Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can I get accurate answers to these problems? Thank you! Problem 4: Ordinary Shares, no growth rate: The expected rate of return of the shareholders

Can I get accurate answers to these problems? Thank you!

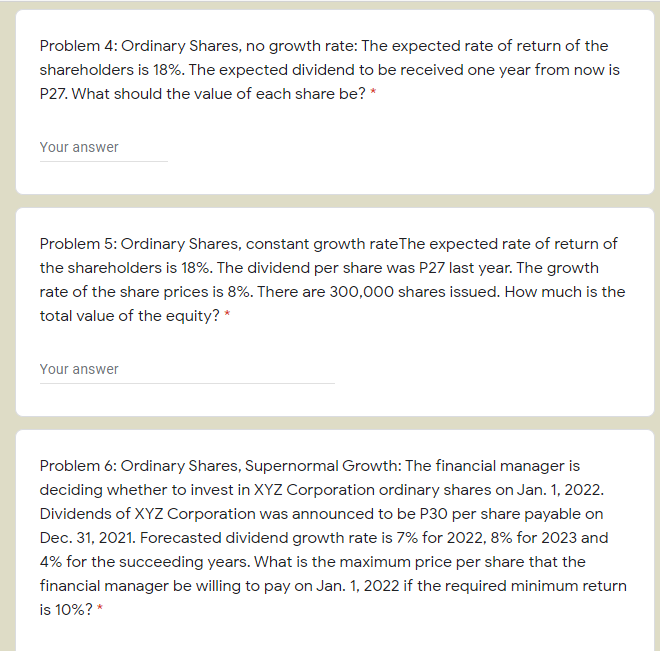

Problem 4: Ordinary Shares, no growth rate: The expected rate of return of the shareholders is 18%. The expected dividend to be received one year from now is P27. What should the value of each share be? * Your answer Problem 5: Ordinary Shares, constant growth rate The expected rate of return of the shareholders is 18%. The dividend per share was P27 last year. The growth rate of the share prices is 8%. There are 300,000 shares issued. How much is the total value of the equity?* Your answer Problem 6: Ordinary Shares, Supernormal Growth: The financial manager is deciding whether to invest in XYZ Corporation ordinary shares on Jan. 1, 2022. Dividends of XYZ Corporation was announced to be P30 per share payable on Dec. 31, 2021. Forecasted dividend growth rate is 7% for 2022,8% for 2023 and 4% for the succeeding years. What is the maximum price per share that the financial manager be willing to pay on Jan. 1, 2022 if the required minimum return is 10%?*Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started