Consider a limit order book with price-time execution priority. There are 250 shares posted at the best bid price, SEK 25.13, and 470 shares

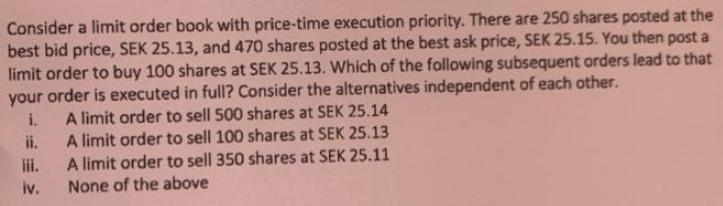

Consider a limit order book with price-time execution priority. There are 250 shares posted at the best bid price, SEK 25.13, and 470 shares posted at the best ask price, SEK 25.15. You then post a limit order to buy 100 shares at SEK 25.13. Which of the following subsequent orders lead to that your order is executed in full? Consider the alternatives independent of each other. i. A limit order to sell 500 shares at SEK 25.14 ii. iii. A limit order to sell 100 shares at SEK 25.13 A limit order to sell 350 shares at SEK 25.11 None of the above iv.

Step by Step Solution

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Step 12 After the limit order to buy 100 shares at SEK 2513 is given The order book is updated and t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started