Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have just started working as a junior accountant for Suppan & Associates LLP, a mid- size firm specializing in the audit of small

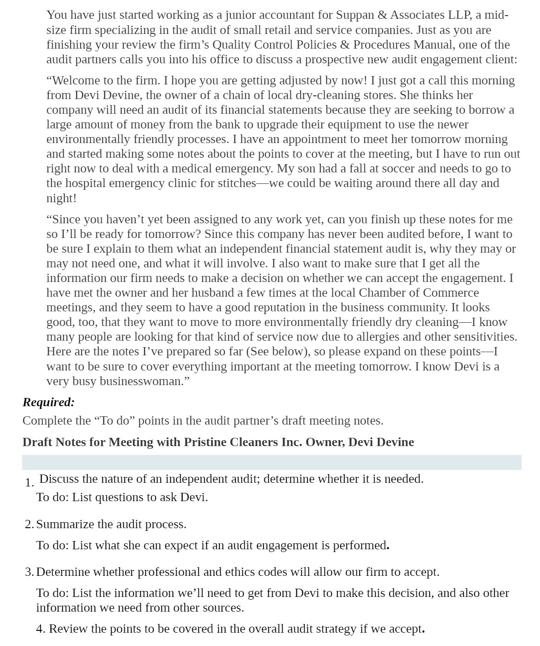

You have just started working as a junior accountant for Suppan & Associates LLP, a mid- size firm specializing in the audit of small retail and service companies. Just as you are finishing your review the firm's Quality Control Policies & Procedures Manual, one of the audit partners calls you into his office to discuss a prospective new audit engagement client: "Welcome to the firm. I hope you are getting adjusted by now! I just got a call this morning from Devi Devine, the owner of a chain of local dry-cleaning stores. She thinks her company will need an audit of its financial statements because they are seeking to borrow a large amount of money from the bank to upgrade their equipment to use the newer environmentally friendly processes. I have an appointment to meet her tomorrow morning and started making some notes about the points to cover at the meeting, but I have to run out right now to deal with a medical emergency. My son had a fall at soccer and needs to go to the hospital emergency clinic for stitches-we could be waiting around there all day and night! "Since you haven't yet been assigned to any work yet, can you finish up these notes for me so I'll be ready for tomorrow? Since this company has never been audited before, I want to be sure I explain to them what an independent financial statement audit is, why they may or may not need one, and what it will involve. I also want to make sure that I get all the information our firm needs to make a decision on whether we can accept the engagement. I have met the owner and her husband a few times at the local Chamber of Commerce meetings, and they seem to have a good reputation in the business community. It looks good, too, that they want to move to more environmentally friendly dry cleaning-I know many people are looking for that kind of service now due to allergies and other sensitivities. Here are the notes I've prepared so far (See below), so please expand on these points-I want to be sure to cover everything important at the meeting tomorrow. I know Devi is a very busy businesswoman." Required: Complete the "To do" points in the audit partner's draft meeting notes. Draft Notes for Meeting with Pristine Cleaners Inc. Owner, Devi Devine 1. Discuss the nature of an independent audit; determine whether it is needed. To do: List questions to ask Devi. 2. Summarize the audit process. To do: List what she can expect if an audit engagement is performed. 3. Determine whether professional and ethics codes will allow our firm to accept. To do: List the information we'll need to get from Devi to make this decision, and also other information we need from other sources. 4. Review the points to be covered in the overall audit strategy if we accept.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 To determine if an audit is necessary questions to ask Devi include What is the purpose of the loa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started