Answered step by step

Verified Expert Solution

Question

1 Approved Answer

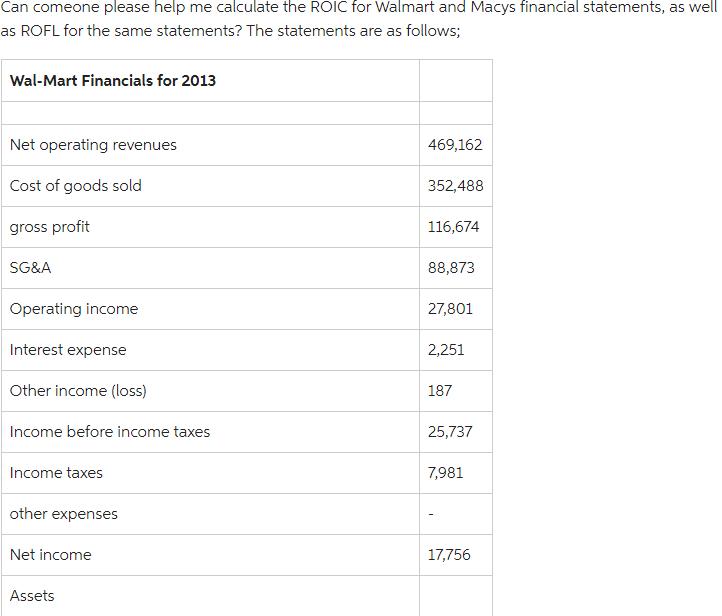

Can comeone please help me calculate the ROIC for Walmart and Macys financial statements, as well as ROFL for the same statements? The statements

Can comeone please help me calculate the ROIC for Walmart and Macys financial statements, as well as ROFL for the same statements? The statements are as follows; Wal-Mart Financials for 2013 Net operating revenues Cost of goods sold gross profit SG&A Operating income Interest expense Other income (loss) Income before income taxes Income taxes other expenses Net income Assets 469,162 352,488 116,674 88,873 27,801 2,251 187 25,737 7,981 17,756 Cash and cash equivalents Short term investments Net receivables Inventories Total current assets Property, plant and equipment Goodwill Other assets Total assets Liabilities and Stockholder Equity Accounts payable Short-term debt Other current liability Total current liability Long-term debt Other liabilities 7,781 6,768 43,803 59,940 116,681 20,497 5,987 203,105 59,099 12,719 71,818 41,417

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started