Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recording Entries for an Installment Note Payable On January 1, 2020, a borrower signed a long-term note, face amount, $240,000; time to maturity, three

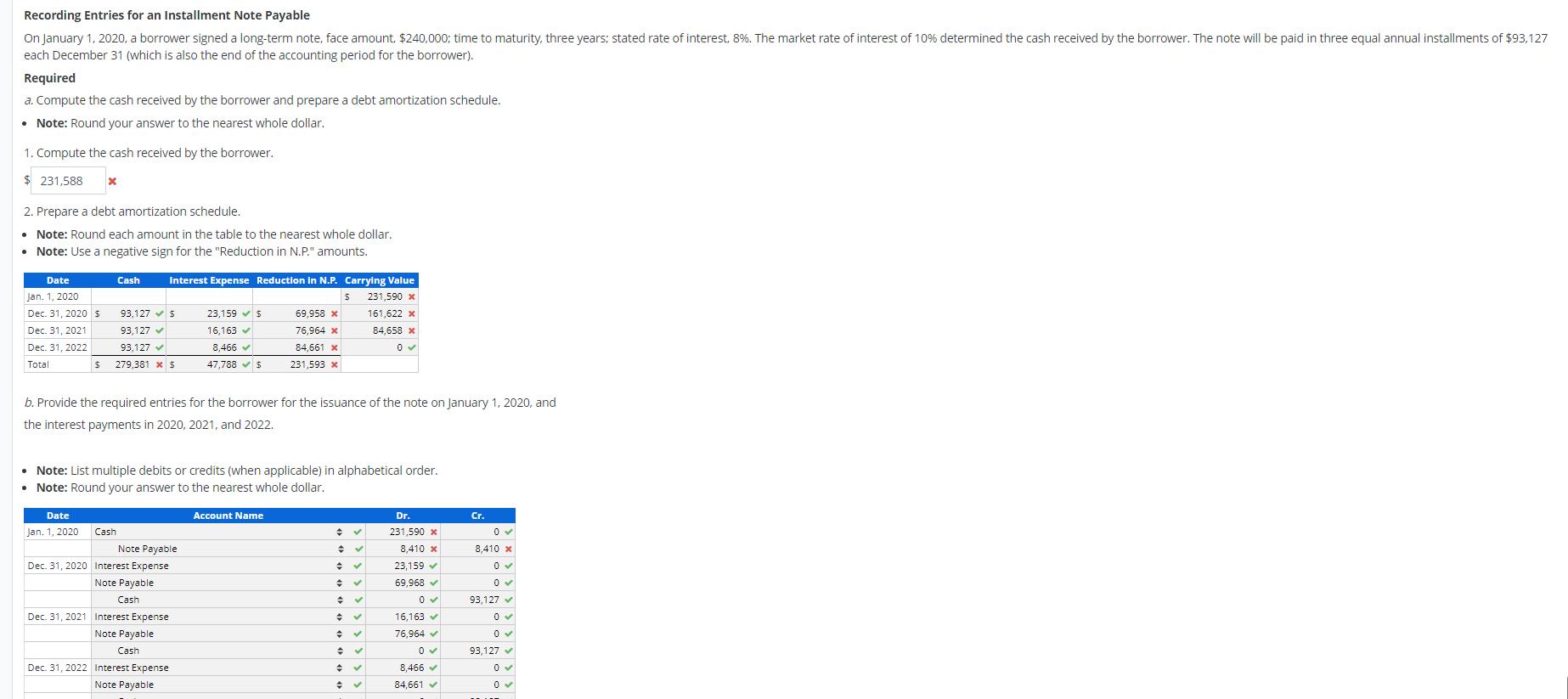

Recording Entries for an Installment Note Payable On January 1, 2020, a borrower signed a long-term note, face amount, $240,000; time to maturity, three years; stated rate of interest, 8%. The market rate of interest of 10% determined the cash received by the borrower. The note will be paid in three equal annual installments of $93,127 each December 31 (which is also the end of the accounting period for the borrower). Required a. Compute the cash received by the borrower and prepare a debt amortization schedule. Note: Round your answer to the nearest whole dollar. 1. Compute the cash received by the borrower. $ 231,588 X 2. Prepare a debt amortization schedule. Note: Round each amount in the table to the nearest whole dollar. Note: Use a negative sign for the "Reduction in N.P." amounts. Date Jan. 1, 2020 Dec. 31, 2020 $ Dec. 31, 2021 Dec. 31, 2022 Total $ Date Jan. 1, 2020 Cash 93,127 $ 93,127 93,127 279,381 x $ Interest Expense Reduction in N.P. Carrying Value 231,590 * 161,622 x 84,658 x 0 Cash b. Provide the required entries for the borrower for the issuance of the note on January 1, 2020, and the interest payments in 2020, 2021, and 2022. Note: List multiple debits or credits (when applicable) in alphabetical order. Note: Round your answer to the nearest whole dollar. Note Payable Dec. 31, 2020 Interest Expense Note Payable Cash 23,159 $ 16,163 8,466 47,788 $ Dec. 31, 2021 Interest Expense Note Payable Cash Dec. 31, 2022 Interest Expense Note Payable 69,958 x 76,964 x 84,661 x 231,593 x Account Name $ + + + + Dr. 231,590 * 8,410 x 23,159 69,968 0 16,163 76,964 0 8,466 84,661 Cr. 0 8,410 x 0 0 93,127 0 0 93,127 v 0 0

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Proceeds form Notes Pyable Present Value of Cash Outflows discounting at market rate Workings Da...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started