Can I get help please

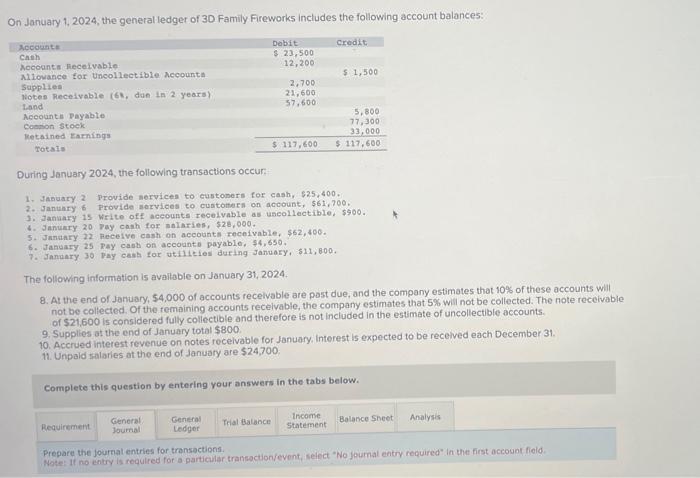

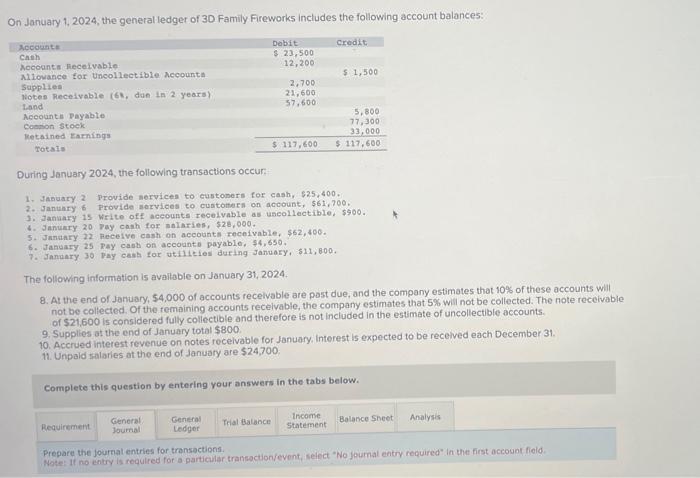

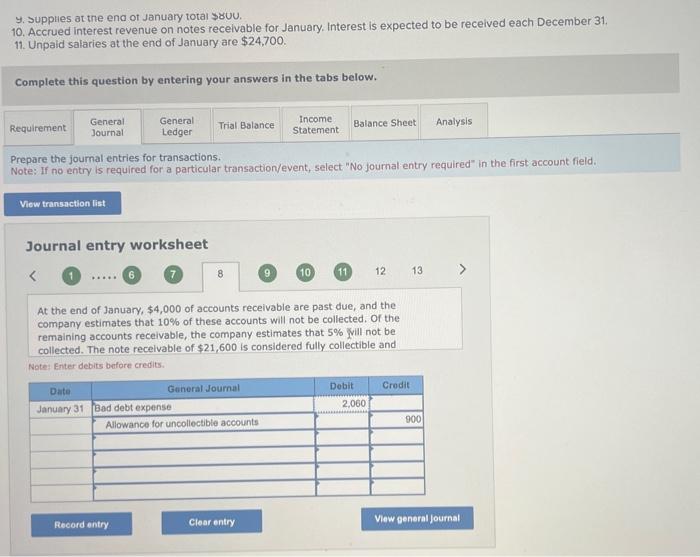

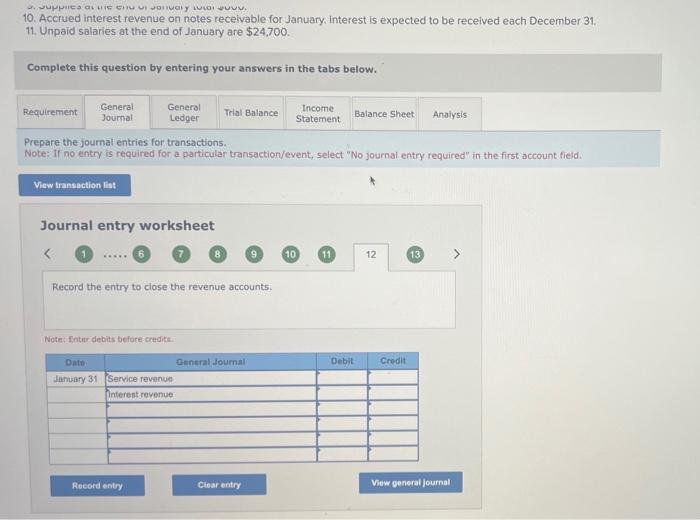

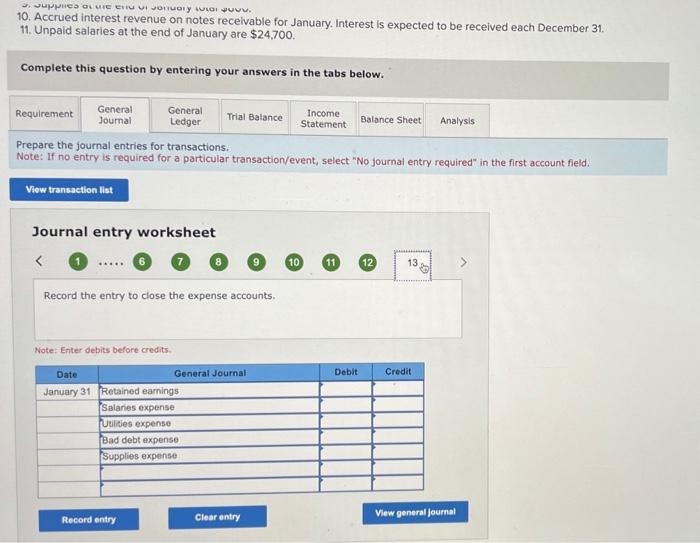

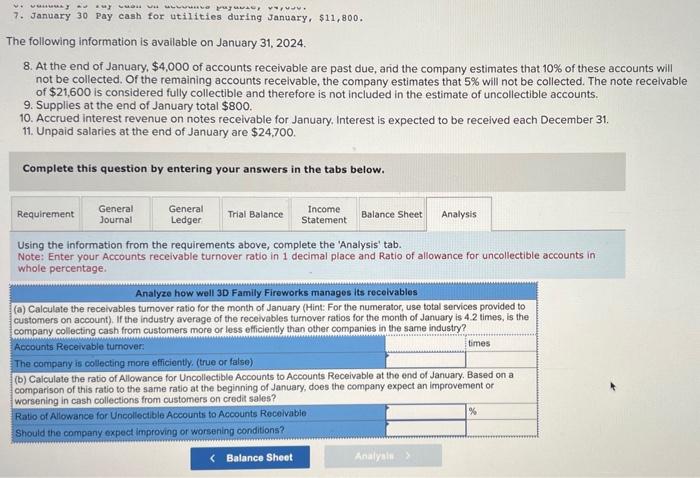

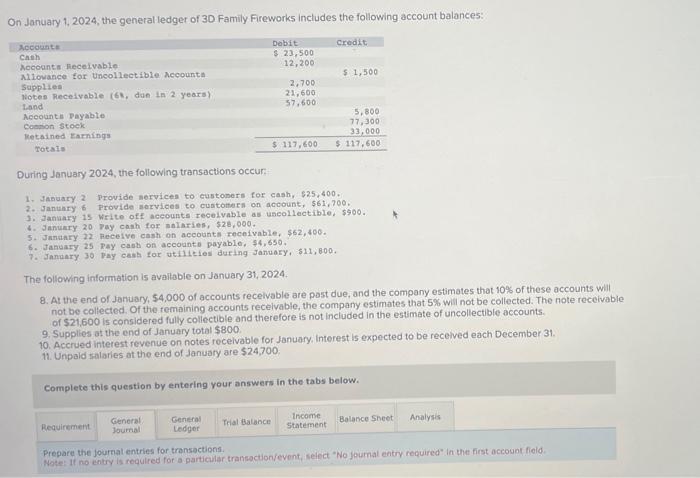

On January 1, 2024, the general ledger of 3D Family Fireworks includes the following account balances: During January 2024, the following transactions occur: 1. Jabuary 2 Provide nervicea to eustoners for cash, 525,400 . 2. Sanuary 6 Provide aervices to cuatottern on account, $61,700. 3. January 1s write off accounts recelvable as uscollectible, $900. 4. January 20 Fay coeb for malaries, $28,000. 5. Jnnahry 22 Feceive cash on acoounts receivable, $62,400. 6. January 25 Pay caob on accounto payable, 54,650 . 7. January 30 pay cash for utilleies during January, $11,800. The following information is avalitoble on January 31,2024. 8. At the end of January, 54,000 of accounts recelvable are post due, and the company estimates that 10\% of these accounts will not be collected. Of the remaining accounts recelvable, the company estimates that 5% will not be collected. The note receivable of $21,600 is considered fully collectible and therefore is not included in the estimate of uncollectible accounts. 9. Supplies at the end of January total $800 10. Accrued interest revenue on notes recelvable for January. Interest is expected to be received each December 31 . 11. Unpald salaries at the end of January are $24,700. Complete this question by entering your answers in the tabs below. Prepare the journat entries for transactions y. supples at the enc of January total $80u. 10. Accrued interest revenue on notes recelvable for January. Interest is expected to be received each December 31. 11. Unpaid salaries at the end of January are $24,700. Complete this question by entering your answers in the tabs below. Prepare the joumal entries for transactions. Note; If no entry is required for a particular transaction/event, select "No joumal entry required" in the first account field. Journal entry worksheet 1 6 10 (11) 1213 At the end of January, $4,000 of accounts receivable are past due, and the company estimates that 10% of these accounts will not be collected. Of the remaining accounts receivable, the company estimates that 5% il not be collected. The note recelvable of $21,600 is considered fully collectible and 10. Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 . 11. Unpaid salaries at the end of January are $24,700. Complete this question by entering your answers in the tabs below. Prepare the joumal entries for transactions. Note: If no entry is required for a particular transaction/event, select "No journal entry required" in the first account fied. Tnumnal ontrumarlrehant 10. Accrued interest revenue on notes recelvable for January. Interest is expected to be received each December 31 . 11. Unpaid salaries at the end of January are $24,700. Complete this question by entering your answers in the tabs below. Prepare the journal entries for transactions. Note: If no entry is required for a particular transaction/event, select "No journal entry required" in the first account field. Journal entrv worksheet Note: enter oepits berore credits. 7. January 30 Pay cash for utilities during January, $11,800. The following information is avallable on January 31,2024. 8. At the end of January, $4,000 of accounts receivable are past due, anid the company estimates that 10% of these accounts will not be collected. Of the remaining accounts recelvable, the company estimates that 5% will not be collected. The note recelvable of $21,600 is considered fully collectible and therefore is not included in the estimate of uncollectible accounts. 9. Supplies at the end of January total $800. 10. Accrued interest revenue on notes recelvable for January. Interest is expected to be recelved each December 31 . 11. Unpaid salaries at the end of January are $24,700. Complete this question by entering your answers in the tabs below. Using the information from the requirements above, complete the 'Analysis' tab. Note: Enter your Accounts receivable turnover ratio in 1 decimal place and Ratio of allowance for uncollectible accounts in whole percentage