Answered step by step

Verified Expert Solution

Question

1 Approved Answer

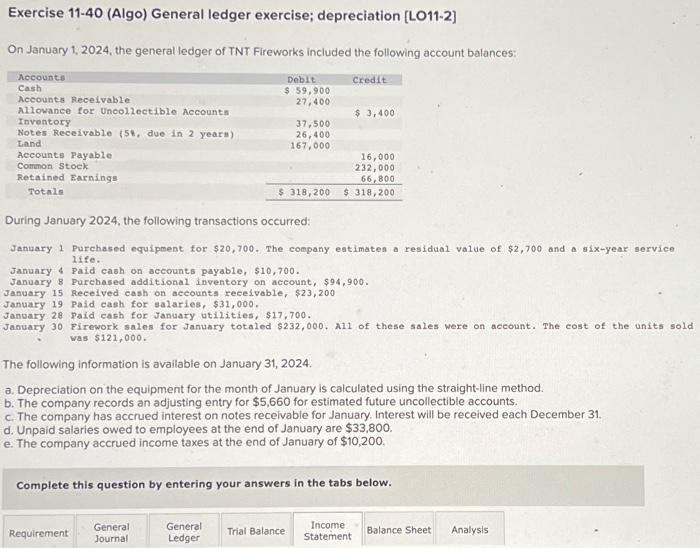

Can I get help please Exercise 11-40 (Algo) General ledger exercise; depreciation [LO11-2] On January 1, 2024, the general ledger of TNT Fireworks included the

Can I get help please

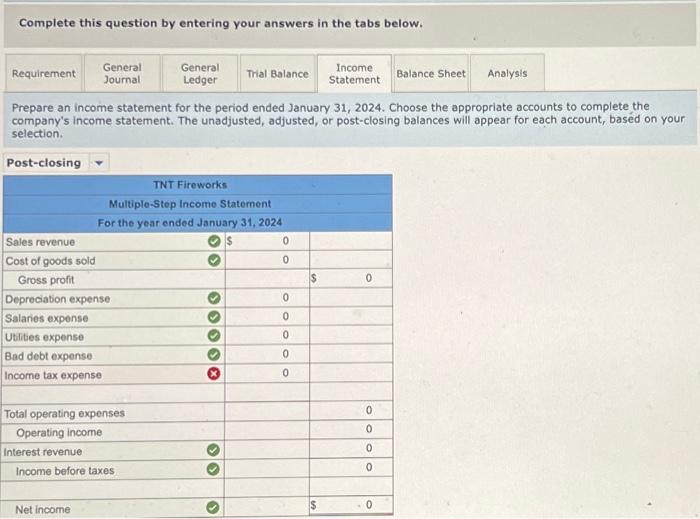

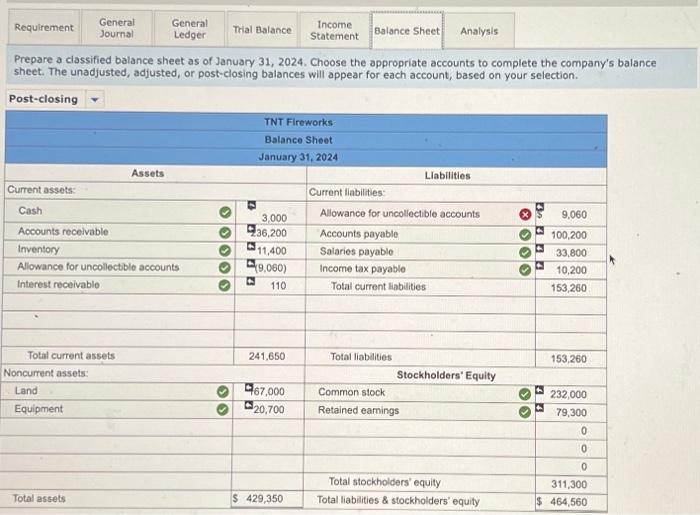

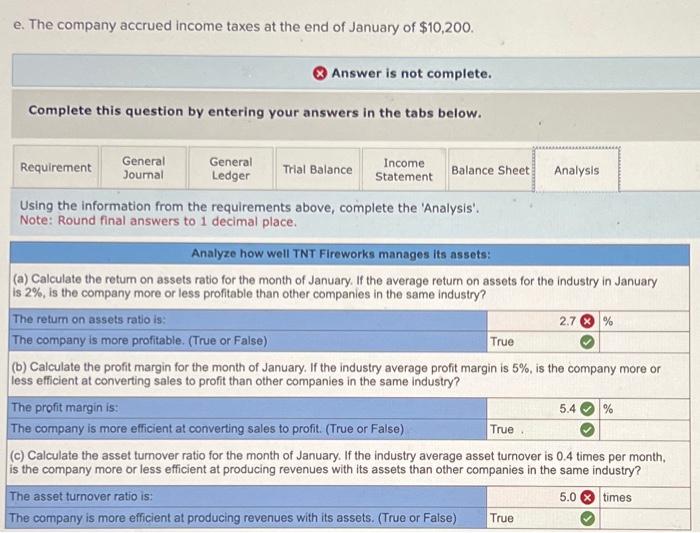

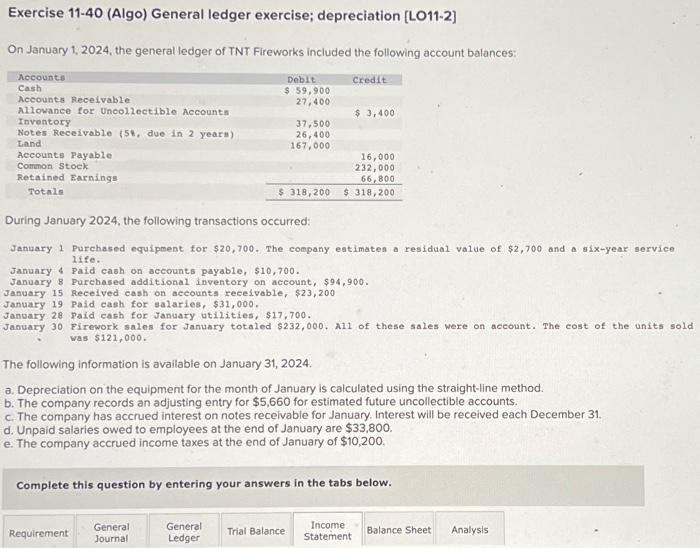

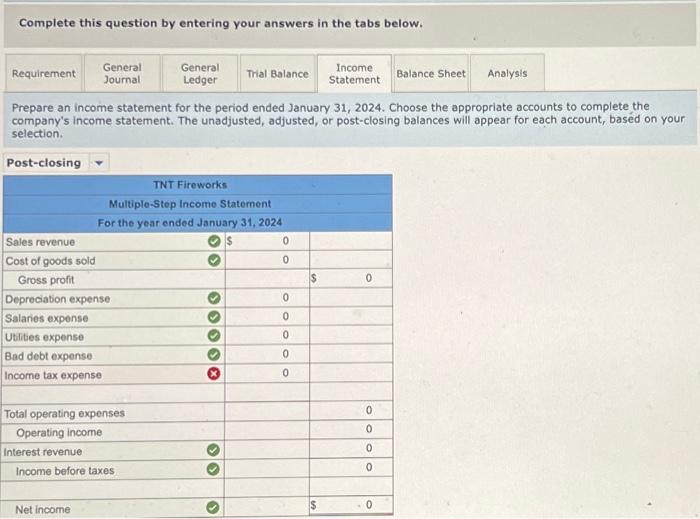

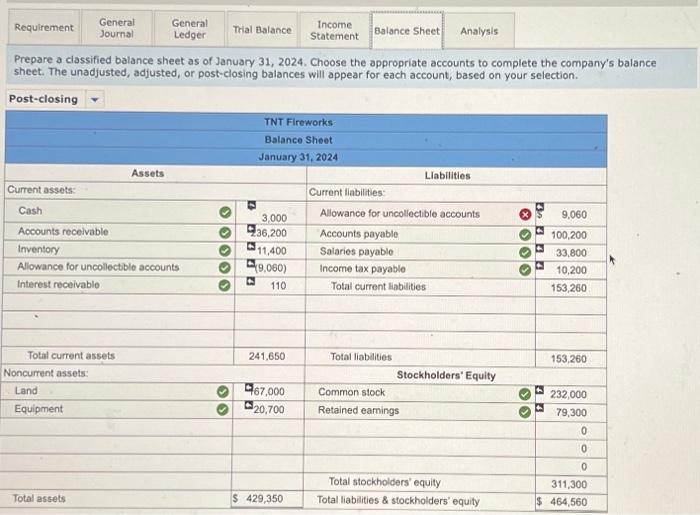

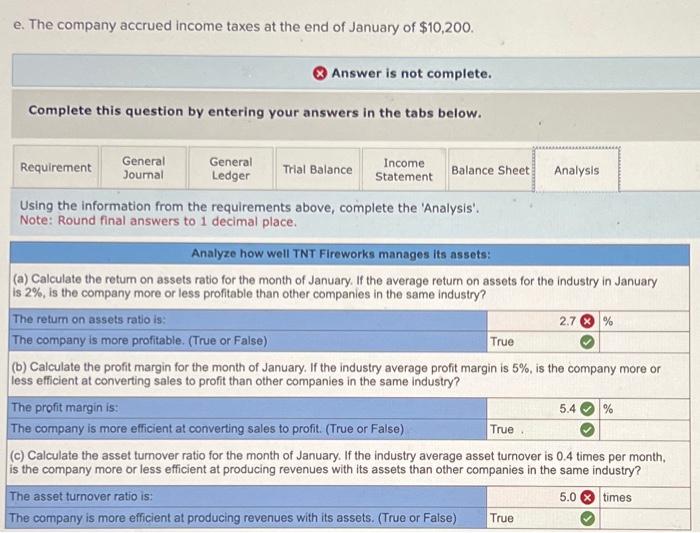

Exercise 11-40 (Algo) General ledger exercise; depreciation [LO11-2] On January 1, 2024, the general ledger of TNT Fireworks included the following account balances: During January 2024, the following transactions occurred: Ganuary 1 Purchased equipment for $20,700. The company estimates a residual value of $2,700 and a six-year service 1 ife. January 4 Paid cash on accounts payable, $10,700. January 8 Purchased additional inventory on account, $94,900. January 15 Received cash on accounts receivable, $23,200 January 19 Paid cash for salaries, $31,000. January 28 paid cash for January utilities, $17,700. January 30 Pirework sales for January totaled $232,000. N11 of these sales were on account. The cost of the units sold was $121,000 The following information is available on January 31,2024. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. b. The company records an adjusting entry for $5,660 for estimated future uncollectible accounts. c. The company has accrued interest on notes recelvable for January. Interest will be received each December 31. d. Unpaid salaries owed to employees at the end of January are $33,800. e. The company accrued income taxes at the end of January of $10,200. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Prepare an income statement for the period ended January 31, 2024. Choose the appropriate accounts to complete the company's income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Prepare a ciassified balance sheet as of January 31, 2024. Choose the appropriate accounts to complete the company's balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. e. The company accrued income taxes at the end of January of $10,200. Answer is not complete. Complete this question by entering your answers in the tabs below. Using the information from the requirements above, complete the 'Analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started