Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can I also please have the work shown because im having a hard time understand this lesson. thank you!! At the beginning of the year,

Can I also please have the work shown because im having a hard time understand this lesson.

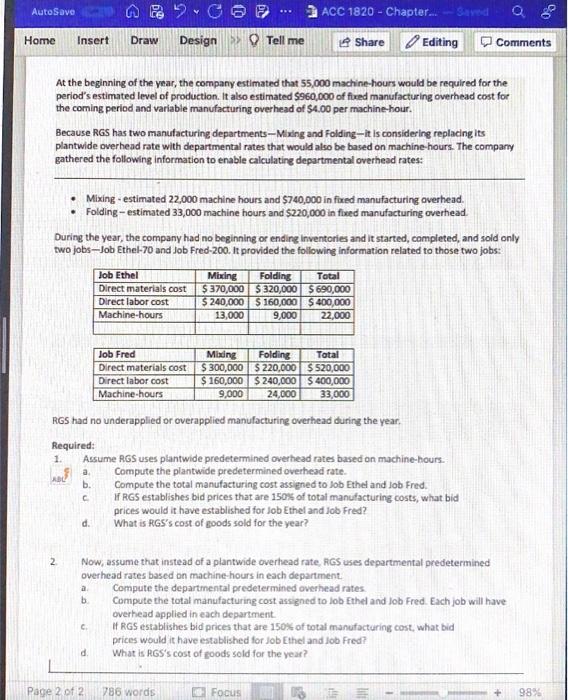

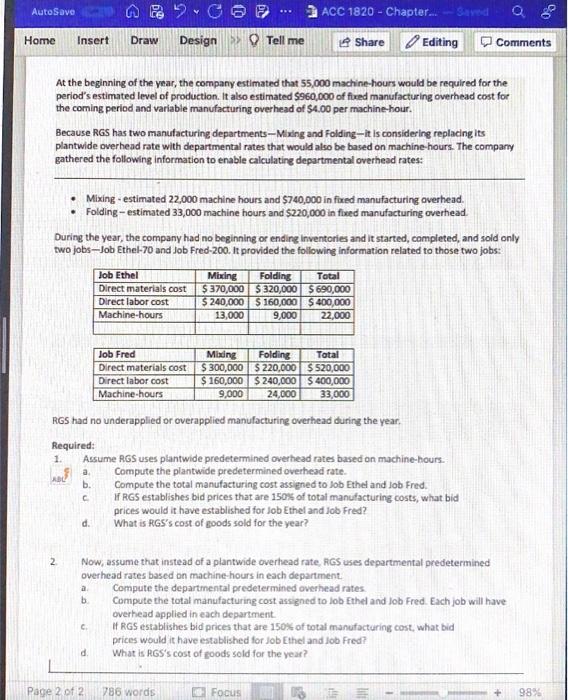

At the beginning of the year, the company estimated that 55,000 machine-hours would be required for the period's estimated level of production. It also estimated $960,000 of fuxed manufacturing overhead cost for the coming period and variable manufacturing overhead of $4.00 per machine-hour. Because RGS has two manufacturing departments-Mixing and Folding - it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The compary gathered the following information to enable calculating departmental overhead rates: - Mixing - estimated 22,000 machine hours and $740,000 in fixed manufacturing overhead. - Folding - estimated 33,000 machine hours and $220,000 in fixed manufacturing overhead During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobs - Job Ethel-70 and Job Fred-200. It provided the following information related to those two jobs: RGS had no underapplied or overapplied manufacturing overhead during the year. Required: 1. Assume RoS uses plantwide predetermined overhead rates based on machine-hours. 4 a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost assigned to lob Ethel and Job Fred. C. If RGS establishes bid prices that are 150% of totat manufacturing costs, what bid prices would it have established for Job Ethel and Job Fred? d. What is HGS's cost of goods sold for the year? 2. Now, assume that instead of a plantwide overhead rate, RGS uses departmental predetermined overhead rates based on machine-hours in each department. a. Compute the departmental predetermined overhead rates. b. Compute the total manufacturing cost assigned to lob fthel and Job Fred. Each job will have overhead applied in each department. c. If RGS establishes bid prices that are 150% of total manufacturing cost, what bid prices would it have established for Job Ethel and Job Fred? d. What is RGS's cost of goods sold for the year thank you!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started