Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can I have help finding the solutions to questions 9 and 10 on my practice guide. thank you 9) Under the Dodd-Frank Financial Reform legislation,

Can I have help finding the solutions to questions 9 and 10 on my practice guide. thank you

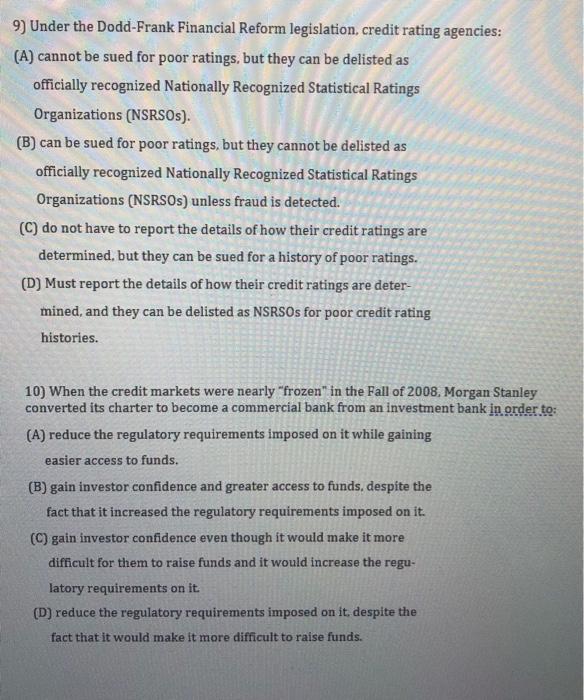

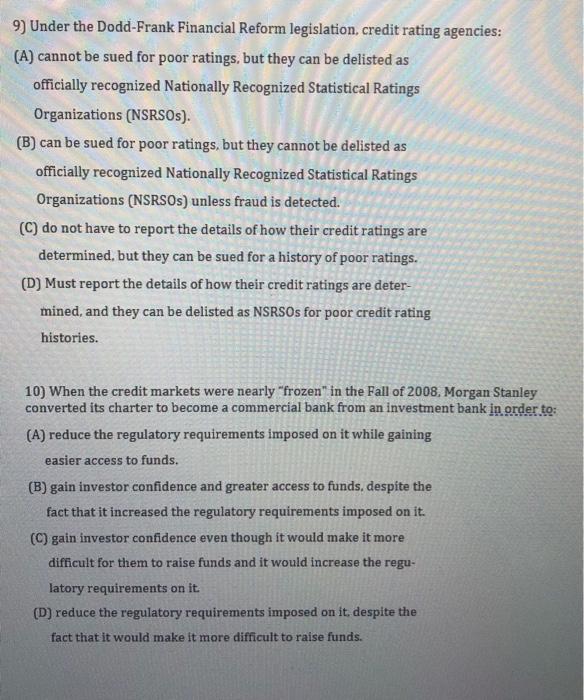

9) Under the Dodd-Frank Financial Reform legislation, credit rating agencies: (A) cannot be sued for poor ratings, but they can be delisted as officially recognized Nationally Recognized Statistical Ratings Organizations (NSRSOs). (B) can be sued for poor ratings, but they cannot be delisted as officially recognized Nationally Recognized Statistical Ratings Organizations (NSRSOs) unless fraud is detected. (C) do not have to report the details of how their credit ratings are determined, but they can be sued for a history of poor ratings. (D) Must report the details of how their credit ratings are deter- mined, and they can be delisted as NSRSOs for poor credit rating histories. 10) When the credit markets were nearly frozen" in the Fall of 2008. Morgan Stanley converted its charter to become a commercial bank from an investment bank in order to: (A) reduce the regulatory requirements imposed on it while gaining easier access to funds. (B) gain investor confidence and greater access to funds, despite the fact that it increased the regulatory requirements imposed on it. (C) gain investor confidence even though it would make it more difficult for them to raise funds and it would increase the regu- latory requirements on it. (D) reduce the regulatory requirements imposed on it, despite the fact that it would make it more difficult to raise funds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started