can i get help with the journal entries

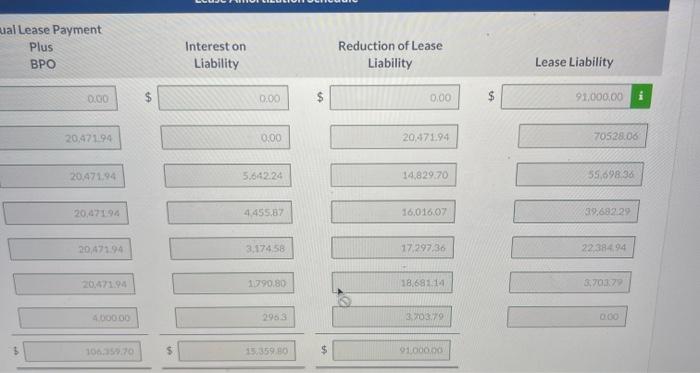

i added the pic of the amortization scheudle , if that helps

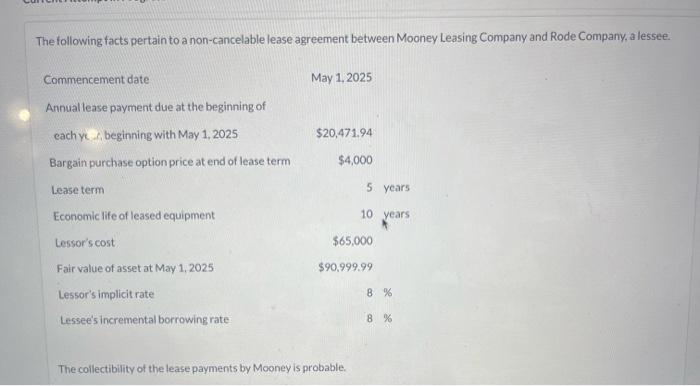

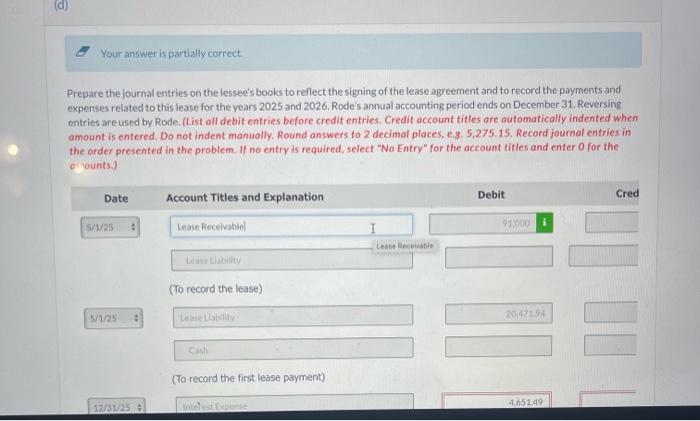

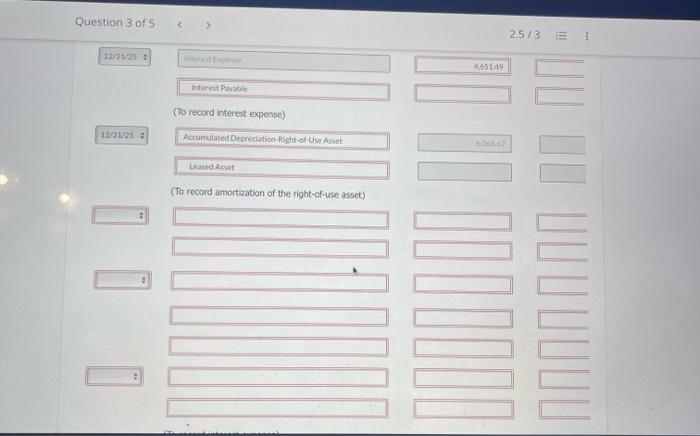

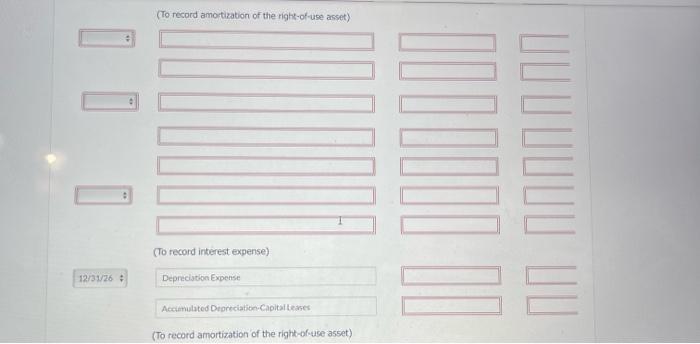

The following facts pertain to a non-cancelable lease agreement between Mooney Leasing Company and Rode Company, a lessee. The collectibility of the lease payments by Mooney is probable. Prepare the journal entries on the lessee's books to reflect the signing of the lease agreement and to record the payments and expenses related to thistease for the years 2025 and 2026. Rode's annual accounting period ends on December 31 . Reversing entries are used by Rode: (L ist all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.8, 5,275,15. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter 0 for the civounts.) Question 3 of 5 12 taras : (To record interest expense) Acoumulated Desredation-Fight-ot Use Aiset (To record amortization of the right-of-uge asset) (To record amortization of the right-of-use asset) (To record interest expense) Depreciation Expense Accithulated Depreciation Capital teares (To record amortization of the right-of-use asset) ual Lease Payment The following facts pertain to a non-cancelable lease agreement between Mooney Leasing Company and Rode Company, a lessee. The collectibility of the lease payments by Mooney is probable. Prepare the journal entries on the lessee's books to reflect the signing of the lease agreement and to record the payments and expenses related to thistease for the years 2025 and 2026. Rode's annual accounting period ends on December 31 . Reversing entries are used by Rode: (L ist all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.8, 5,275,15. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter 0 for the civounts.) Question 3 of 5 12 taras : (To record interest expense) Acoumulated Desredation-Fight-ot Use Aiset (To record amortization of the right-of-uge asset) (To record amortization of the right-of-use asset) (To record interest expense) Depreciation Expense Accithulated Depreciation Capital teares (To record amortization of the right-of-use asset) ual Lease Payment