can i get help please

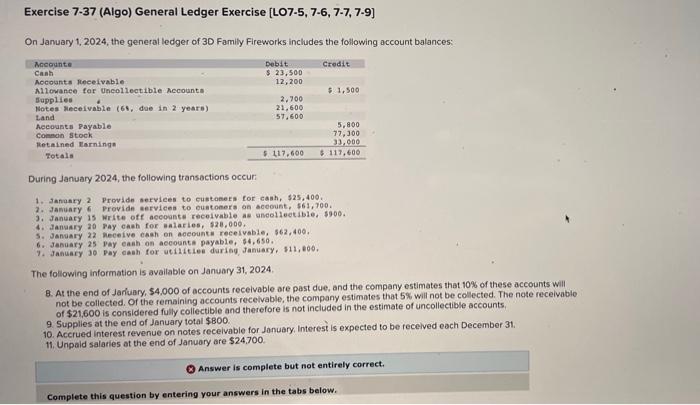

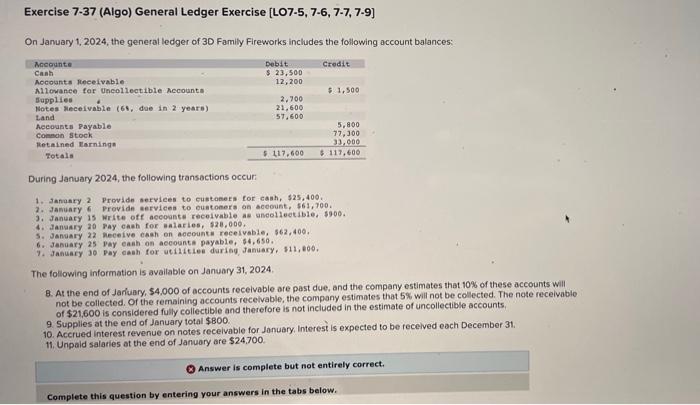

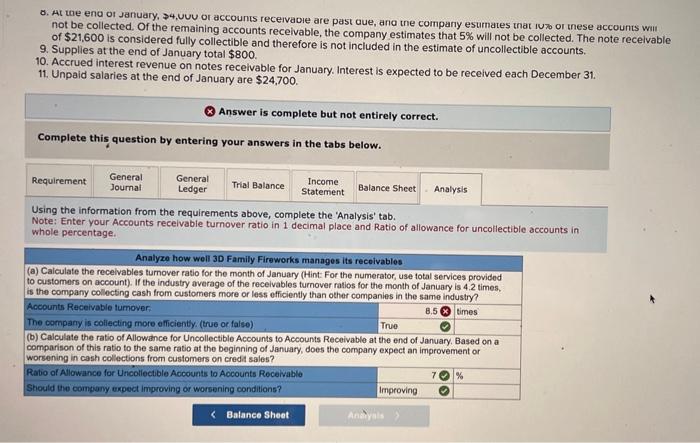

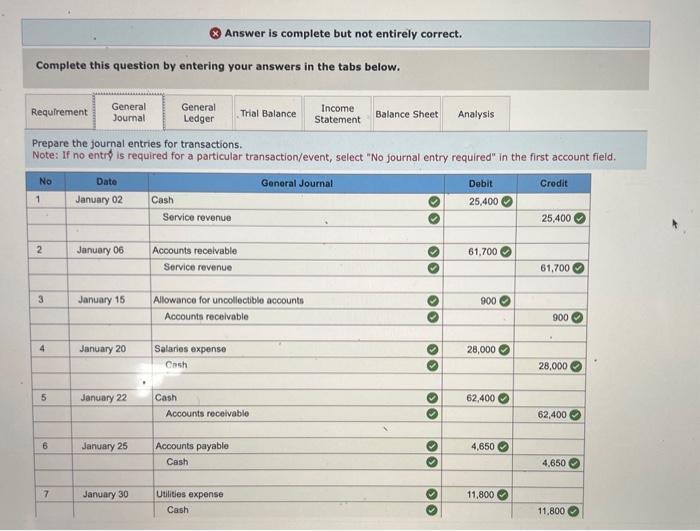

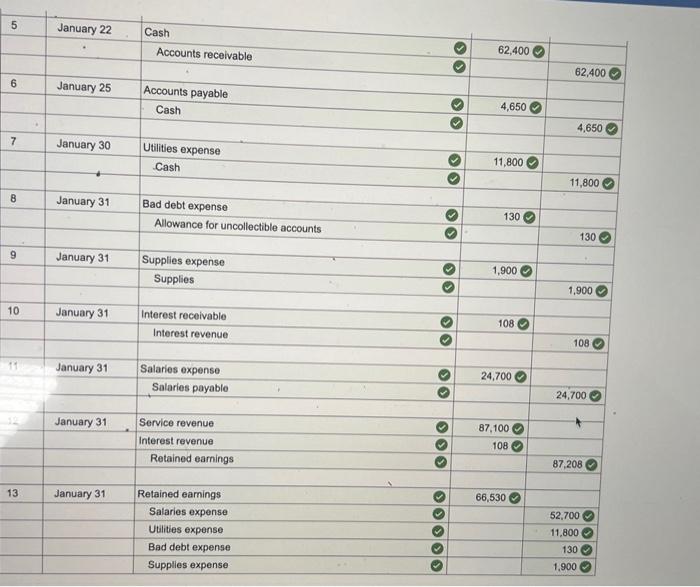

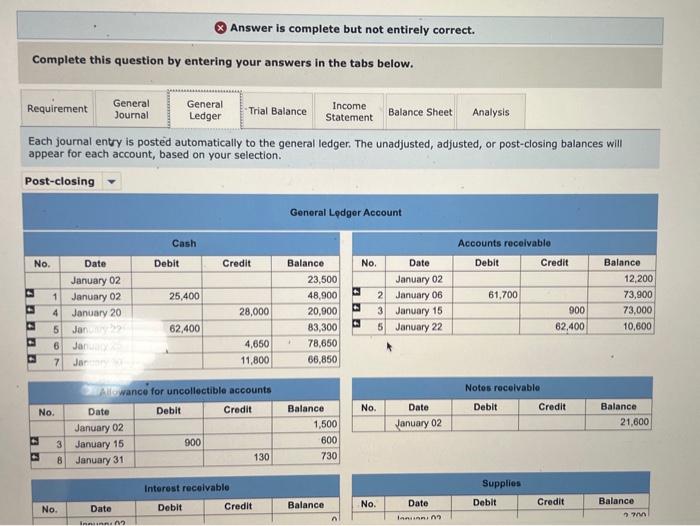

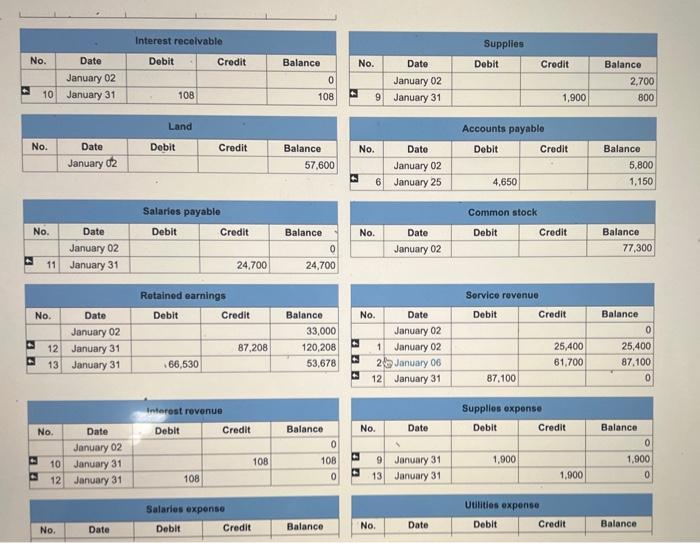

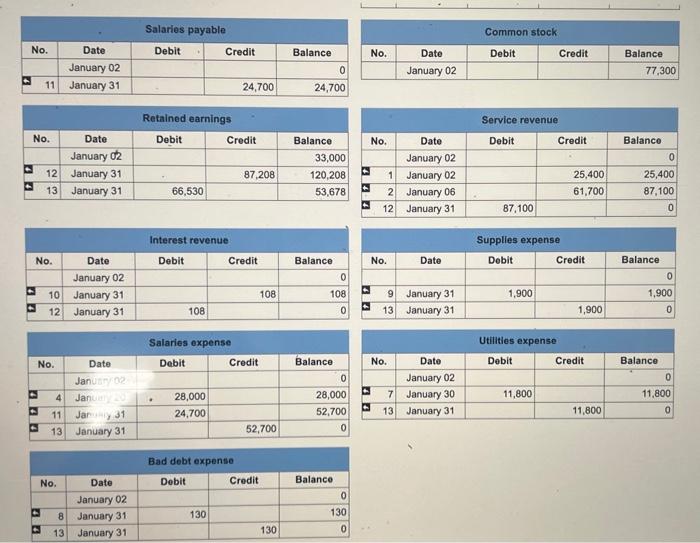

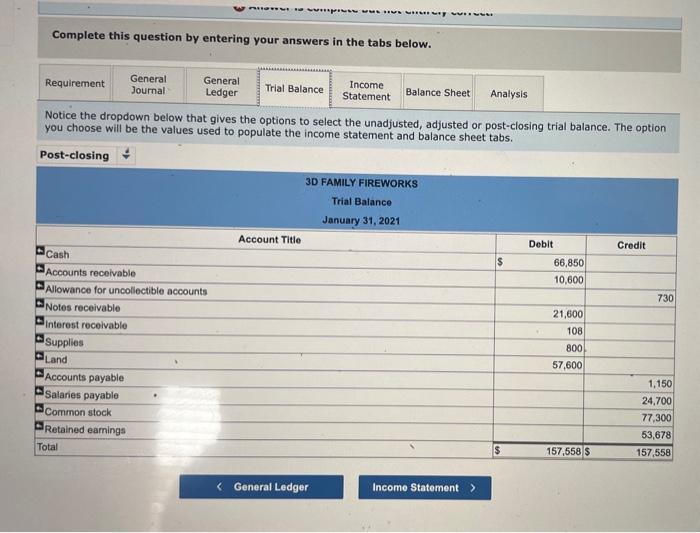

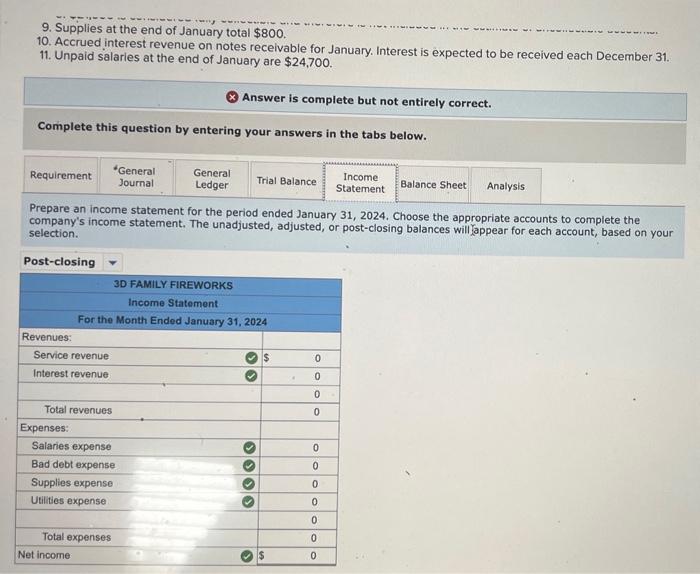

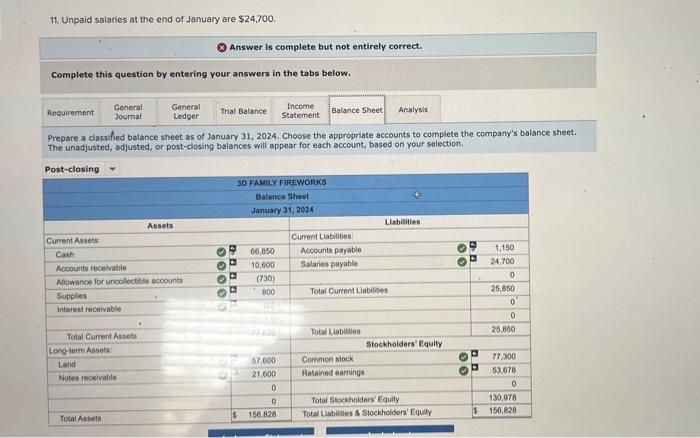

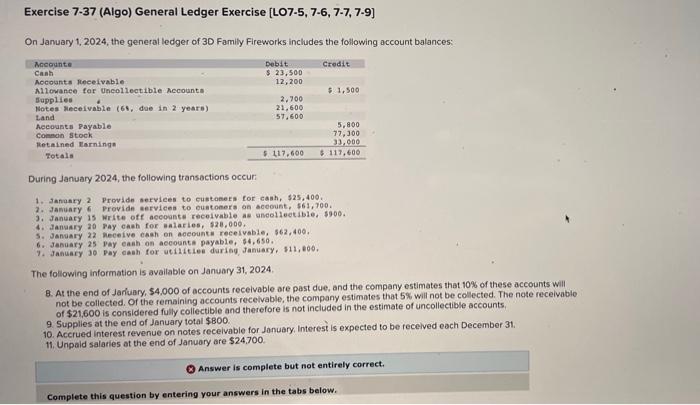

Exercise 7-37 (Algo) General Ledger Exercise [LO7-5, 7-6, 7-7, 7-9] On January 1, 2024, the general ledger of 30 Family Fireworks includes the following account balances: During January 2024, the following transactions occur: 1. Janunty 2 Provide services to eustaners for canh, $25,400. 2. January 6 Provide services to euntomers on aceount, 561,700 , 3. January is write off accoonte recelvable as ancolleetible, 5900a 4. January 20 pay eash for =alaries, 928,000 . 5. January 22 Meceive eash on aceounta recelvable, 562,400 6. Jabuary 25 pay eain on accounta payable, 54,650 . 6. January 30 pay caah for utistitee daring January, 111,000. The following information is available on January 31,2024 8. At the end of Jarivary, $4,000 of accounts recelvable are past due, and the company estimates that 10% of these accounts will not be collected. Of the remaining accounts recelvable, the company estimates that 5% will not be collected. The note receivable of $21,600 is considered fully collectible and therefore is not included in the estimate of uncollectible accounts. 9 Supplies at the end of January total $800 10. Accrued interest revenue on notes receivabie for January, Interest is expected to be received each December 34 . 11. Unpaid salaries ot the end of January are $24,700. 8. At the end of January, $4, vuu or accounts receivadie are past cue, ano the company esumates that IU7 or these accounts wit not be collected. Of the remaining accounts receivable, the company estimates that 5% will not be collected. The note recelvable of $21,600 is considered fully collectible and therefore is not included in the estimate of uncollectible accounts. 9. Supplies at the end of January total $800. 10. Accrued interest revenue on notes recelvable for January. Interest is expected to be recelved each December 31 . 11. Unpaid salaries at the end of January are $24,700. \&) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Using the information from the requirements above, complete the 'Analysis' tab. Note: Enter your Accounts recelvable turnover ratio in 1 decimal place and Ratio of allowance for uncollectible accounts in whole percentage. Analyze how well 3D Family Fireworks manages its receivables (a) Calculate the recelvables tumover ratio for the month of January (Hint For the numerator, use total services provided o customers on account). If the industry average of the receivables turnover ratios for the month of January is 4.2 times. s the company collocting cash from customers more or less efficiently than other companies in the same industr? (x) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare the journal entries for transactions. Note: If no entry is required for a particular transaction/event, select "No fournal entry required" in the first account field. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Each journal entry is posted automatically to the general ledger. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. \begin{tabular}{|r|c|c|c|r|} \hline \multicolumn{5}{|c|}{ Interest recelvable } \\ \hline No. & Date & Debit & Credit & \multicolumn{1}{|c|}{ Balance } \\ \hline & January 02 & & & 0 \\ \hline 10 & January 31 & 108 & & 108 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|r|r|} \hline \multicolumn{5}{|c|}{ Supplies } \\ \hline No. & Date & Debit & Crodit & \multicolumn{1}{c|}{ Balance } \\ \hline & January 02 & & & 2,700 \\ \hline 9 & January 31 & & 1,900 & 800 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Land } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January of & & & 57,600 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|r|} \hline \multicolumn{5}{|c|}{ Accounts payablo } \\ \hline No. & Date & \multicolumn{1}{|c|}{ Debit } & Credit & \multicolumn{1}{c|}{ Balance } \\ \hline & January 02 & & & 5,800 \\ \hline \$ 6 & January 25 & 4,650 & & 1,150 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|r|r|} \hline \multicolumn{5}{|c|}{ Salarios payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 02 & & & 0 \\ \hline 11 & January 31 & & 24,700 & 24,700 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 02 & & & 77,300 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Retainod earnings } \\ \hline No. & Date & Debit & \multicolumn{1}{|c|}{ Credit } & \multicolumn{1}{|c|}{ Balance } \\ \hline & January 02 & & & 33,000 \\ \hline 12 & January 31 & & 87,208 & 120,208 \\ \hline A 13 & January 31 & .66,530 & & 53,678 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{4}{|c|}{ Salaries expense } \\ \hline No. & Date & Deblt & Credit & Balance \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{5}{|c|}{ Uuities expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline \end{tabular} \begin{tabular}{|l|c|c|r|r|} \hline \multicolumn{5}{|c|}{ Salaries payable } \\ \hline No. & Date & Debit & \multicolumn{1}{|c|}{ Credit } & \multicolumn{1}{|c|}{ Balance } \\ \hline & January 02 & & & 0 \\ \hline 11 & January 31 & & 24,700 & 24,700 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 02 & & & 77,300 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|r|r|} \hline \multicolumn{5}{|c|}{ Retained earnings } \\ \hline No. & Date & Debit & \multicolumn{1}{|c|}{ Credit } & \multicolumn{1}{|c|}{ Balance } \\ \hline & January of & & & 33,000 \\ \hline 12 & January 31 & & 87,208 & 120,208 \\ \hline 13 & January 31 & 66,530 & & 53,678 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|c|r|} \hline \multicolumn{5}{|c|}{ Interest revenue } \\ \hline No. & Date & \multicolumn{1}{|c|}{ Debit } & \multicolumn{1}{|c|}{ Credit } & \multicolumn{1}{|c|}{ Balance } \\ \hline & January 02 & & & 0 \\ \hline 10 & January 31 & & 108 & 108 \\ \hline 12 & January 31 & 108 & & 0 \\ \hline \end{tabular} \begin{tabular}{|r|c|r|r|r|} \hline \multicolumn{5}{|c|}{ Utilities expense } \\ \hline No. & Date & \multicolumn{1}{|c|}{ Dobit } & Credit & \multicolumn{1}{|c|}{ Balance } \\ \hline & January 02 & & & 0 \\ \hline 7 & January 30 & 11,800 & & 11,800 \\ \hline 13 & January 31 & & 11,800 & 0 \\ \hline \end{tabular} Complete this question by entering your answers in the tabs below. Notice the dropdown below that gives the options to select the unadjusted, adjusted or post-closing trial balance. The option you choose will be the values used to populate the income statement and balance sheet tabs. 9. Supplies at the end of January total $800. 10. Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31. 11. Unpaid salaries at the end of January are $24,700. * Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare an income statement for the period ended January 31, 2024. Choose the appropriate accounts to complete the company's income statement. The unadjusted, adjusted, or post-closing balances will Yappear for each account, based on your selection. 11. Unpaid salarles at the end of January are $24,700. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare a dossified balance sheet as of January 31, 2024. Choose the appropriate accounts to complete the company's balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Exercise 7-37 (Algo) General Ledger Exercise [LO7-5, 7-6, 7-7, 7-9] On January 1, 2024, the general ledger of 30 Family Fireworks includes the following account balances: During January 2024, the following transactions occur: 1. Janunty 2 Provide services to eustaners for canh, $25,400. 2. January 6 Provide services to euntomers on aceount, 561,700 , 3. January is write off accoonte recelvable as ancolleetible, 5900a 4. January 20 pay eash for =alaries, 928,000 . 5. January 22 Meceive eash on aceounta recelvable, 562,400 6. Jabuary 25 pay eain on accounta payable, 54,650 . 6. January 30 pay caah for utistitee daring January, 111,000. The following information is available on January 31,2024 8. At the end of Jarivary, $4,000 of accounts recelvable are past due, and the company estimates that 10% of these accounts will not be collected. Of the remaining accounts recelvable, the company estimates that 5% will not be collected. The note receivable of $21,600 is considered fully collectible and therefore is not included in the estimate of uncollectible accounts. 9 Supplies at the end of January total $800 10. Accrued interest revenue on notes receivabie for January, Interest is expected to be received each December 34 . 11. Unpaid salaries ot the end of January are $24,700. 8. At the end of January, $4, vuu or accounts receivadie are past cue, ano the company esumates that IU7 or these accounts wit not be collected. Of the remaining accounts receivable, the company estimates that 5% will not be collected. The note recelvable of $21,600 is considered fully collectible and therefore is not included in the estimate of uncollectible accounts. 9. Supplies at the end of January total $800. 10. Accrued interest revenue on notes recelvable for January. Interest is expected to be recelved each December 31 . 11. Unpaid salaries at the end of January are $24,700. \&) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Using the information from the requirements above, complete the 'Analysis' tab. Note: Enter your Accounts recelvable turnover ratio in 1 decimal place and Ratio of allowance for uncollectible accounts in whole percentage. Analyze how well 3D Family Fireworks manages its receivables (a) Calculate the recelvables tumover ratio for the month of January (Hint For the numerator, use total services provided o customers on account). If the industry average of the receivables turnover ratios for the month of January is 4.2 times. s the company collocting cash from customers more or less efficiently than other companies in the same industr? (x) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare the journal entries for transactions. Note: If no entry is required for a particular transaction/event, select "No fournal entry required" in the first account field. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Each journal entry is posted automatically to the general ledger. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. \begin{tabular}{|r|c|c|c|r|} \hline \multicolumn{5}{|c|}{ Interest recelvable } \\ \hline No. & Date & Debit & Credit & \multicolumn{1}{|c|}{ Balance } \\ \hline & January 02 & & & 0 \\ \hline 10 & January 31 & 108 & & 108 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|r|r|} \hline \multicolumn{5}{|c|}{ Supplies } \\ \hline No. & Date & Debit & Crodit & \multicolumn{1}{c|}{ Balance } \\ \hline & January 02 & & & 2,700 \\ \hline 9 & January 31 & & 1,900 & 800 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Land } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January of & & & 57,600 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|r|} \hline \multicolumn{5}{|c|}{ Accounts payablo } \\ \hline No. & Date & \multicolumn{1}{|c|}{ Debit } & Credit & \multicolumn{1}{c|}{ Balance } \\ \hline & January 02 & & & 5,800 \\ \hline \$ 6 & January 25 & 4,650 & & 1,150 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|r|r|} \hline \multicolumn{5}{|c|}{ Salarios payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 02 & & & 0 \\ \hline 11 & January 31 & & 24,700 & 24,700 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 02 & & & 77,300 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Retainod earnings } \\ \hline No. & Date & Debit & \multicolumn{1}{|c|}{ Credit } & \multicolumn{1}{|c|}{ Balance } \\ \hline & January 02 & & & 33,000 \\ \hline 12 & January 31 & & 87,208 & 120,208 \\ \hline A 13 & January 31 & .66,530 & & 53,678 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{4}{|c|}{ Salaries expense } \\ \hline No. & Date & Deblt & Credit & Balance \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{5}{|c|}{ Uuities expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline \end{tabular} \begin{tabular}{|l|c|c|r|r|} \hline \multicolumn{5}{|c|}{ Salaries payable } \\ \hline No. & Date & Debit & \multicolumn{1}{|c|}{ Credit } & \multicolumn{1}{|c|}{ Balance } \\ \hline & January 02 & & & 0 \\ \hline 11 & January 31 & & 24,700 & 24,700 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 02 & & & 77,300 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|r|r|} \hline \multicolumn{5}{|c|}{ Retained earnings } \\ \hline No. & Date & Debit & \multicolumn{1}{|c|}{ Credit } & \multicolumn{1}{|c|}{ Balance } \\ \hline & January of & & & 33,000 \\ \hline 12 & January 31 & & 87,208 & 120,208 \\ \hline 13 & January 31 & 66,530 & & 53,678 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|c|r|} \hline \multicolumn{5}{|c|}{ Interest revenue } \\ \hline No. & Date & \multicolumn{1}{|c|}{ Debit } & \multicolumn{1}{|c|}{ Credit } & \multicolumn{1}{|c|}{ Balance } \\ \hline & January 02 & & & 0 \\ \hline 10 & January 31 & & 108 & 108 \\ \hline 12 & January 31 & 108 & & 0 \\ \hline \end{tabular} \begin{tabular}{|r|c|r|r|r|} \hline \multicolumn{5}{|c|}{ Utilities expense } \\ \hline No. & Date & \multicolumn{1}{|c|}{ Dobit } & Credit & \multicolumn{1}{|c|}{ Balance } \\ \hline & January 02 & & & 0 \\ \hline 7 & January 30 & 11,800 & & 11,800 \\ \hline 13 & January 31 & & 11,800 & 0 \\ \hline \end{tabular} Complete this question by entering your answers in the tabs below. Notice the dropdown below that gives the options to select the unadjusted, adjusted or post-closing trial balance. The option you choose will be the values used to populate the income statement and balance sheet tabs. 9. Supplies at the end of January total $800. 10. Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31. 11. Unpaid salaries at the end of January are $24,700. * Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare an income statement for the period ended January 31, 2024. Choose the appropriate accounts to complete the company's income statement. The unadjusted, adjusted, or post-closing balances will Yappear for each account, based on your selection. 11. Unpaid salarles at the end of January are $24,700. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare a dossified balance sheet as of January 31, 2024. Choose the appropriate accounts to complete the company's balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection