can I get an explanation?

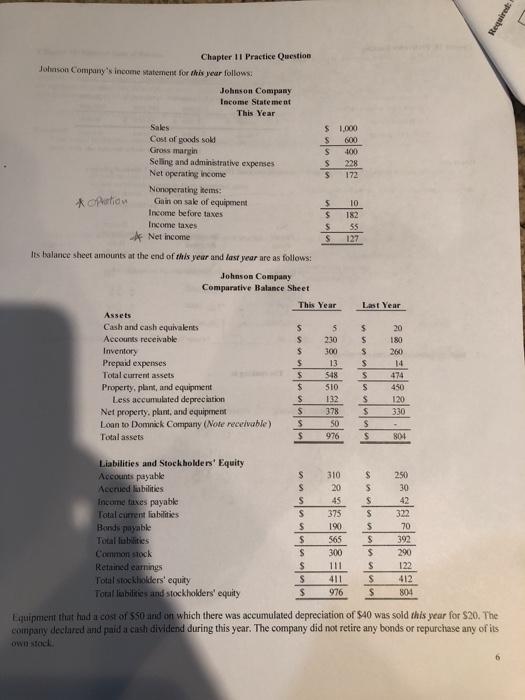

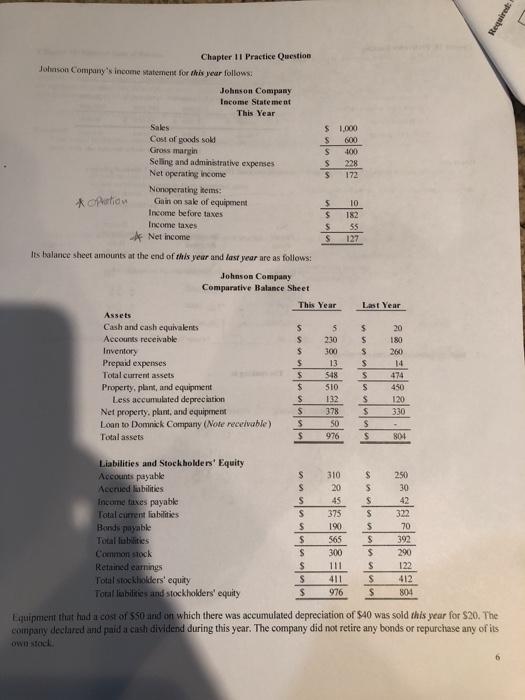

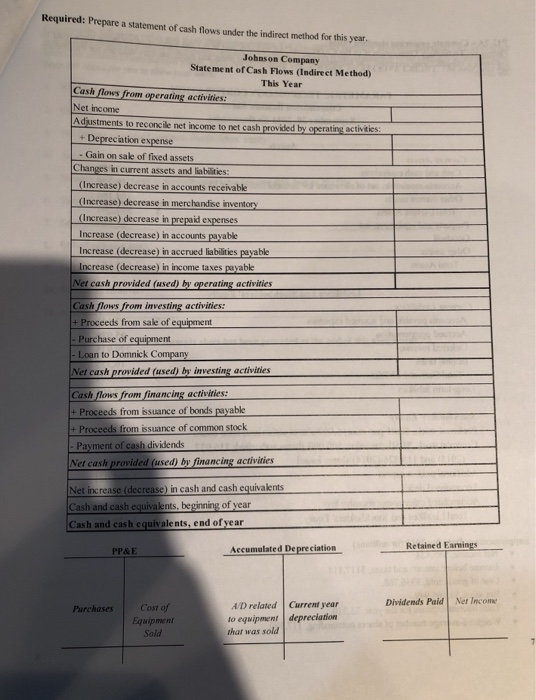

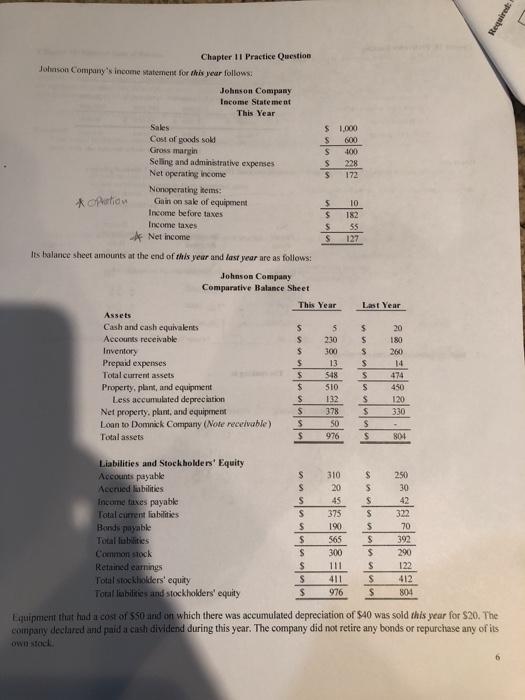

Chapter 11 Practice Question Johnson Company's income statement for this year follows: Johnson Company Income State ment This Year Sales Cost of goods sokd Gross margin Selling and administrative expenses Net operating income Nonoperating items: S 400 S 228 S 172 OPatioGain on sae of equipment Income before taxes Income taxes $ 182 S 55 S 127 Net income Its balance sheet amounts at the end of this year and last year are as follows: Johnson Company Comparative Balance Sheet Last Year This Year Assets Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment S 230 S 10 S 300 S260 S 548 474 S 132 13 14 S 510 450 120 Less accumulated depreciation Net property. plant, and equipment Loan to Domnick Company (Note receivable) Total assets $ 378 S 330 S 50 $ 976 Liabilities and Stockholders' Equity Accounts payable Accrued labilities Income taxes payabke Total current liabilities Bonds payabe Total lablities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity S 310 S 250 30 42 S 32 70 20 45 S 375 190 S $ 190 S 300 S 290 111 S 12 804 $ 976 Equipment that had a cost of $50 and on which there was accumulated depreciation of $40 was sold this year for $20. The company declared and paid a cash dividend during this year. The company did not retire any bonds or repurchase any of is own stock Required: Prepare a statement of cash flows under the indirect method for this year Johnson Company State me nt of Cash Flows (Indire ct Method) This Year Cash flows from operating activiries Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Gain on sale of fixed assets Changes in current assets and lia bilities (Increase) decrease in accounts receivabk (Increase) decrease in merchandise inventory Increase) decrease in prepaid expenses Increase (decrease) in accounts payable Increase (decrease) in accrued liabilities payable Increase (decrease) in income taxes payable Cash flows from investing activities: + Proceeds from sale of equipment Purchase of equipment Loan to Domnick Company Net cash provided (used) by investing activities Cash flows from financing activities: + Proceeds from ssuance of bonds payable + Proceeds from issuance of common stock Payment of cash dividends Net cash provided (used) by financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year Retained Eamings Accumulated Depreciation PP&E Dividends Paid Net Inc ome AD related Current year to equipment depreciation that was sold Purchases Cost of Equipment Sold