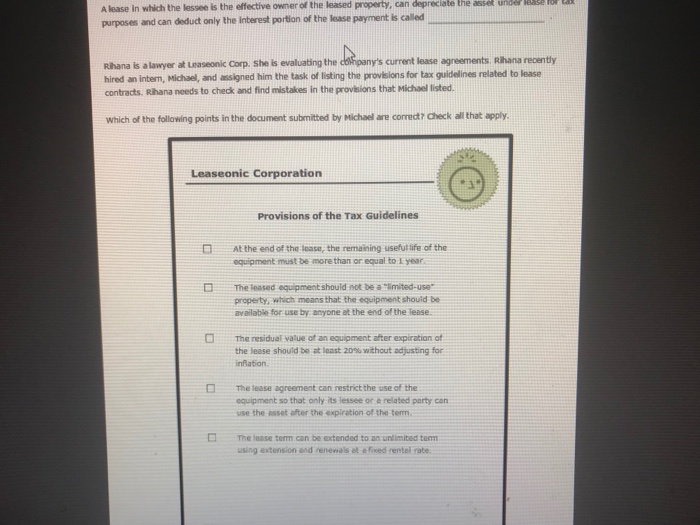

can depreciate the assel A lease in which the lessee is the effective owner of the leased property, purposes and can deduct only the Inberest portion of the lease payment is called Rihana is a lawyer at Leaseonic Corp. She is evaluating the hired an intem, Michael, and assigned him the task of listing the provisions for tax guidelines related to lease contracts. Rihana needs to check and find mistakes in the provisions that Michsel listed s current lease agreements Rihana recently which of the following points in the document submitted by Michael are correct? Check all that apply Leaseonic Corporation Provisions of the Tax Guidelines At the end of the lease, the remaining usefut life of the equipment must be more than or equal to E year ? The eased equipment should not be a-smited-use. property, which means that the equipment should be available for use by anyone at the end of the Tease The residual value of an equipment after expiration at the lease should be?least 20% without adjusting for inflation. The lease agreement can restrict the use of the equipment so that only its lessee or e related party can use the asset after the expiration of the term E The lease tern can be extended to an untimibed tem using extension and renewa's eFixed rentel rabe. can depreciate the assel A lease in which the lessee is the effective owner of the leased property, purposes and can deduct only the Inberest portion of the lease payment is called Rihana is a lawyer at Leaseonic Corp. She is evaluating the hired an intem, Michael, and assigned him the task of listing the provisions for tax guidelines related to lease contracts. Rihana needs to check and find mistakes in the provisions that Michsel listed s current lease agreements Rihana recently which of the following points in the document submitted by Michael are correct? Check all that apply Leaseonic Corporation Provisions of the Tax Guidelines At the end of the lease, the remaining usefut life of the equipment must be more than or equal to E year ? The eased equipment should not be a-smited-use. property, which means that the equipment should be available for use by anyone at the end of the Tease The residual value of an equipment after expiration at the lease should be?least 20% without adjusting for inflation. The lease agreement can restrict the use of the equipment so that only its lessee or e related party can use the asset after the expiration of the term E The lease tern can be extended to an untimibed tem using extension and renewa's eFixed rentel rabe