Answered step by step

Verified Expert Solution

Question

1 Approved Answer

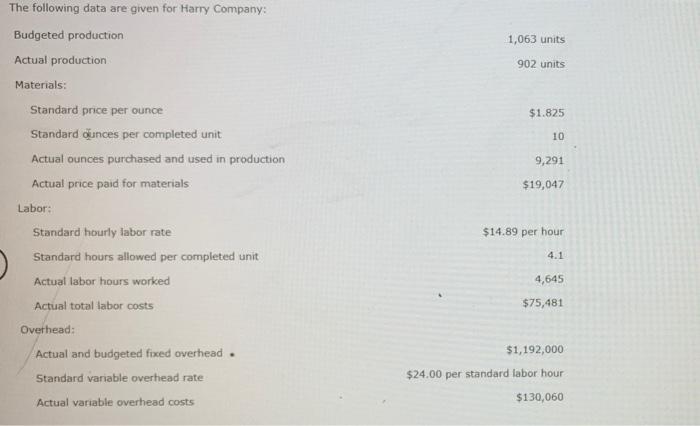

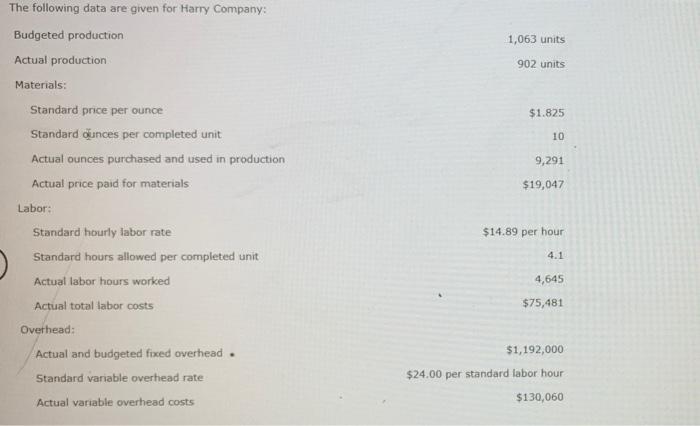

can i get help with this? 1,063 units 902 units $1.825 10 9,291 $19,047 The following data are given for Harry Company: Budgeted production Actual

can i get help with this?

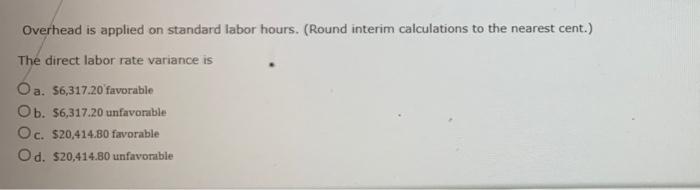

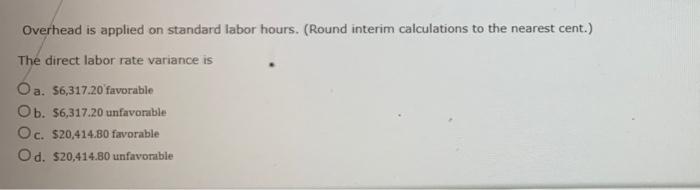

1,063 units 902 units $1.825 10 9,291 $19,047 The following data are given for Harry Company: Budgeted production Actual production Materials: Standard price per ounce Standard ounces per completed unit Actual ounces purchased and used in production Actual price paid for materials Labor: Standard hourly labor rate Standard hours allowed per completed unit Actual labor hours worked Actual total labor costs Overhead: Actual and budgeted fixed overhead . Standard variable overhead rate Actual variable overhead costs $14.89 per hour 4.1 4,645 $75,481 . $1,192,000 $24.00 per standard labor hour $130,060 Overhead is applied on standard labor hours. (Round interim calculations to the nearest cent.) The direct labor rate variance is Oa. $6,317.20 favorable Ob. 56,317.20 unfavorable Oc. $20,414.80 favorable Od. $20.414.80 unfavorable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started