Answered step by step

Verified Expert Solution

Question

1 Approved Answer

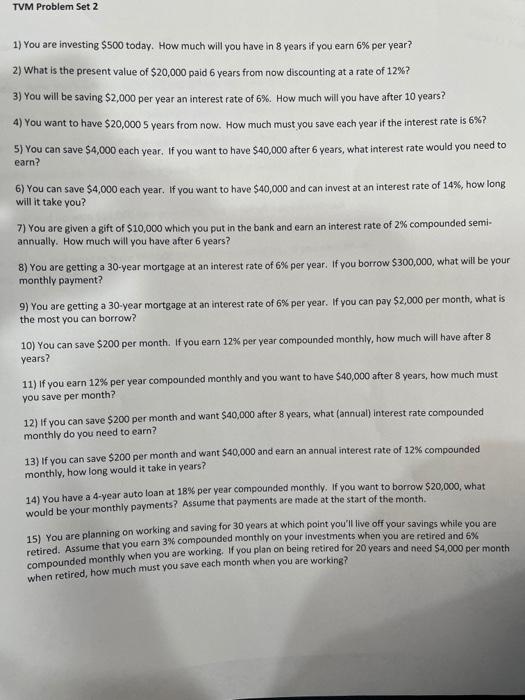

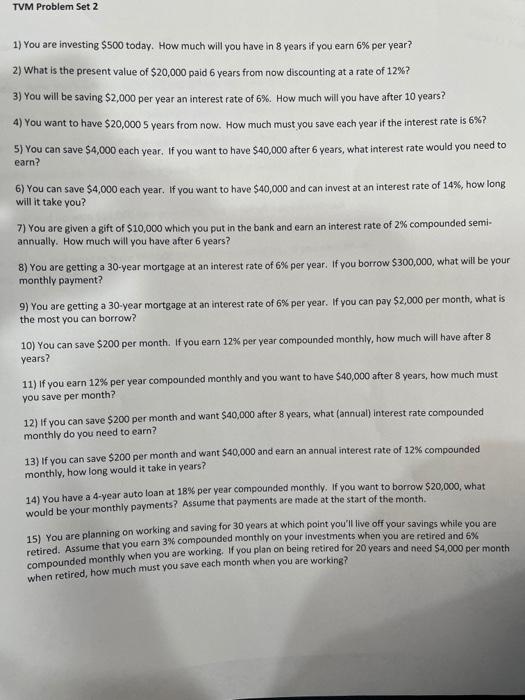

Can i get help with the process of inputting the information into my finance calculator to answer these questions please TVM Problem Set 2 1)

Can i get help with the process of inputting the information into my finance calculator to answer these questions please

TVM Problem Set 2 1) You are investing $500 today. How much will you have in 8 years if you earn 6% per year? 2) What is the present value of $20,000 paid 6 years from now discounting at a rate of 12%? 3) You will be saving $2,000 per year an interest rate of 6%. How much will you have after 10 years? 4) You want to have $20,000 5 years from now. How much must you save each year if the interest rate is 6%? 5) You can save $4,000 each year. If you want to have $40,000 after 6 years, what interest rate would you need to earn? 6) You can save $4,000 each year. If you want to have $40,000 and can invest at an interest rate of 14%, how long will it take you? 7) You are given a gift of $10,000 which you put in the bank and earn an interest rate of 2% compounded semi- annually. How much will you have after 6 years? 8) You are getting a 30-year mortgage at an interest rate of 6% per year. If you borrow $300,000, what will be your monthly payment? 9) You are getting a 30-year mortgage at an interest rate of 6% per year. If you can pay $2,000 per month, what is the most you can borrow? 10) You can save $200 per month. If you earn 12% per year compounded monthly, how much will have after 8 years? 11) If you earn 12% per year compounded monthly and you want to have $40,000 after 8 years, how much must you save per month? 12) If you can save $200 per month and want $40,000 after 8 years, what (annual) interest rate compounded monthly do you need to earn? 13) If you can save $200 per month and want $40,000 and earn an annual interest rate of 12% compounded monthly, how long would it take in years? 14) You have a 4-year auto loan at 18% per year compounded monthly. If you want to borrow $20,000, what would be your monthly payments? Assume that payments are made at the start of the month. 15) You are planning on working and saving for 30 years at which point you'll live off your savings while you are compounded monthly when you are working. If you plan on being retired for 20 years and need $4,000 per month when retired, how much must you save each month when you are working

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started