Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can i get help with this please it's emergency General Lithograph Corporation uses no preferred stock. Their capital structure uses 50% debt (hint: the rest

can i get help with this please it's emergency

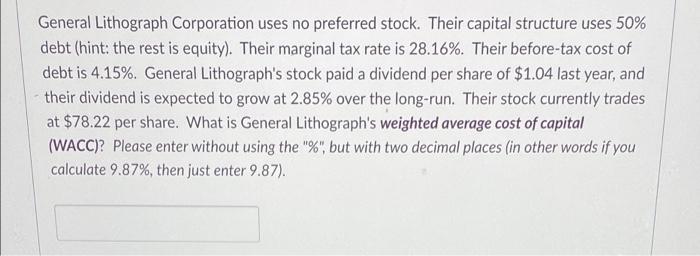

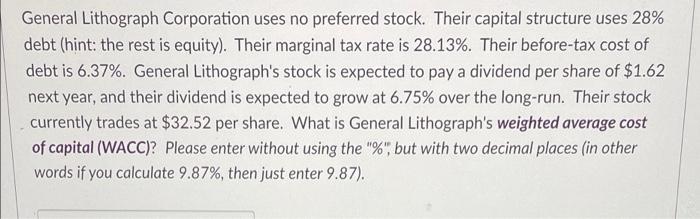

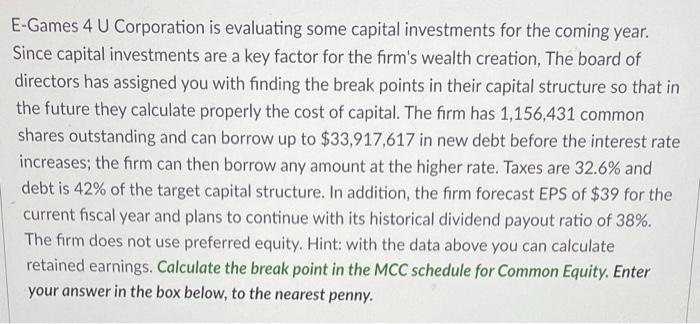

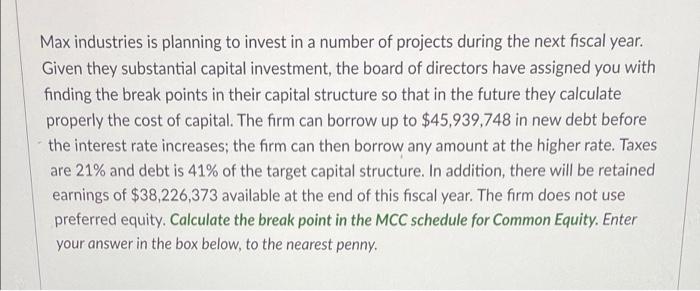

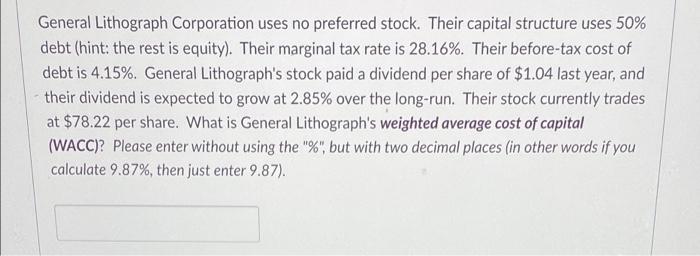

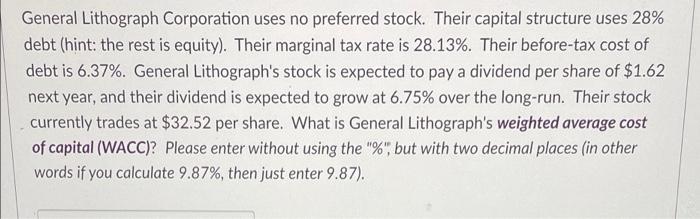

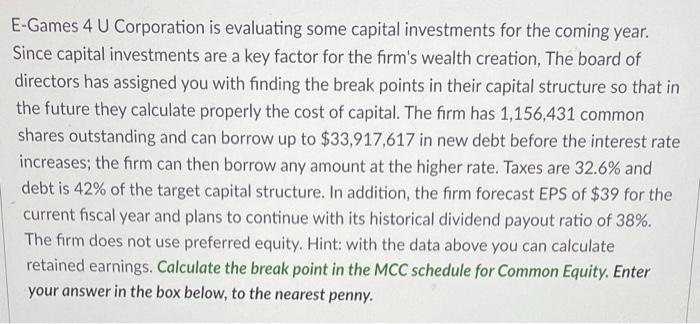

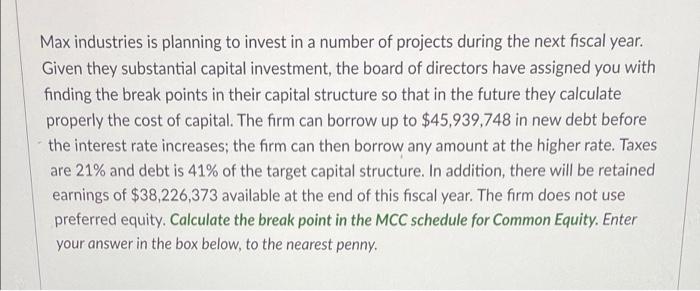

General Lithograph Corporation uses no preferred stock. Their capital structure uses 50% debt (hint: the rest is equity). Their marginal tax rate is 28.16%. Their before-tax cost of debt is 4.15%. General Lithograph's stock paid a dividend per share of $1.04 last year, and their dividend is expected to grow at 2.85% over the long-run. Their stock currently trades at $78.22 per share. What is General Lithograph's weighted average cost of capital (WACC)? Please enter without using the "%", but with two decimal places (in other words if you calculate 9.87%, then just enter 9.87). General Lithograph Corporation uses no preferred stock. Their capital structure uses 28% debt (hint: the rest is equity). Their marginal tax rate is 28.13%. Their before-tax cost of debt is 6.37%. General Lithograph's stock is expected to pay a dividend per share of $1.62 next year, and their dividend is expected to grow at 6.75% over the long-run. Their stock currently trades at $32.52 per share. What is General Lithograph's weighted average cost of capital (WACC)? Please enter without using the "%", but with two decimal places (in other words if you calculate 9.87%, then just enter 9.87). E-Games 4 U Corporation is evaluating some capital investments for the coming year. Since capital investments are a key factor for the firm's wealth creation, The board of directors has assigned you with finding the break points in their capital structure so that in the future they calculate properly the cost of capital. The firm has 1,156,431 common shares outstanding and can borrow up to $33,917,617 in new debt before the interest rate increases; the firm can then borrow any amount at the higher rate. Taxes are 32.6% and debt is 42% of the target capital structure. In addition, the firm forecast EPS of $39 for the current fiscal year and plans to continue with its historical dividend payout ratio of 38%. The firm does not use preferred equity. Hint: with the data above you can calculate retained earnings. Calculate the break point in the MCC schedule for Common Equity. Enter your answer in the box below, to the nearest penny. Max industries is planning to invest in a number of projects during the next fiscal year. Given they substantial capital investment, the board of directors have assigned you with finding the break points in their capital structure so that in the future they calculate properly the cost of capital. The firm can borrow up to $45,939,748 in new debt before the interest rate increases; the firm can then borrow any amount at the higher rate. Taxes are 21% and debt is 41% of the target capital structure. In addition, there will be retained earnings of $38,226,373 available at the end of this fiscal year. The firm does not use preferred equity. Calculate the break point in the MCC schedule for Common Equity. Enter your answer in the box below, to the nearest penny

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started