Answered step by step

Verified Expert Solution

Question

1 Approved Answer

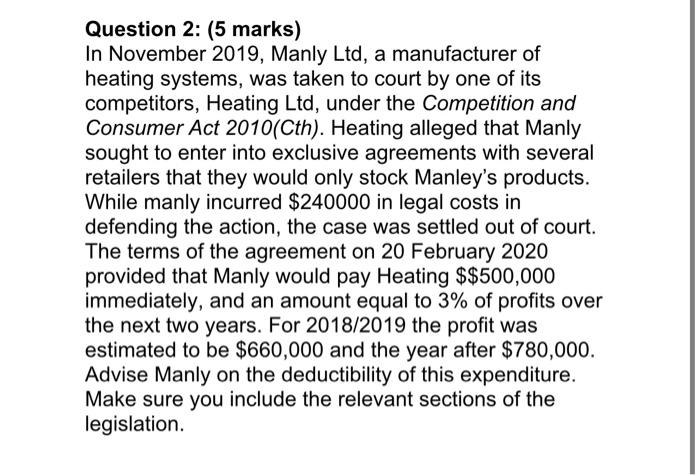

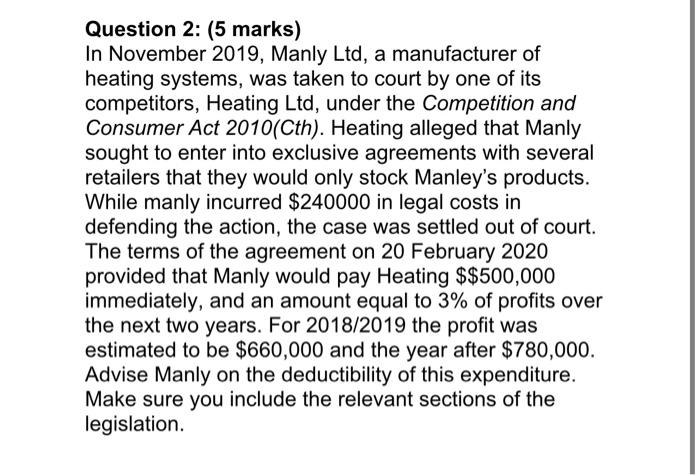

can i get answer for this urgently please? answer needs to be under current tax deductibility act . Question 2: (5 marks) In November 2019,

can i get answer for this urgently please?

Question 2: (5 marks) In November 2019, Manly Ltd, a manufacturer of heating systems, was taken to court by one of its competitors, Heating Ltd, under the Competition and Consumer Act 2010(Cth). Heating alleged that Manly sought to enter into exclusive agreements with several retailers that they would only stock Manley's products. While manly incurred $240000 in legal costs in defending the action, the case was settled out of court. The terms of the agreement on 20 February 2020 provided that Manly would pay Heating $$500,000 immediately, and an amount equal to 3% of profits over the next two years. For 2018/2019 the profit was estimated to be $660,000 and the year after $780,000. Advise Manly on the deductibility of this expenditure. Make sure you include the relevant sections of the legislation answer needs to be under current tax deductibility act .

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started