Answered step by step

Verified Expert Solution

Question

1 Approved Answer

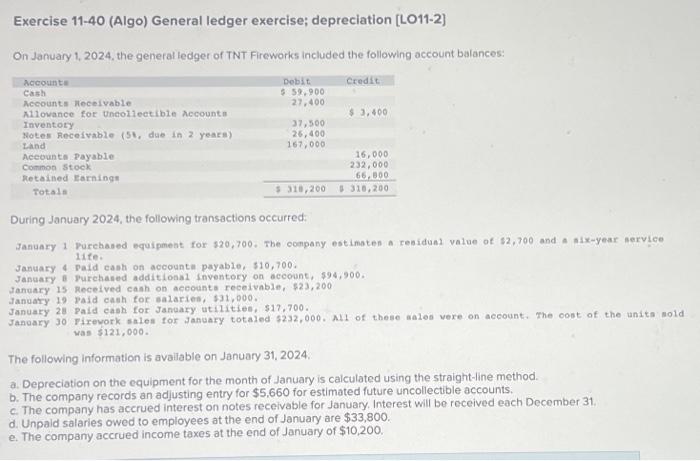

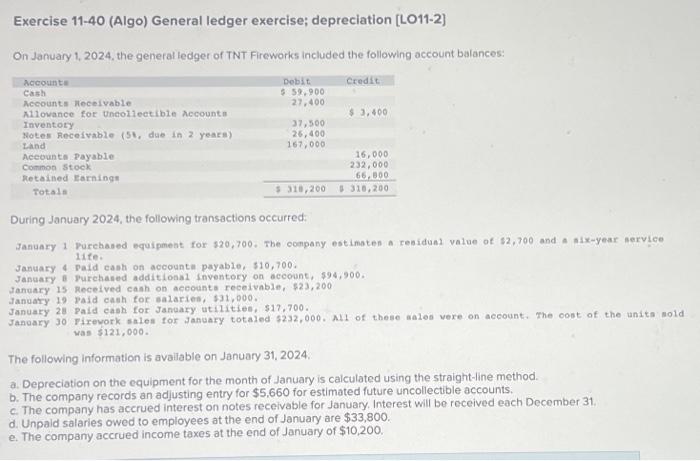

Can I grt help please Exercise 11-40 (Algo) General ledger exercise; depreciation [LO11-2] On January 1, 2024, the general ledger of TNT Fireworks included the

Can I grt help please

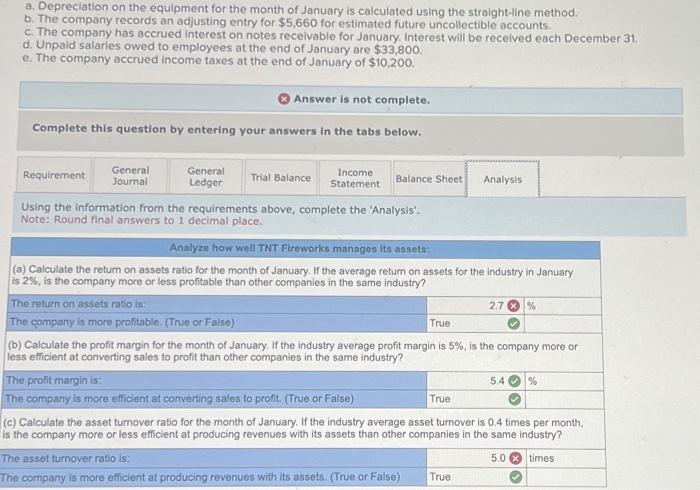

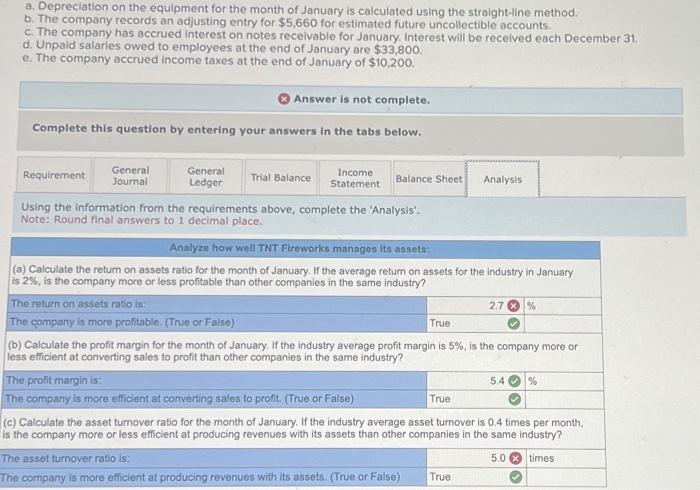

Exercise 11-40 (Algo) General ledger exercise; depreciation [LO11-2] On January 1, 2024, the general ledger of TNT Fireworks included the following account balances: During January 2024, the following transactions occurred: January 1 Purehased equipment for 320,700 . The company estimaten a reaidund value of 32,700 and a six-year nervice 1ife. January 4 paid cash on accountn payable, 510,700 . January of purchased additional inventory on occount, 594,900. January is Received caah on accounts receivable, 523,200 January is paid cash for salaries, s31,000. January 28 paid caoh for Janoary utilitien, 117,700 . January 30 Firevork salon for January totaled 5232,000 . A11 of these anles vere on account. The cont of the units sold vas $121,000. The following information is available on January 31,2024. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. b. The company records an adjusting entry for $5,660 for estimated future uncollectible accounts. c. The company has accued interest on notes receivable for January. Interest will be received each December 31 . d. Unpald salaries owed to employees at the end of January are $33,800. e. The company accrued income taxes at the end of January of $10,200. a. Depreciation on the equipment for the month of January is calculated using the straight-ine method. b. The company records an adjusting entry for $5,660 for estimated future uncollectible accounts c. The company has accrued interest on notes recelvable for January. Interest will be recelved each December 31 . d. Unpald salaries owed to employees at the end of January are $33,800. e. The company accrued income taxes at the end of January of $10,200. * Answer is not complete. Complete this question by entering your answers in the tabs below. Using the information from the requirements above, complete the 'Analysis'. Exercise 11-40 (Algo) General ledger exercise; depreciation [LO11-2] On January 1, 2024, the general ledger of TNT Fireworks included the following account balances: During January 2024, the following transactions occurred: January 1 Purehased equipment for 320,700 . The company estimaten a reaidund value of 32,700 and a six-year nervice 1ife. January 4 paid cash on accountn payable, 510,700 . January of purchased additional inventory on occount, 594,900. January is Received caah on accounts receivable, 523,200 January is paid cash for salaries, s31,000. January 28 paid caoh for Janoary utilitien, 117,700 . January 30 Firevork salon for January totaled 5232,000 . A11 of these anles vere on account. The cont of the units sold vas $121,000. The following information is available on January 31,2024. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. b. The company records an adjusting entry for $5,660 for estimated future uncollectible accounts. c. The company has accued interest on notes receivable for January. Interest will be received each December 31 . d. Unpald salaries owed to employees at the end of January are $33,800. e. The company accrued income taxes at the end of January of $10,200. a. Depreciation on the equipment for the month of January is calculated using the straight-ine method. b. The company records an adjusting entry for $5,660 for estimated future uncollectible accounts c. The company has accrued interest on notes recelvable for January. Interest will be recelved each December 31 . d. Unpald salaries owed to employees at the end of January are $33,800. e. The company accrued income taxes at the end of January of $10,200. * Answer is not complete. Complete this question by entering your answers in the tabs below. Using the information from the requirements above, complete the 'Analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started