Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can I get help resolving next exercises? The following information is useful in answering questions 1 to 6 : Acme makes and sells two products,

can I get help resolving next exercises?

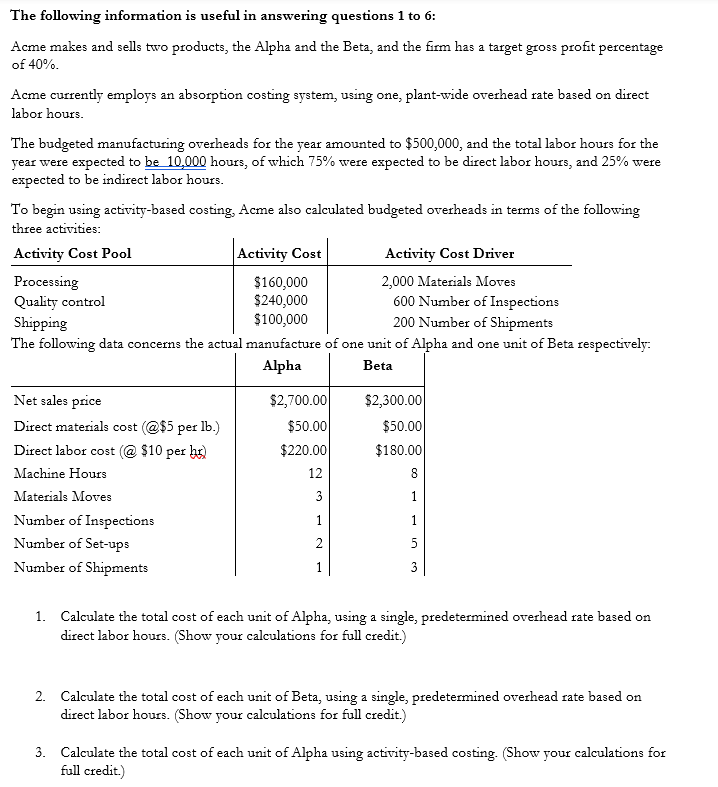

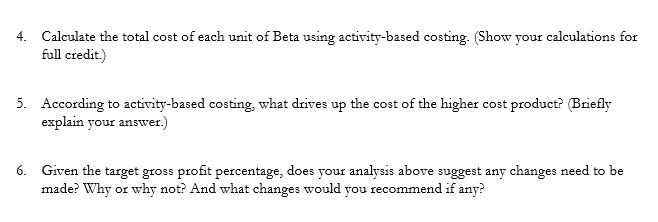

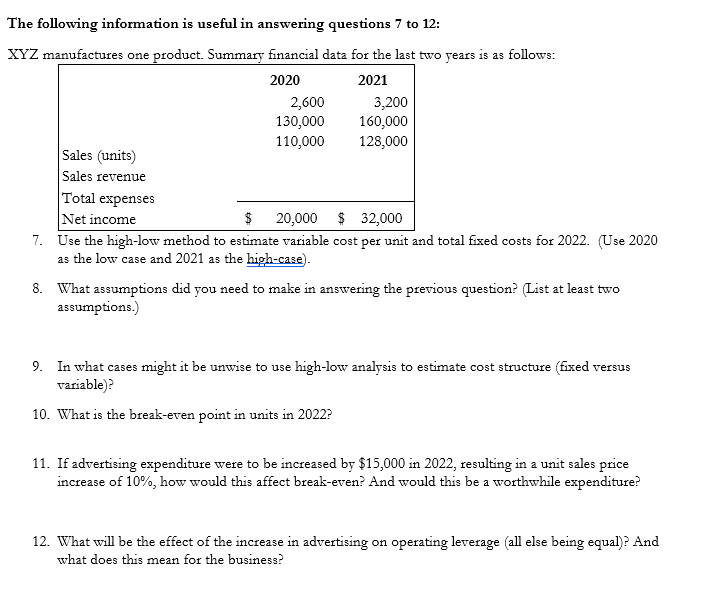

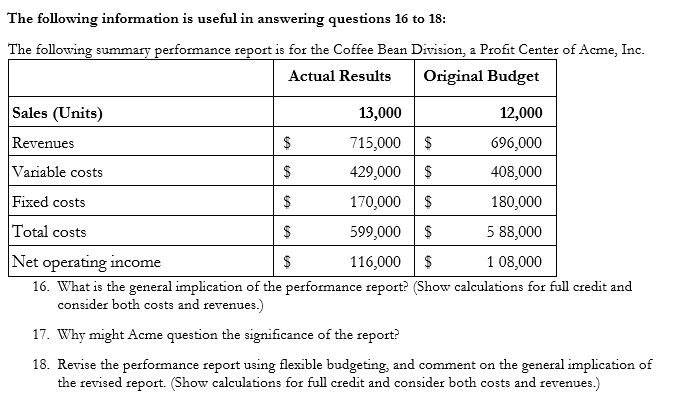

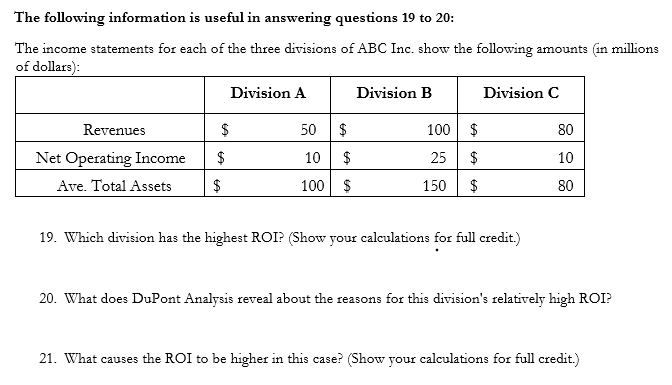

The following information is useful in answering questions 1 to 6 : Acme makes and sells two products, the Alpha and the Beta, and the firm has a target gross profit percentage of 40% Acme currently employs an absorption costing system, using one, plant-wide overhead rate based on direct labor hours. The budgeted manufacturing overheads for the year amounted to $500,000, and the total labor hours for the year were expected to be 10,000 hours, of which 75% were expected to be direct labor hours, and 25% were expected to be indirect labor hours. To begin using activity-based costing, Acme also calculated budgeted overheads in terms of the following three activities: The following data concerns the actual manufacture of one unit of Alpha and one unit of Beta respectively: 1. Calculate the total cost of each unit of Alpha, using a single, predetermined overhead rate based on direct labor hours. (Show your calculations for full credit.) 2. Calculate the total cost of each unit of Beta, using a single, predetermined overhead rate based on direct labor hours. (Show your calculations for full credit.) 3. Calculate the total cost of each unit of Alpha using activity-based costing. (Show your calculations for full credit.) Calculate the total cost of each unit of Beta using activity-based costing. (Show your calculations for full credit.) According to activity-based costing, what drives up the cost of the higher cost product? (Briefly explain your answer.) Given the target gross profit percentage, does your analysis above suggest any changes need to be made? Why or why not? And what changes would you recommend if any? The following information is useful in answering questions 7 to 12: XYZ manufactures one product. Summary financial data for the last two years is as follows: 7. Use the high-low method to estimate variable cost per unit and total fixed costs for 2022. (Use 2020 as the low case and 2021 as the high-case). 8. What assumptions did you need to make in answering the previous question? (List at least two assumptions.) 9. In what cases might it be unwise to use high-low analysis to estimate cost structure (fixed versus variable)? 10. What is the break-even point in units in 2022 ? 11. If advertising expenditure were to be increased by $15,000 in 2022 , resulting in a unit sales price increase of 10%, how would this affect break-even? And would this be a worthwhile expenditure? 12. What will be the effect of the increase in advertising on operating leverage (all else being equal)? And what does this mean for the business? The following information is useful in answering questions 13 to 15 : Acme produces a single product. Normal revenue and costs per unit are as follows: After completing its usual monthly orders, Acme received a one-off order from a firm in Canada to purchase 500 units at $50 each. If they do not fulfill the Canadian order, they would have capacity to fulfill an alternative order deriving a net cash in-flow of $9,000. To fulfill the Canadian order, Acme would have to use a machine it purchased last year for $7,500. (This machine was used last year for a different project and has no alternative uses this year.) And Acme would need to rent additional warehouse space costing $2,500. 13. Calculate the dollar value of the increase (or decrease) in monthly profits if Acme accepts the special order. (Show a decrease in profits as a negative number.) 14. So, does this analysis suggest Acme should accept the special order? (Simply state yes, or no.) 15. What qualitative factors might change your decision in this case? (List at least two relevant factors.) The following information is useful in answering questions 16 to 18 : The following summary performance report is for the Coffee Bean Division, a Profit Center of Acme, Inc. 16. What is the general implication of the performance report? (Show calculations for full credit and consider both costs and revenues.) 17. Why might Acme question the significance of the report? 18. Revise the performance report using flexible budgeting, and comment on the general implication of the revised report. (Show calculations for full credit and consider both costs and revenues.) The following information is useful in answering questions 19 to 20 : The income statements for each of the three divisions of ABC Inc. show the following amounts (in millions of dollars): 19. Which division has the highest ROI? (Show your calculations for full credit.) 20. What does DuPont Analysis reveal about the reasons for this division's relatively high ROI? 21. What causes the ROI to be higher in this case? (Show your calculations for full credit.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started