Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can i get a clear explanation please and the answer clear because its comfusing FSU Manufacturing has just issued a 15-year, 11% coupon interest rate,

can i get a clear explanation please and the answer clear because its comfusing

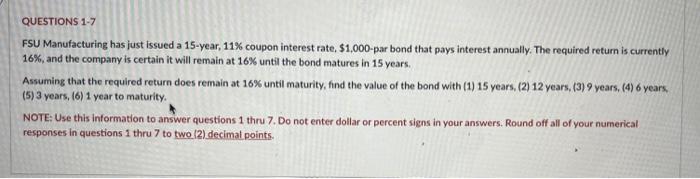

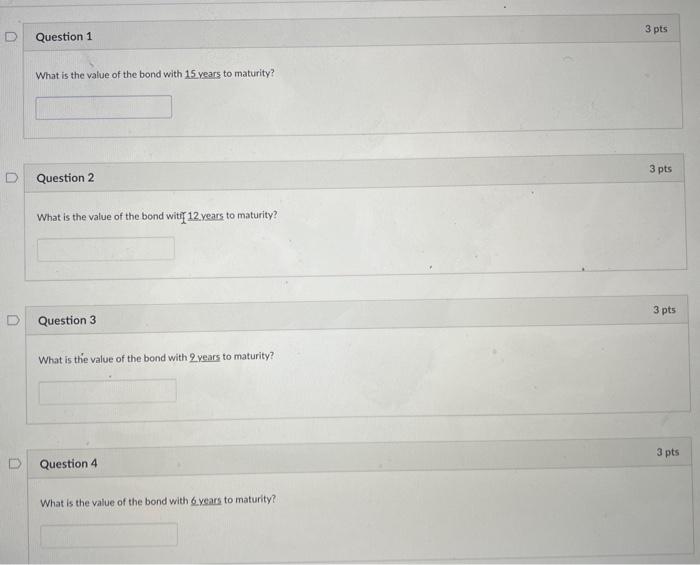

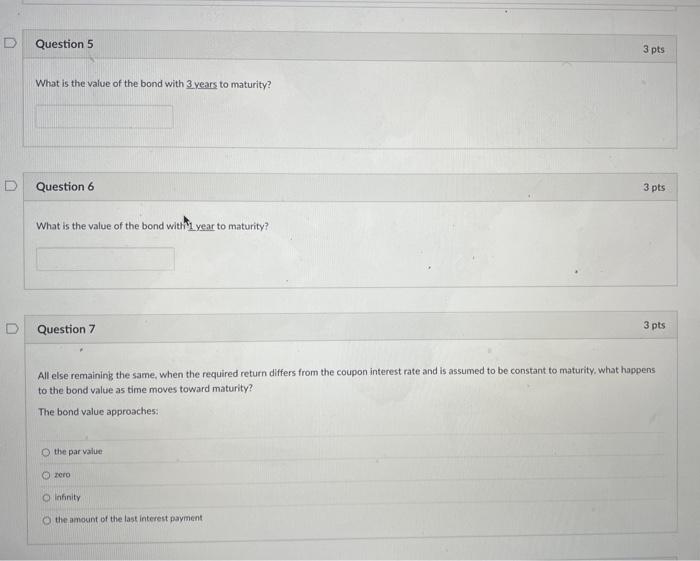

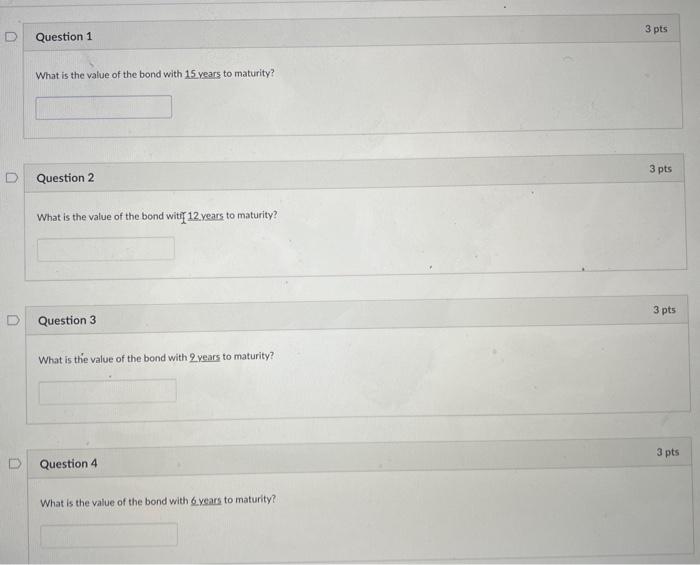

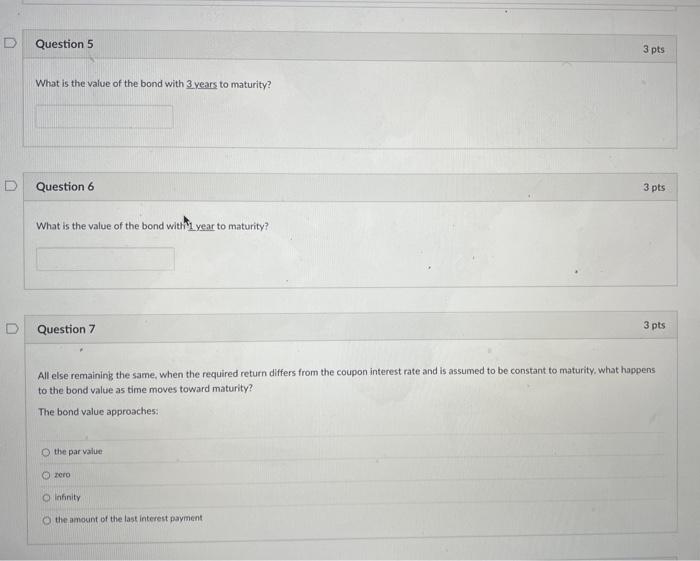

FSU Manufacturing has just issued a 15-year, 11% coupon interest rate, $1,000-par bond that pays interest annually. The required return is currently 16%, and the company is certain it will remain at 16% until the bond matures in 15 years. Assuming that the required return does remain at 16% until maturity, find the value of the bond with (1) 15 years, (2) 12 years, (3) 9 years, (4) 6 years (5) 3 years, (6) 1 year to maturity. NOTE: Use this information to answer questions 1 thru 7. Do not enter dollar or percent signs in your answers. Round off all of your numerical responses in questions 1 thru 7 to two (2) decimal points. What is the value of the bond with 15 years to maturity? Question 2 What is the value of the bond witr 12 years to maturity? Question 4 What is the value of the bond with 6 years to maturity? What is the value of the bond with 3 years to maturity? Question 6 3pts What is the value of the bond with 1 year to maturity? Question 7 3pts All else remaining the same, when the required return differs from the coupon interest rate and is assumed to be constant to maturity. what happens to the bond value as time moves toward maturity? The bond value approaches: the par value zero infinity the amount of the lask interest payment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started