can i ask for answers and explanation so that I could review and study it again?

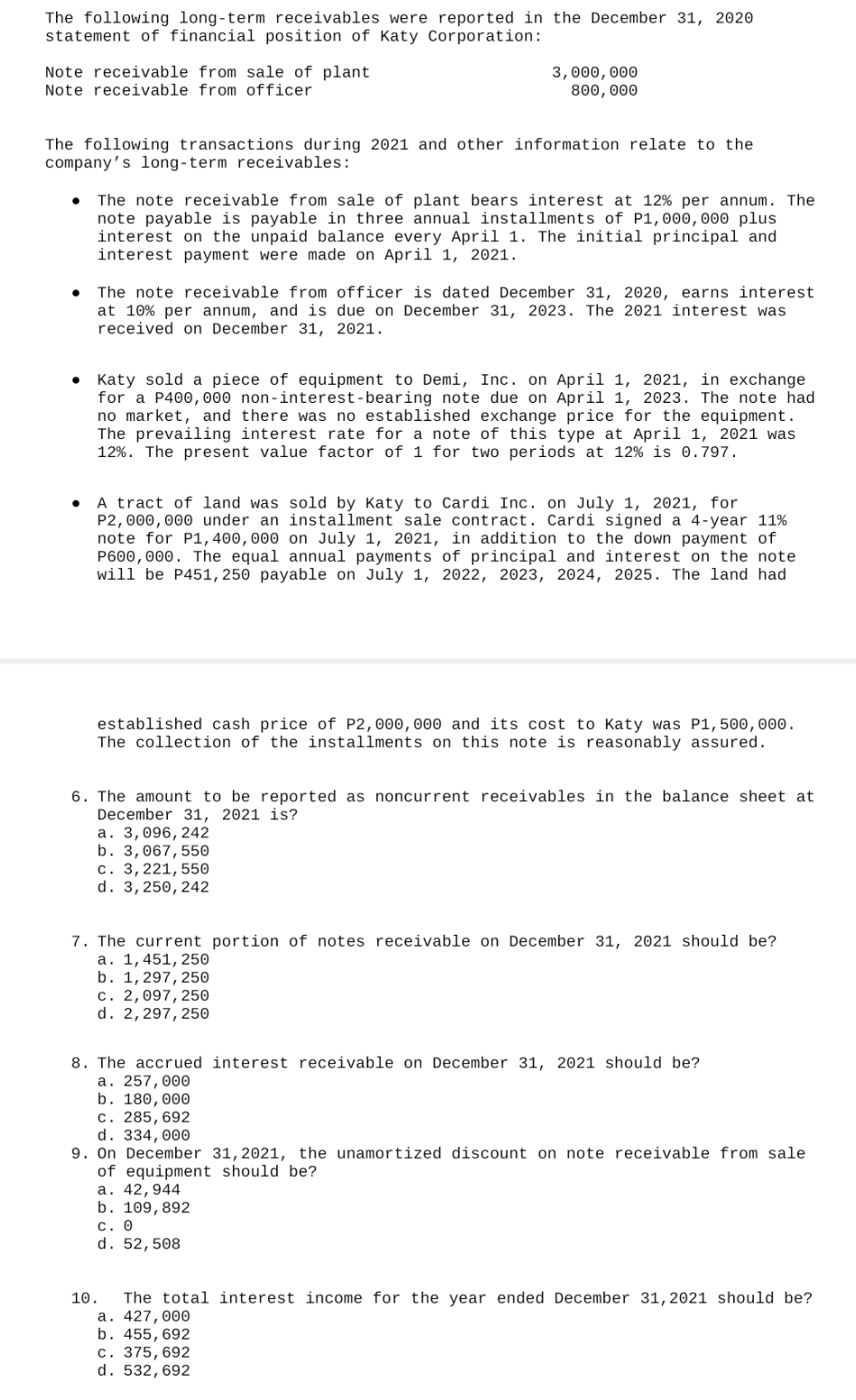

The following long-term receivables were reported in the December 31, 2020 statement of financial pOsition of Katy Corporation: Note receivable from sale of plant 3,000,000 Note receivable from officer 800,000 The following transactions during 2021 and other information relate to the company's long-term receivables: - The note receivable from sale of plant bears interest at 12% per annum. The note payable is payable in three annual installments of P1,000,000 plus interest on the unpaid balance every April 1. The initial principal and interest payment were made on April 1, 2021. a The note receivable from officer is dated December 31, 2020, earns interest at 10% per annum, and is due on December 31, 2023. The 2021 interest was received on December 31, 2021. 0 Katy sold a piece of equipment to Demi, Inc. on April 1, 2021, in exchange for a P400,000 non-interest-bearing note due on April 1, 2023. The note had no market, and there was no established exchange price for the equipment. The prevailing interest rate for a note of this type at April 1, 2021 was 12%. The present value factor of 1 for two periods at 12% is 0.797. a A tract of land was sold by Katy to Cardi Inc. on July 1, 2021, for P2,000,000 under an installment sale contract. Cardi signed a 4-year 11% note for P1,400,000 on July 1, 2021, in addition to the down payment of P500,000. The equal annual payments of principal and interest on the note will be P451,250 payable on July 1, 2022, 2023, 2024, 2025. The land had established cash price of P2,000,000 and its cost to Katy was P1,500,000. The collection of the installments on this note is reasonably assured. 6. The amount to be reported as noncurrent receivables in the balance sheet at December 31, 2021 is? . 3,095,242 . 3,067,550 . 3,221,550 . 3,250,242 10593 7. The current portion of notes receivable on December 31, 2021 should be? a. 1,451,250 b. 1,297,250 c. 2,097,250 d. 2,297,250 8. The accrued interest receivable on December 31, 2021 should be? a. 257,000 0. 180,000 c. 235,592 d. 334,000 9. On December 31,2021, the unamortized discount on note receivable from sale of equipment should be? a. 42,944 b. 109,592 c. 0 d. 52,508 10. The total interest income for the year ended December 31,2021 should be? . 427,000 . 455,692 . 375,592 . 532,592 QHUW