Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can I get the solution with explanation, thank you. John took a personal loan of $100,000 from the bank at a nominal interest rate of

Can I get the solution with explanation, thank you.

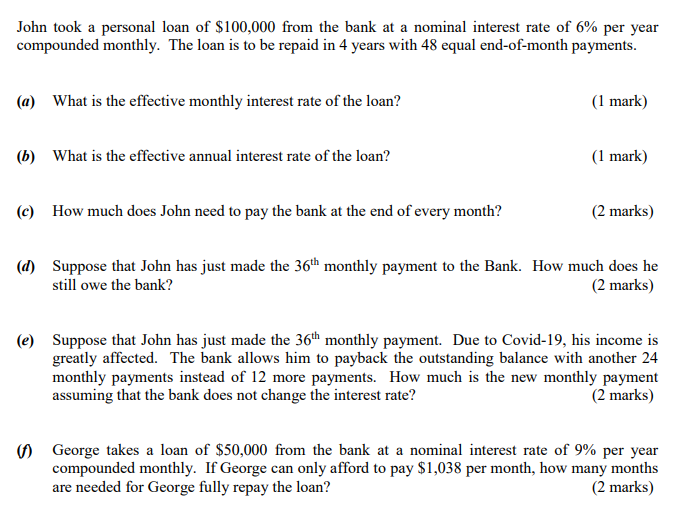

John took a personal loan of $100,000 from the bank at a nominal interest rate of 6% per year compounded monthly. The loan is to be repaid in 4 years with 48 equal end-of-month payments. (a) What is the effective monthly interest rate of the loan? (1 mark) (b) What is the effective annual interest rate of the loan? (1 mark) (c) How much does John need to pay the bank at the end of every month? (2 marks) (d) Suppose that John has just made the 36th monthly payment to the Bank. How much does he still owe the bank? (2 marks) (@) Suppose that John has just made the 36th monthly payment. Due to Covid-19, his income is greatly affected. The bank allows him to payback the outstanding balance with another 24 monthly payments instead of 12 more payments. How much is the new monthly payment assuming that the bank does not change the interest rate? (2 marks) George takes a loan of $50,000 from the bank at a nominal interest rate of 9% per year compounded monthly. If George can only afford to pay $1,038 per month, how many months are needed for George fully repay the loan? (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started