise date T is given by CK(t, T) z(t, T) (F(t, T)'b - (d2)), log + (r + (T t) Hint (i) Let Where is normally distributed. (ii) Be careful about the range Of integration for Y. (iii) Use the identity o-v)2 202 r + v + a r , where r = (T 202 r (b) Use put-call parity to prove that the price T) Of a European put is given by PK@, T) = z(t, (-d2) - T)cb (4)).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started