Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can anyone tell me where is 0.92 come from? Question 2 Industrial and Commercial Bank of China (ICBC) is planning to raise $800 million through

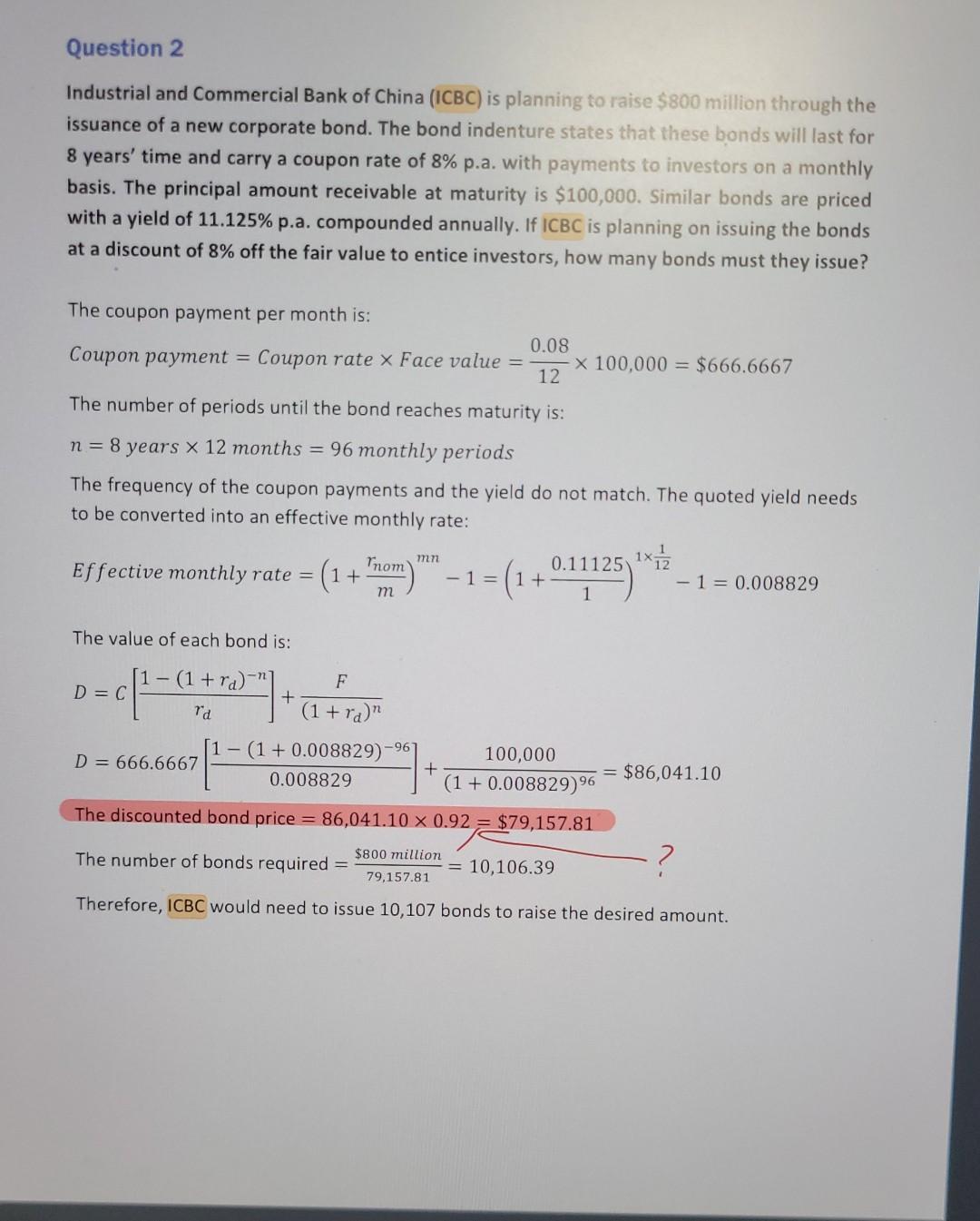

Can anyone tell me where is 0.92 come from?

Question 2 Industrial and Commercial Bank of China (ICBC) is planning to raise $800 million through the issuance of a new corporate bond. The bond indenture states that these bonds will last for 8 years' time and carry a coupon rate of 8% p.a. with payments to investors on a monthly basis. The principal amount receivable at maturity is $100,000. Similar bonds are priced with a yield of 11.125% p.a. compounded annually. If ICBC is planning on issuing the bonds at a discount of 8% off the fair value to entice investors, how many bonds must they issue? The coupon payment per month is: 0.08 Coupon payment = Coupon rate x Face value = x 100,000 $666.6667 12 The number of periods until the bond reaches maturity is: n = 8 years x 12 months = 96 monthly periods The frequency of the coupon payments and the yield do not match. The quoted yield needs to be converted into an effective monthly rate: mn 1x1/2 Tnom Effective monthly rate = = (1 + = (1 + 0.11125) 2 - 1 = 0.008829 m The value of each bond is: (1+ra)"] F D = C =c| + Td (1+ra)n 100,000 D=666.6667 1 (1+0.008829)-961 0.008829 + = $86,041.10 (1 + 0.008829)6 The discounted bond price = 86,041.10 x 0.92 $79,157.81 The number of bonds required = $800 million = 10,106.39 79,157.81 Therefore, ICBC would need to issue 10,107 bonds to raise the desired amount. -1=Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started