Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can help me with this Ivanhoe issues a bank-accepted bill to pay its debt. The bill is issued for 212 days, with a face value

can help me with this

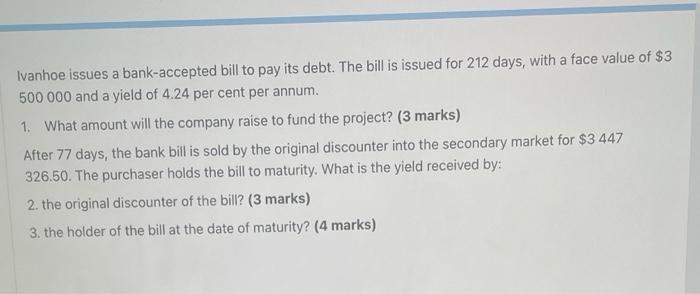

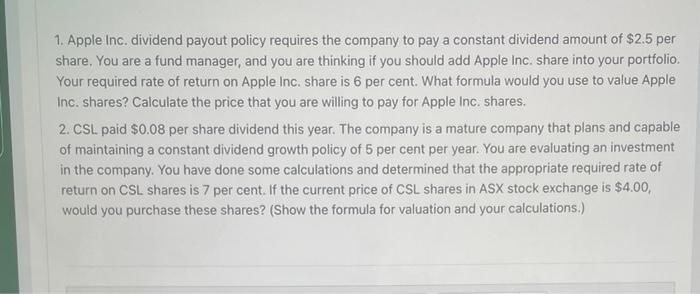

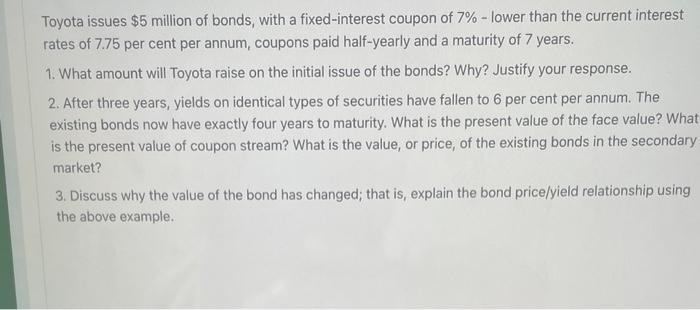

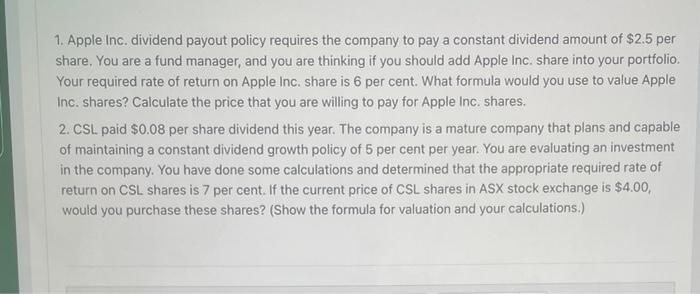

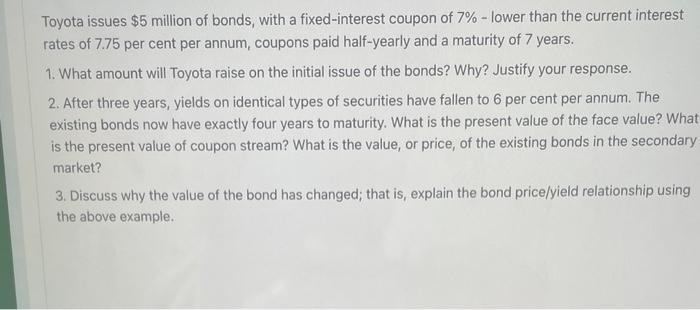

Ivanhoe issues a bank-accepted bill to pay its debt. The bill is issued for 212 days, with a face value of $3 500000 and a yield of 4.24 per cent per annum. 1. What amount will the company raise to fund the project? ( 3 marks) After 77 days, the bank bill is sold by the original discounter into the secondary market for $3447 326.50. The purchaser holds the bill to maturity. What is the yield received by: 2. the original discounter of the bill? ( 3 marks) 3. the holder of the bill at the date of maturity? (4 marks) 1. Apple Inc. dividend payout policy requires the company to pay a constant dividend amount of $2.5 per share, You are a fund manager, and you are thinking if you should add Apple Inc. share into your portfolio. Your required rate of return on Apple Inc. share is 6 per cent. What formula would you use to value Apple Inc. shares? Calculate the price that you are willing to pay for Apple Inc. shares. 2. CSL paid $0.08 per share dividend this year. The company is a mature company that plans and capable of maintaining a constant dividend growth policy of 5 per cent per year. You are evaluating an investment in the company. You have done some calculations and determined that the appropriate required rate of return on CSL shares is 7 per cent. If the current price of CSL shares in ASX stock exchange is $4.00, would you purchase these shares? (Show the formula for valuation and your calculations.) Toyota issues $5 million of bonds, with a fixed-interest coupon of 7% - lower than the current interest rates of 7.75 per cent per annum, coupons paid half-yearly and a maturity of 7 years. 1. What amount will Toyota raise on the initial issue of the bonds? Why? Justify your response. 2. After three years, yields on identical types of securities have fallen to 6 per cent per annum. The existing bonds now have exactly four years to maturity. What is the present value of the face value? What is the present value of coupon stream? What is the value, or price, of the existing bonds in the secondary market? 3. Discuss why the value of the bond has changed; that is, explain the bond price/yield relationship using the above example

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started