Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can I afford this home? - Part 2 Can Shen and Valerie afford this home using the installment debt loan criterion? Next week, your friends

Can I afford this home? Part

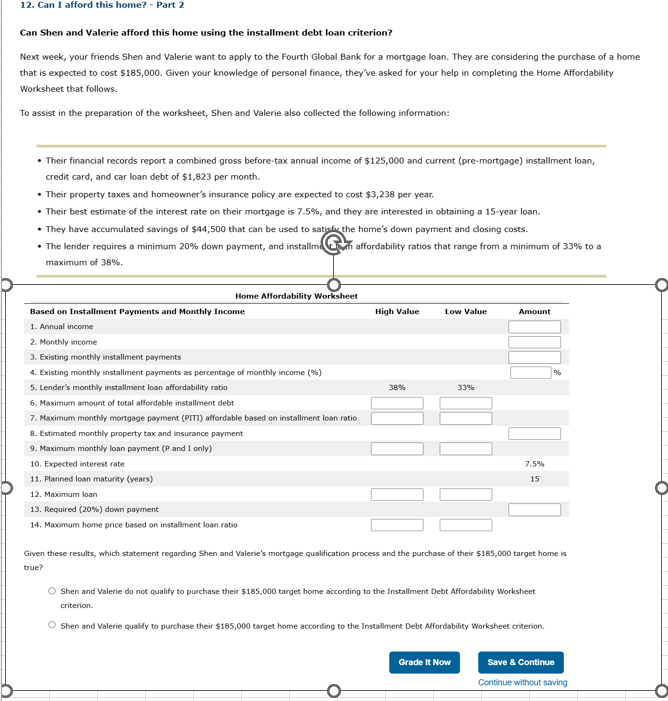

Can Shen and Valerie afford this home using the installment debt loan criterion?

Next week, your friends Shen and Valerie want to apply to the Fourth Global Bank for a mortgage loan. They are considering the purchase of a home

that is expected to cost $ Given your knowledge of personal finance, they've asked for your help in completing the Home Affordability

Worksheet that follows.

To assist in the preparation of the worksheet, Shen and Valerie also collected the following information:

Their financial records report a combined gross beforetax annual income of $ and current premortgage installment loan,

credit card, and car loan debt of $ per month.

Their property taxes and homeowner's insurance policy are expected to cost $ per year.

Their best estimate of the interest rate on their mortgage is and they are interested in obtaining a year loan.

They have accumulated savings of $ that can be used to satiche the home's down payment and closing costs.

The lender requires a minimum down payment, and installme affordability ratios that range from a minimum of to a

maximum of

Given these results, which statement regarding Shen and Valerie's mortgage qualification process and the purchase of their $ target home is

true?

Shen and Valerie do not qualify to purchase their $ target home according to the Installment Debt Affordability Worksheet

criterion.

Shen and Valerie qualify to purchase their $ target home according to the Installment Debt Affordability Worksheet criterion.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started