can i get help with this question please and can you show me on Excel and formula too

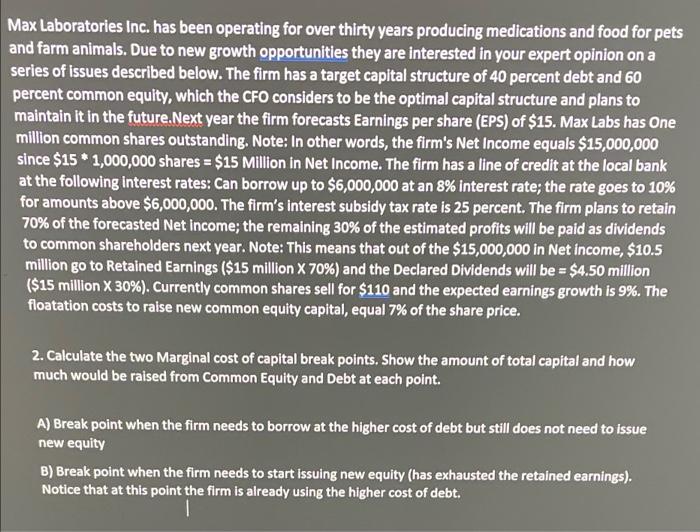

Les Laboratories Fee has been operating over dats es podring medications and food fin pers and formatimah. Doe to w goth spesasses they were interested in your expert opinions in a series sal dee he farm lesa taiget catals opty, which de CFO od to be the optimal capital cor and plass so e of 40 percent debt and 60 perco Next year the fam focess Eags pershme % of $15. Mas Lals bs Our millo connen slins ding Nate to the the 'No Ime al 1000,00 215 1,000,000 u Milioni The fim lisa lernt odit as de local bud at de blowing inter Can brone to $600,000 an The n'sindsily state 25 pers incest ste, de st get 10% hox she $0 and the Died 14.30 1 The Emplos 10% of de l Net istiar, de seming 30% of the stand pestes will be paid as desleale to come un e Now The Maf003 million yo te Red Haring (13 mille Currently concesin shaper sell for $110 sad de especial emings growd in 9% The corputy capital, epul 7 of de shane puce 2 Calolate the two Marginal cost of capital berak points. Show the amount of total capital and how much would be saised from Common Erary and Debt at each point A) Berah point when the firm needs to borrow at the higher cost of debt but still does not need to issue new equity B) Break point when the firm needs to start issuing new equity (has exhausted the retained earnings). Notice that at this point the firm is already using the higher cost of debt. Max Laboratories Inc. has been operating for over thirty years producing medications and food for pets and farm animals. Due to new growth opportunities they are interested in your expert opinion on a series of issues described below. The firm has a target capital structure of 40 percent debt and 60 percent common equity, which the CFO considers to be the optimal capital structure and plans to maintain it in the future.Next year the firm forecasts Earnings per share (EPS) of $15. Max Labs has One million common shares outstanding. Note: In other words, the firm's Net Income equals $15,000,000 since $15 * 1,000,000 shares = $15 Million in Net Income. The firm has a line of credit at the local bank at the following interest rates: Can borrow up to $6,000,000 at an 8% interest rate; the rate goes to 10% for amounts above $6,000,000. The firm's interest subsidy tax rate is 25 percent. The firm plans to retain 70% of the forecasted Net income; the remaining 30% of the estimated profits will be paid as dividends to common shareholders next year. Note: This means that out of the $15,000,000 in Net income, $10.5 million go to Retained Earnings ($15 million X 70%) and the Declared Dividends will be = $4.50 million ($15 million X 30%). Currently common shares sell for $110 and the expected earnings growth is 9%. The floatation costs to raise new common equity capital, equal 7% of the share price. 2. Calculate the two Marginal cost of capital break points. Show the amount of total capital and how much would be raised from Common Equity and Debt at each point. A) Break point when the firm needs to borrow at the higher cost of debt but still does not need to issue new equity B) Break point when the firm needs to start issuing new equity (has exhausted the retained earnings). Notice that at this point the firm is already using the higher cost of debt. Les Laboratories Fee has been operating over dats es podring medications and food fin pers and formatimah. Doe to w goth spesasses they were interested in your expert opinions in a series sal dee he farm lesa taiget catals opty, which de CFO od to be the optimal capital cor and plass so e of 40 percent debt and 60 perco Next year the fam focess Eags pershme % of $15. Mas Lals bs Our millo connen slins ding Nate to the the 'No Ime al 1000,00 215 1,000,000 u Milioni The fim lisa lernt odit as de local bud at de blowing inter Can brone to $600,000 an The n'sindsily state 25 pers incest ste, de st get 10% hox she $0 and the Died 14.30 1 The Emplos 10% of de l Net istiar, de seming 30% of the stand pestes will be paid as desleale to come un e Now The Maf003 million yo te Red Haring (13 mille Currently concesin shaper sell for $110 sad de especial emings growd in 9% The corputy capital, epul 7 of de shane puce 2 Calolate the two Marginal cost of capital berak points. Show the amount of total capital and how much would be saised from Common Erary and Debt at each point A) Berah point when the firm needs to borrow at the higher cost of debt but still does not need to issue new equity B) Break point when the firm needs to start issuing new equity (has exhausted the retained earnings). Notice that at this point the firm is already using the higher cost of debt. Max Laboratories Inc. has been operating for over thirty years producing medications and food for pets and farm animals. Due to new growth opportunities they are interested in your expert opinion on a series of issues described below. The firm has a target capital structure of 40 percent debt and 60 percent common equity, which the CFO considers to be the optimal capital structure and plans to maintain it in the future.Next year the firm forecasts Earnings per share (EPS) of $15. Max Labs has One million common shares outstanding. Note: In other words, the firm's Net Income equals $15,000,000 since $15 * 1,000,000 shares = $15 Million in Net Income. The firm has a line of credit at the local bank at the following interest rates: Can borrow up to $6,000,000 at an 8% interest rate; the rate goes to 10% for amounts above $6,000,000. The firm's interest subsidy tax rate is 25 percent. The firm plans to retain 70% of the forecasted Net income; the remaining 30% of the estimated profits will be paid as dividends to common shareholders next year. Note: This means that out of the $15,000,000 in Net income, $10.5 million go to Retained Earnings ($15 million X 70%) and the Declared Dividends will be = $4.50 million ($15 million X 30%). Currently common shares sell for $110 and the expected earnings growth is 9%. The floatation costs to raise new common equity capital, equal 7% of the share price. 2. Calculate the two Marginal cost of capital break points. Show the amount of total capital and how much would be raised from Common Equity and Debt at each point. A) Break point when the firm needs to borrow at the higher cost of debt but still does not need to issue new equity B) Break point when the firm needs to start issuing new equity (has exhausted the retained earnings). Notice that at this point the firm is already using the higher cost of debt