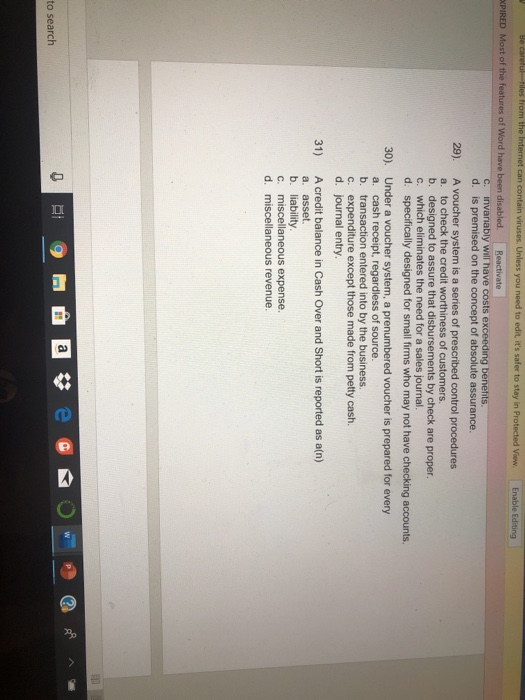

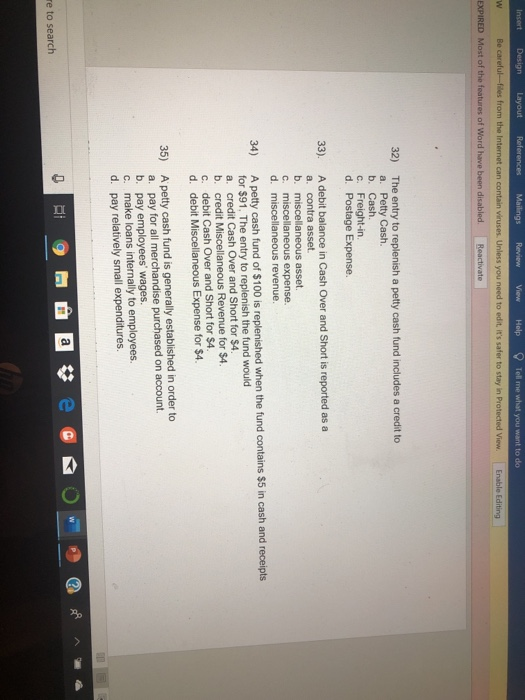

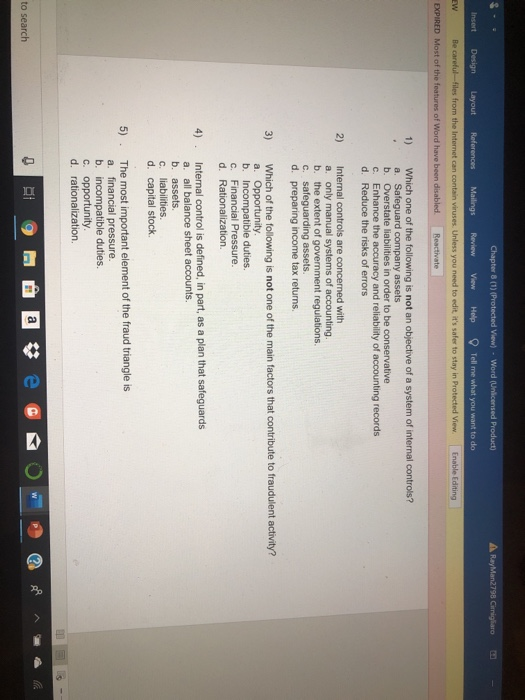

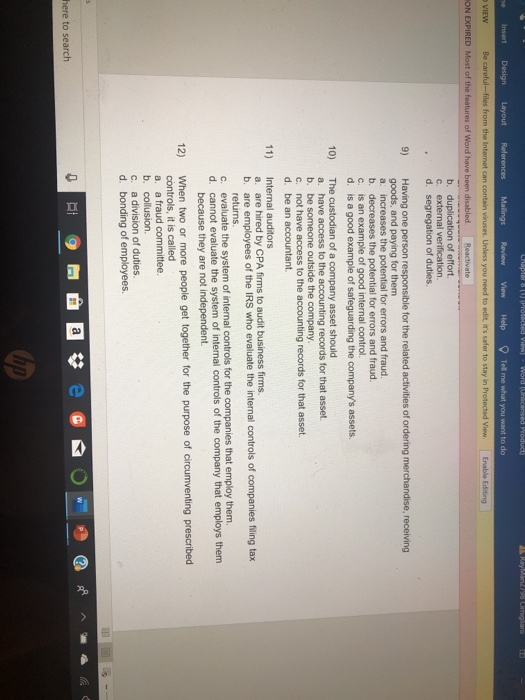

can contain vi XPIRED Most of the features of Word have been disabled. Reactivate exceeding benefits is premised on the concept of absolute assurance. d. 29). A voucher system is a series of prescribed control procedures a. to check the credit worthiness of customers. b. designed to assure that disbursements by check are proper. c. which eliminates the need for a sales journal d. specifically designed for small firms who may not have checking accounts. 30). Under a voucher system, a prenumbered voucher is prepared for every a. cash receipt, regardless of source. b. transaction entered into by the business. c. expenditure except those made from petty cash. d. journal entry. A credit balance in Cash Over and Short is reported as a(n) a. asset 31) b. liability c. miscellaneous expense. d. miscellaneous revenue. to search Be careful-files from the Internet can viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing 32) The entry to replenish a petty cash fund includes a credit to a. Petty Cash. b. Cash C. Freight-in 33) A debit balance in Cash Over and Short is reported as a a. contra asset b. miscellaneous asset C. miscellaneous expense. d. miscellaneous revenue 34) A petty cash fund of $100 is replenished when the fund contains $5 in cash and receipts for $91, The entry to replenish the fund would a. credit Cash Over and Short for $4 credit Miscellaneous Revenue for $4. debit Cash Over and Short for $A debit Miscellaneous Expense for $4. b. c. d. A petty cash fund is generally established in order to a. pay for all merchandise purchased on account. b. pay employees wages c. make loans internally to employees. d. pay relatively small expenditures. 35) e to search View Help Tell me what you want to do Unless you need to edit, it's safer to stay in Protected View Enable Editing 1) Which one of the following is not an objective of a system of internal controls? b. Overstate liabilities in order to be conservative Enhance the accuracy and reliability of accounting records Reduce the risks of errors C. d. 2) Internal controls are concened with a. only manual systems of accounting. b. the extent of government regulations. c. safeguarding assets. d. preparing income tax returns. 3) Which of the following is not one of the main factors that contribute to fraudulent activity? b. Incompatible duties d. Rationalization 4) Internal control is defined, in part, as a plan that safeguards a. all balance sheet accounts. c. liabilities. d. capital stock. The most important element of the fraud triangle is a. financial pressure. b. incompatible duties c. opportunity d. rationalization. 5). to search Unless you need to edit, it's safer to stay in ON EXPIRED Most of the features of Word have been disabled. Reactivate b. d of effort. , d. segregation of duties. Having one person responsible for the related activities of ordering merchandise, receiving goods, and paying for them a. increases the potential for errors and fraud. b. decreases the potential for errors and fraud. c. is an example of good internal control. d. is a good example of safeguarding th 9) company's assets. The custodian of a company asset should a. have access to the accounting records for that asset b. be someone outside the company c. not have access to the accounting records for that asset. d, be an accountant. 10) 11) Internal auditors a. are hired by CPA firms to audit business firms. b. are employees of the IRS who evaluate the internal controls of companies filing tax returns c. evaluate the system of internal controls for the companies that employ them. d. cannot evaluate the system of internal controls of the company that employs them because they are not independent. When two or more people get together for the purpose of circumventing prescribed controls, it is called 12) c. a division of duties. d. bonding of employees. here to search