Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can I get help filling out the blanks? Le Jardin Papillons Company, an event planning company. At all of its events, Le Jardin incorporates a

Can I get help filling out the blanks?

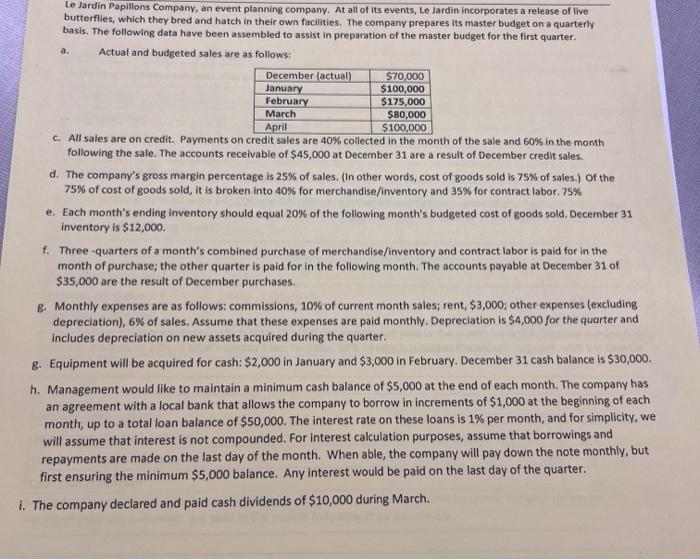

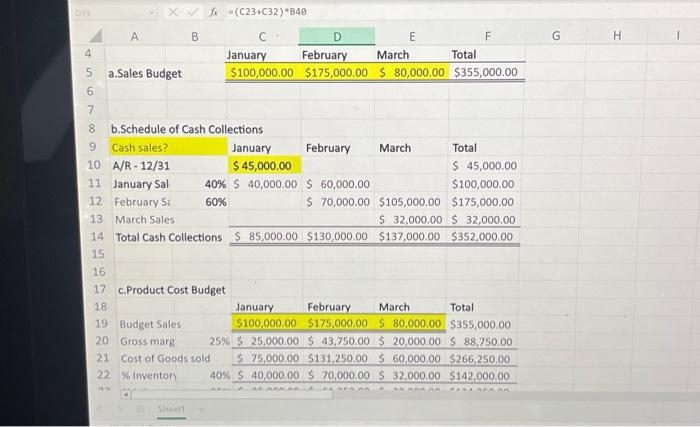

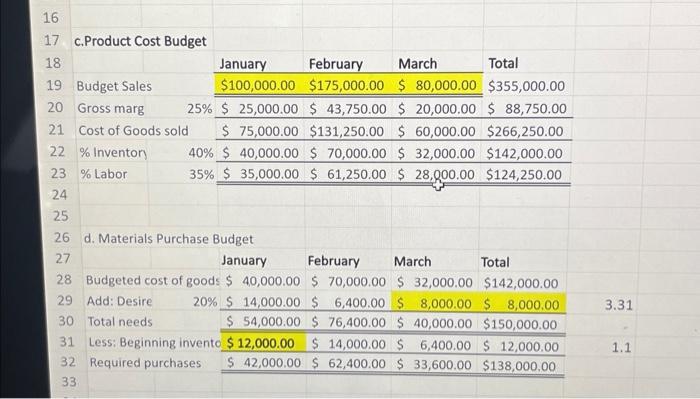

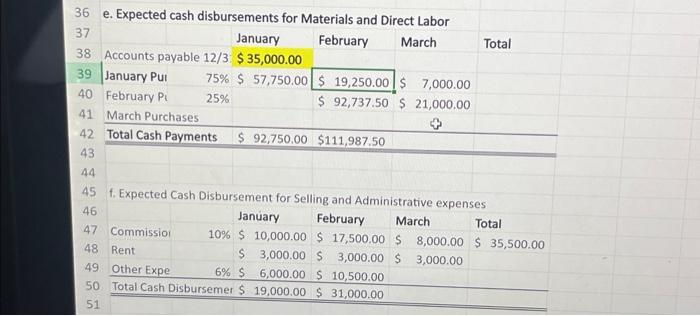

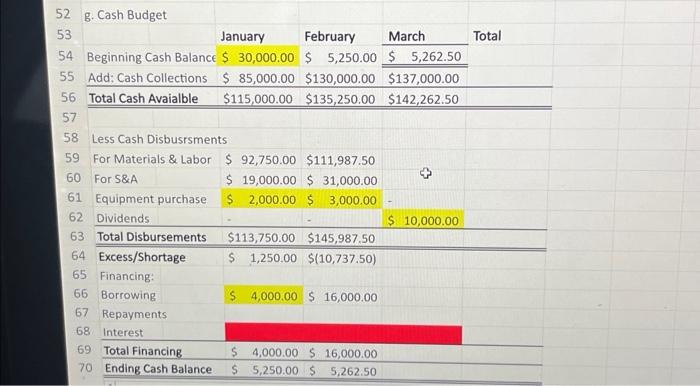

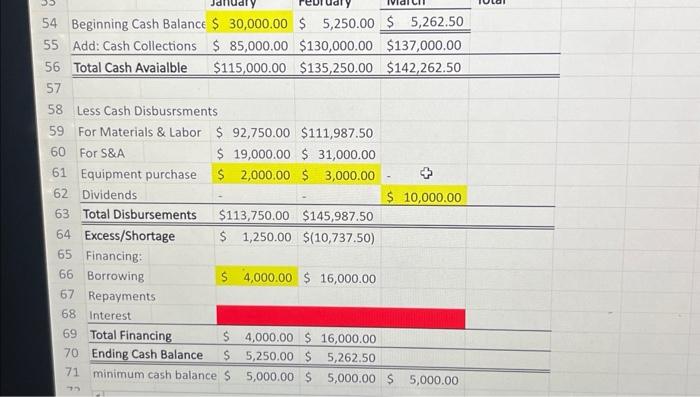

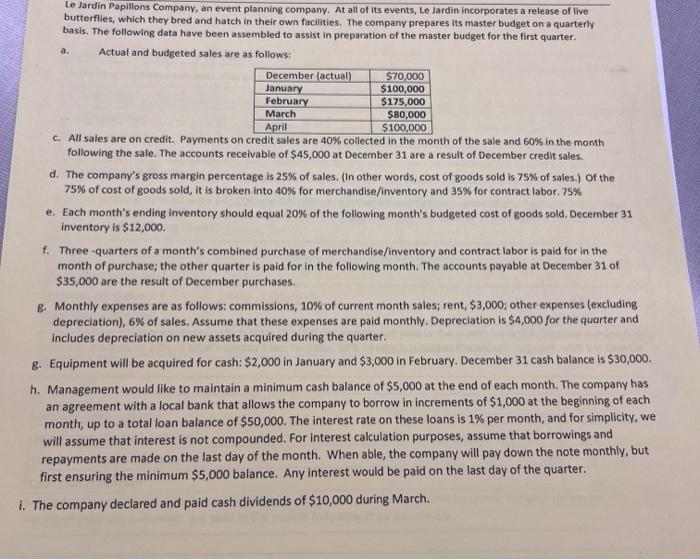

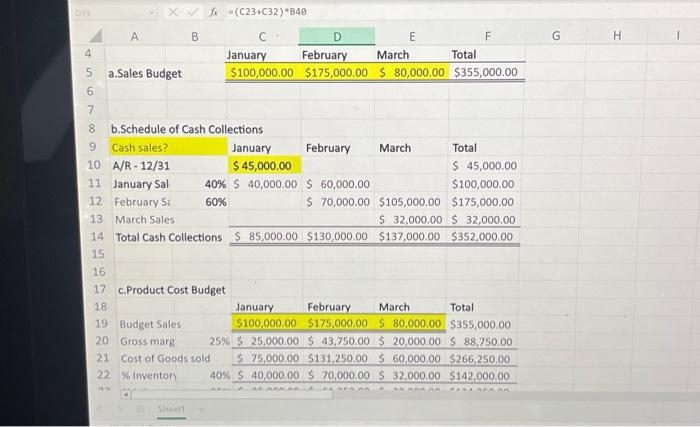

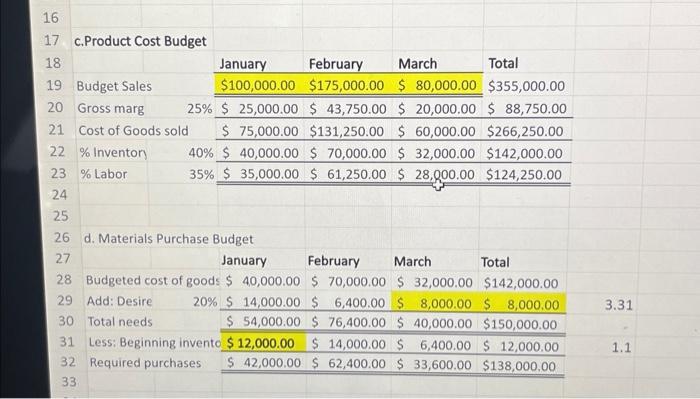

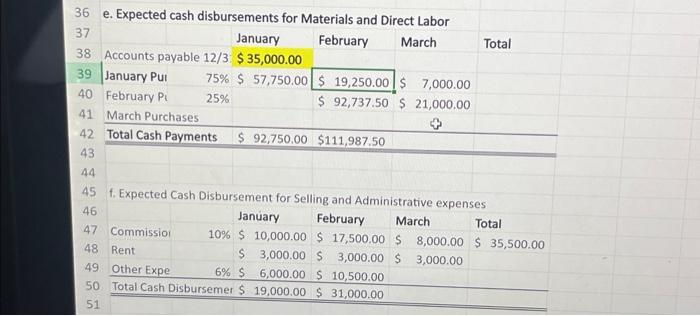

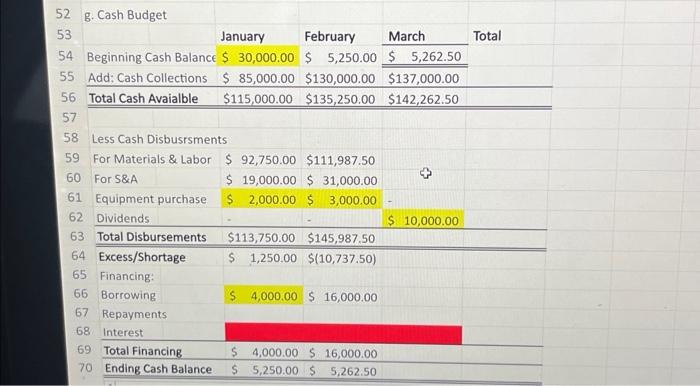

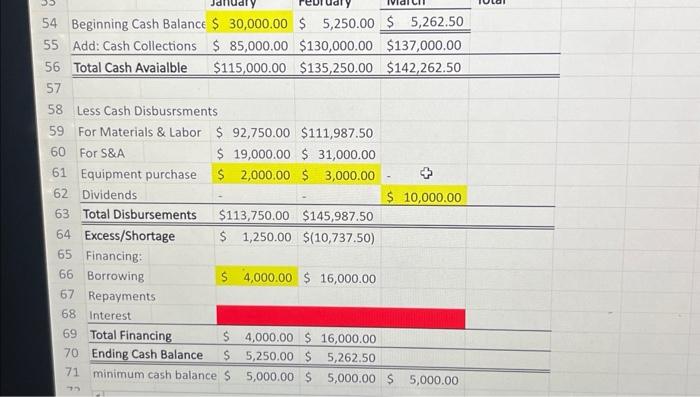

Le Jardin Papillons Company, an event planning company. At all of its events, Le Jardin incorporates a release of live butterflies, which they bred and hatch in thelr own facilities. The company prepares its master budget on a quarterly basis. The following data have been assembled to assist in preparation of the master budget for the first quarter. a. Actual and budgeted sales are as follows: c. All sales are on credit. Payments on credit sales are 40% collected in the month of the sale and 60% in the month following the sale. The accounts receivable of $45,000 at December 31 are a result of December credit sales. d. The company's gross margin percentage is 25% of sales. (In other words, cost of goods sold is 75% of sales.) Of the 75% of cost of goods sold, it is broken into 40% for merchandise/inventory and 35% for contract labor. 75% e. Each month's ending inventory should equal 20% of the following month's budgeted cost of goods sold. December 31 inventory is $12,000. f. Three-quarters of a month's combined purchase of merchandise/inventory and contract labor is paid for in the month of purchase; the other quarter is paid for in the following month. The accounts payable at December 31 of $35,000 are the result of December purchases. g. Monthly expenses are as follows: commissions, 10% of current month sales; rent, $3,000; other expenses (excluding depreciation), 6% of sales. Assume that these expenses are paid monthly. Depreciation is $4,000 for the quarter and includes depreciation on new assets acquired during the quarter. g. Equipment will be acquired for cash: $2,000 in January and $3,000 in February. December 31 cash balance is $30,000. h. Management would like to maintain a minimum cash balance of $5,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $50,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that interest is not compounded. For interest calculation purposes, assume that borrowings and repayments are made on the last day of the month. When able, the company will pay down the note monthly, but first ensuring the minimum $5,000 balance. Any interest would be paid on the last day of the quarter. i. The company declared and paid cash dividends of $10,000 during March. e. Expected cash disbursements for Materials and Dirert I ahnr fx=(C23+C32)B40 \begin{tabular}{|c|c|c|c|c|c|c|} \hline \\ \hline & & & & & & \\ \hline 17 & \multicolumn{6}{|c|}{ c. Product Cost Budget } \\ \hline 18 & & & January & February & March & Total \\ \hline 19 & \multicolumn{2}{|l|}{ Budget Sales } & $100,000.00 & $175,000.00 & $80,000.00 & $355,000.00 \\ \hline 20 & Gross marg & 25% & $25,000.00 & $43,750.00 & $20,000.00 & $88,750,00 \\ \hline 21 & \multicolumn{2}{|c|}{ Cost of Goods sold } & \$ 75,000.00 & $131,250.00 & $60,000.00 & $266,250.00 \\ \hline 22 & % Inventon & 40% & $40,000.00 & $70,000.00 & $32,000.00 & $142,000.00 \\ \hline 23 & % Labor & 35%= & $35,000.00 & $61,250.00 & $28,0,00.00 & $124,250.00 \\ \hline \\ \hline \multicolumn{7}{|l|}{25} \\ \hline 26 & \multicolumn{6}{|c|}{ d. Materials Purchase Budget } \\ \hline 27 & & & January & February & March & Total \\ \hline 28 & \multicolumn{2}{|c|}{ Budgeted cost of goods } & Is $40,000.00 & $70,000.00 & $32,000.00 & $142,000.00 \\ \hline 29 & Add: Desire & 20% & \$ 14,000.00 & $6,400.00 & $8,000.00 & $8,000,00 \\ \hline 30 & \multicolumn{2}{|l|}{ Total needs } & $54,000.00 & $76,400.00 & $40,000.00 & $150,000.00 \\ \hline 31 & \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{l} Less: Beginning invento \\ Required purchases \end{tabular}}} & $12,000.00 & $14,000.00 & $6,400.00 & \$ 12,000.00 \\ \hline 32 & & & $42,000.00 & $62,400.00 & $33,600.00 & $138,000,00 \\ \hline 33 & & & & & & \\ \hline \end{tabular} Le Jardin Papillons Company, an event planning company. At all of its events, Le Jardin incorporates a release of live butterflies, which they bred and hatch in thelr own facilities. The company prepares its master budget on a quarterly basis. The following data have been assembled to assist in preparation of the master budget for the first quarter. a. Actual and budgeted sales are as follows: c. All sales are on credit. Payments on credit sales are 40% collected in the month of the sale and 60% in the month following the sale. The accounts receivable of $45,000 at December 31 are a result of December credit sales. d. The company's gross margin percentage is 25% of sales. (In other words, cost of goods sold is 75% of sales.) Of the 75% of cost of goods sold, it is broken into 40% for merchandise/inventory and 35% for contract labor. 75% e. Each month's ending inventory should equal 20% of the following month's budgeted cost of goods sold. December 31 inventory is $12,000. f. Three-quarters of a month's combined purchase of merchandise/inventory and contract labor is paid for in the month of purchase; the other quarter is paid for in the following month. The accounts payable at December 31 of $35,000 are the result of December purchases. g. Monthly expenses are as follows: commissions, 10% of current month sales; rent, $3,000; other expenses (excluding depreciation), 6% of sales. Assume that these expenses are paid monthly. Depreciation is $4,000 for the quarter and includes depreciation on new assets acquired during the quarter. g. Equipment will be acquired for cash: $2,000 in January and $3,000 in February. December 31 cash balance is $30,000. h. Management would like to maintain a minimum cash balance of $5,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $50,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that interest is not compounded. For interest calculation purposes, assume that borrowings and repayments are made on the last day of the month. When able, the company will pay down the note monthly, but first ensuring the minimum $5,000 balance. Any interest would be paid on the last day of the quarter. i. The company declared and paid cash dividends of $10,000 during March. e. Expected cash disbursements for Materials and Dirert I ahnr fx=(C23+C32)B40 \begin{tabular}{|c|c|c|c|c|c|c|} \hline \\ \hline & & & & & & \\ \hline 17 & \multicolumn{6}{|c|}{ c. Product Cost Budget } \\ \hline 18 & & & January & February & March & Total \\ \hline 19 & \multicolumn{2}{|l|}{ Budget Sales } & $100,000.00 & $175,000.00 & $80,000.00 & $355,000.00 \\ \hline 20 & Gross marg & 25% & $25,000.00 & $43,750.00 & $20,000.00 & $88,750,00 \\ \hline 21 & \multicolumn{2}{|c|}{ Cost of Goods sold } & \$ 75,000.00 & $131,250.00 & $60,000.00 & $266,250.00 \\ \hline 22 & % Inventon & 40% & $40,000.00 & $70,000.00 & $32,000.00 & $142,000.00 \\ \hline 23 & % Labor & 35%= & $35,000.00 & $61,250.00 & $28,0,00.00 & $124,250.00 \\ \hline \\ \hline \multicolumn{7}{|l|}{25} \\ \hline 26 & \multicolumn{6}{|c|}{ d. Materials Purchase Budget } \\ \hline 27 & & & January & February & March & Total \\ \hline 28 & \multicolumn{2}{|c|}{ Budgeted cost of goods } & Is $40,000.00 & $70,000.00 & $32,000.00 & $142,000.00 \\ \hline 29 & Add: Desire & 20% & \$ 14,000.00 & $6,400.00 & $8,000.00 & $8,000,00 \\ \hline 30 & \multicolumn{2}{|l|}{ Total needs } & $54,000.00 & $76,400.00 & $40,000.00 & $150,000.00 \\ \hline 31 & \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{l} Less: Beginning invento \\ Required purchases \end{tabular}}} & $12,000.00 & $14,000.00 & $6,400.00 & \$ 12,000.00 \\ \hline 32 & & & $42,000.00 & $62,400.00 & $33,600.00 & $138,000,00 \\ \hline 33 & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started