Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can i get some help please Suppose Series A investor invested $6M and holds PCPC. The following is the description of the PCPC: : First

Can i get some help please

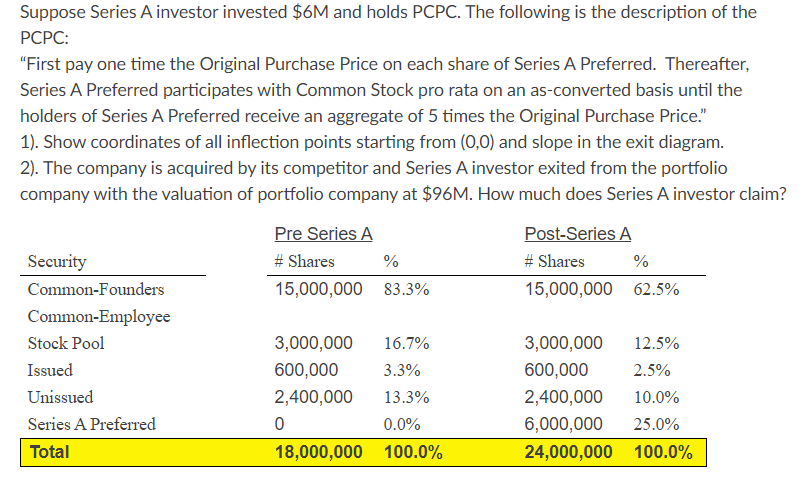

Suppose Series A investor invested $6M and holds PCPC. The following is the description of the PCPC: : "First pay one time the Original Purchase Price on each share of Series A Preferred. Thereafter, Series A Preferred participates with Common Stock pro rata on an as-converted basis until the holders of Series A Preferred receive an aggregate of 5 times the Original Purchase Price." 1). Show coordinates of all inflection points starting from (0,0) and slope in the exit diagram. 2). The company is acquired by its competitor and Series A investor exited from the portfolio company with the valuation of portfolio company at $96M. How much does Series A investor claim? Pre Series A Post-Series A Security # Shares % # Shares % Common-Founders 15,000,000 83.3% 15,000,000 62.5% Common-Employee Stock Pool 3,000,000 16.7% 3,000,000 12.5% Issued 600,000 3.3% 600,000 2.5% Unissued 2,400,000 13.3% 2,400,000 10.0% Series A Preferred 0 0.0% 6,000,000 25.0% Total 18,000,000 100.0% 24,000,000 100.0% Suppose Series A investor invested $6M and holds PCPC. The following is the description of the PCPC: : "First pay one time the Original Purchase Price on each share of Series A Preferred. Thereafter, Series A Preferred participates with Common Stock pro rata on an as-converted basis until the holders of Series A Preferred receive an aggregate of 5 times the Original Purchase Price." 1). Show coordinates of all inflection points starting from (0,0) and slope in the exit diagram. 2). The company is acquired by its competitor and Series A investor exited from the portfolio company with the valuation of portfolio company at $96M. How much does Series A investor claim? Pre Series A Post-Series A Security # Shares % # Shares % Common-Founders 15,000,000 83.3% 15,000,000 62.5% Common-Employee Stock Pool 3,000,000 16.7% 3,000,000 12.5% Issued 600,000 3.3% 600,000 2.5% Unissued 2,400,000 13.3% 2,400,000 10.0% Series A Preferred 0 0.0% 6,000,000 25.0% Total 18,000,000 100.0% 24,000,000 100.0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started