Answered step by step

Verified Expert Solution

Question

1 Approved Answer

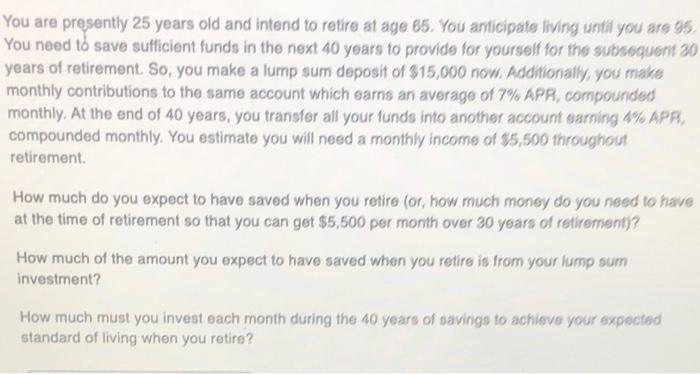

can i have some help You are presently 25 years old and intend to retire at age 65. You anticipate living until you are 95

can i have some help

You are presently 25 years old and intend to retire at age 65. You anticipate living until you are 95 You need to save sufficient funds in the next 40 years to provide for yourself for the subsequent 30 years of retirement. So, you make a lump sum deposit of $15,000 now. Additionally, you make monthly contributions to the same account which earns an average of 1% APR, compounded monthly. At the end of 40 years, you transfer all your funds into another account earning 4% APR, compounded monthly. You estimate you will need a monthly income of $5,500 throughout retirement How much do you expect to have saved when you retire (or, how much money do you need to have at the time of retirement so that you can get $5,500 per month over 30 years of retirement)? How much of the amount you expect to have saved when you retire is from your lump sum investment? How much must you invest each month during the 40 years of savings to achieve your expected standard of living when you retire

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started