can I please get a detailed answer for the NPV? thanks.

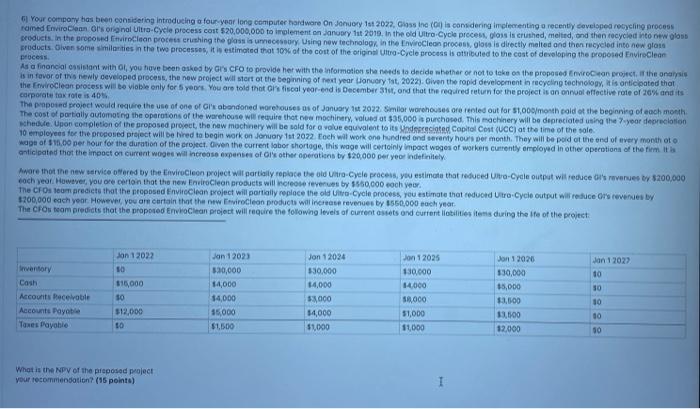

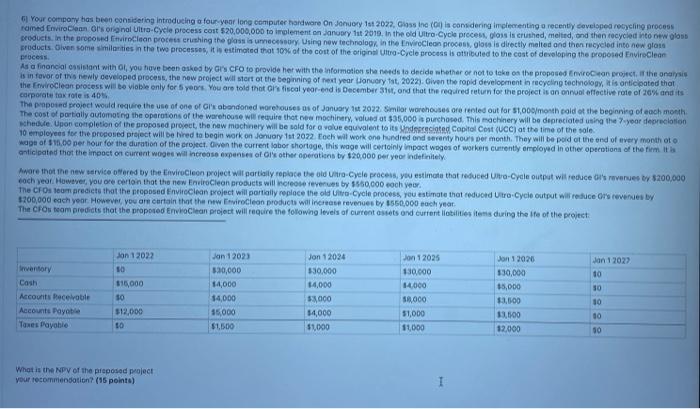

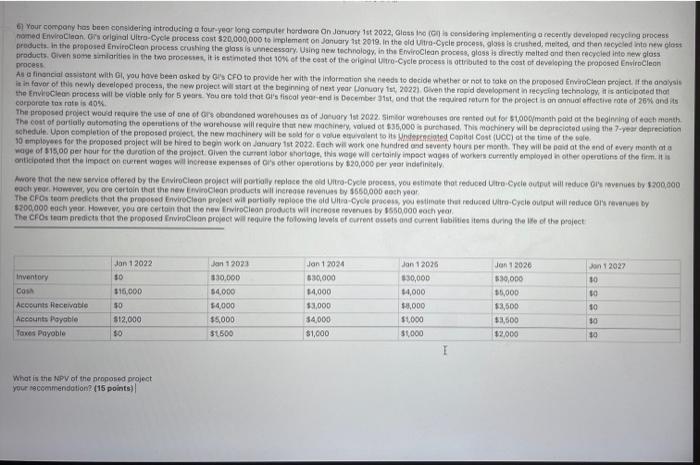

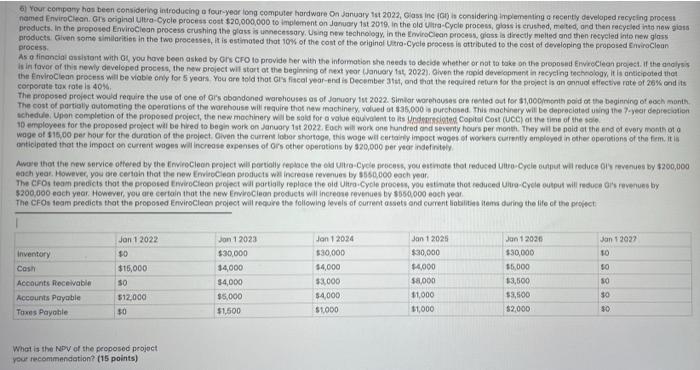

Your company has been considering Introducing a four year long computer hardware On January 11 2022. Gloss in is considering implementing a recently developed recycling process ramed EnviroClean Ors original Ultra-Cycle process cost $20.000,000 to implement on January 1st 2019, in the old Ultra-Cycle process, gloss is crushed, melted, and then recycled to news products in the proposed EnviroClean proces crushing the loss is unnecessary. Using new technology in the EnviroClean process, gloss is directly melted and then recycled into new gone products. Olves some similarities in the two processes, it is estimated that 10% of the cost of the original Ultra-Cycle process is attributed to the cost of developing the proposed EnviroClean process As a financial assistant with ol, you have been asked by G CFO to provide her with the information she needs to decide whether or not to take on the proposed Environ project. I the one is in favor of newly developed process, the new project will start of the beginning of next year Lanuary 1st 2022). Given the rapid development in recycling technology, it is anticipated that the EnviroClean process will be viable only for years. You are told that are fiscal year-end is December 31, and that the required return for the project is an annual effective role of 20% and its corporate tax role is 40% The proposed project would require the use of one of Gr's abandoned warehouses os of January 1 2022. Similar warehouses are rented out for $1,000/month old at the beginning of each month The cost of partially automoting the operations of the warehouse will require thot new machinery, valued at $35.000 is purchased. This machinery will be depreciated using the year depreco whedule Upon completion of the proposed project, the new machinery will be sold for a value equvalent to its indepeciated Capitol Cost (UCC) of the time of the sale 10 employees for the proposed project will be red to begin work on January 1 2072 Toch will work one hundred ondervonly hours per month. They will be pod at the end of every month to wage of 18,00 per hour for the duration of the groject. Given the current lobor shortage, this wage will certainly impact wages of workers currently employed in other operations of the time anticipated that the impact on current wages will increase expenses of or's other operations by $20,000 per yerindefinitely Aware that the new service offered by the EnviroCleon project will partially replace the old Utro-Cycle process, you estimate that reduced Ultra-Cycle output wil reduce ai's revenues w $200,000 each year. However, you are certain that the new EnviroClean products will increase revenues by 1560,000 coch year. The CFOsteom predicts that the proposed Envirocion project will partially replace the old Ultra-Cycle process, you estimate that reduard Utro-Cycle output will reduce or revenues by $200,000 each year. However, you mountain that the new EnviroClean products will increase revenues by $550,000 each year The CFOsteom predicts that the proposed EnviroClean project will require the following levels of current assets and current lotilities itens during the Ife of the project Inventory Cash Accounts Receivable Accounts Payable Tones Payable on 1 2022 10 115,000 10 $12,000 10 on 12023 530,000 14,000 14,000 55.000 $1,500 Jon 12024 $30,000 14,000 53,000 54,000 $1,000 Jon 12025 130.000 14.000 5,000 $1,000 11000 Jon 1 2020 $30,000 $5,000 13,000 15:00 12.000 Jan 1 2022 10 30 10 10 10 What is the NPV of the proposed project your recommendation? (15 points) 6) Your company has been considering introducing a four-year long computer hardware On January 1st 2022, Gloss the con la considering inplementing a recently developed recycling process nomed EnviroClean on original Uitra-Cycle process cost $20,000,000 to implement on January 1st 2019, in the old Vitra-Cycle processos is crushed, melted, and then recycled into new lost products. In the proposed Evroleon process crushing the glass is unnecessary. Using new technology, in the EnviroClean process, gloss is directly melted and then recycled into new gloss products. Oiven some simlarities in the two processes, it is estimated that 10% of the cost of the original Ultra-Cycle process is attributed to the cost of developing the proposed EnviroClean process As a financial assistant with ol, you have been asked by US CFO to provide her with the information she needs to decide whether or not to take on the proposed ErwioClean project. If the analysis e in favor of this newly developed process, the new project will start of the beginning of next year January 1st, 2022) Given the rapid development in recycling technology, it is anticipated that the EnviroClean process will be viable only for 5 years. You are told that is tool year-end is December Stat and that the required return for the project is an annual effective rate of 25% and its corporate tax rate is 40% The proposed project would require the use of one of Orobandoned warehouses as of Joruary 1st 2022. Similar worehouses are rented out for $1,000/month old at the beginning of each month The cost of partially automoting the operations of the warehouse will require that new machinery, value of $35,000 is purchased. This machinery will be depreciated using the 7-year deoreciation schedule. Upon completion of the proposed project the new machinery will be sold for a value to its capital Cost (UCC) at the time of the 10 employees for the proposed project will be hired to begin work on January 1st 2022. Each will work one hundred and seventy hours per month. They will be paid at the end of every month of wage of $15.00 per hour for the daration of the probet Given the current lobor shortage, this wage will certainly impact wage of workers currently employed in other operations of the firm it anticipated that the impact on current wages will increase expenses of or other operations by $20,000 per year indefinitely wore that the new service offered by the EnviroClean project will partially lace the old Utro-Cycle process you estimate that reduced Utro-Cycle tout will reduces revenues by $200,000 each year. However, you are certain that the new EnviroClean products will increase revenues by $650,000 coth year The CFOs tem predicts that the proposed EnviroCheon project wit portioly ploce ne old Vitra-Cyce process your estimate that reduced Vitra-Cycle output will reduce or even y $200,000 each year. However you are certain that the new EnviroClean products will increase revenues by $550,000 each year The CFOs team predict that the proposed EnviroClean project will require the following levels of current ovets and current abilities items during the of the project Jan 1 2022 10 on 1 2022 10 Inventory Accounts Receivable Accounts Payable Taxes Payable Jan 12023 330.000 $4,000 14.000 $5.000 $1500 316,000 10 $12,000 50 Jan 1 2024 630,000 14,000 $3,000 $4,000 $1,000 Jan 12026 130,000 $4,000 $8.000 $1,000 $1,000 Jan 1 2020 $30,000 16.000 $3,600 $3,500 $2.000 10 30 30 I What is the NPV of the proposed project your recommendation? (15 points) 6) Your company has been considering introducing a four-year long computer hardware On January 1st 2022, Glass in ) is considering Implementing a recently developed recycling process named EnviroClean Grs original Ultra-Cycle process cost $20,000,000 to implement on January 1st 2019, in the old Ultra-Cycle process, gloss is crushed, melted, and then recycled into now 018 products. In the proposed EnviroClean process crushing the glass is unnecessary. Using new technology. In the wroClean proces gjess is directly melled and then recycled into new less products Given some similarities in the two processes, it is estimated that 10% of the cost of the original Vitra-Cycle process is attributed to the cost of developing the proposed EnviroClean process As a financial assistent with ot, you have been asked by ons CFO to provide her with the information she needs to decide whether or not to take on the proposed EnviroClean project. If the analysis is in favor of this newly developed process, the new project will start at the beginning of next year January 1st 2022). Given the rapid development in recycling technology. It is anticipated that the EnviroClean process will be viable only for 5 years You are told that Giscal year-endis December 31, and that the required return for the project is an annual efective rate of 26% and its corporate tax fotels 40% The proposed project would require the use of one of Gr's abandoned warehouses as of January 1 2032. Similar worehouses are rented out for $1,000/month paid of the beginning of each month The cost of partially automating the operations of the worehouse will require thot new machinery, volue of $35.000 purchased. This machinery will be depreciated using the year depreciation schedule. Upon completion of the proposed project, the new machinery will be sold for a value tuve to its indersited Copital Con (UCC) at the time of the 10 employees for the proposed project will be hired to begin work on January 1st 2022. Each will work one hundred and severity hours per month. They will be nold at the end of every month oto wage of $15,00 per hour for the duration of the project. Given the current lobor shortage, this wage will certainly impact wages of workers currently employed in the operations of the firm. It is anticipated that the impact on current wages will increase expenses of or other operations by 320,000 per year indefinitely Aware that the new service offered by the EnviroClean project will partially replace the dita Cycle process, you estimate that reduced Ufo-Cycle wil reduces revenues by $200,000 each year. However, you are certain that the new EnviroClean products will increase revenues by 5560,000 each year, The CFOs team predicts that the proposed to trochon project will partially replace the old UltroCyela process, vou estimate that reduced two-Cycle output will reduce al revenues by $200,000 each year. However, you are certain that the new Enviolon products will increase revenues by $550.000 och year The CFO team predicts that the proposed EnviroClean project will require the following levels of current assets and current liabilities tones during the life of the project Jon 1 2022 10 Inventory Cost Accounts Receivable Accounts Payable Toxes Payohle Jon 1 2022 30 $15,000 SO $12,000 30 Jon 1 2023 $30,000 14,000 $4,000 $5,000 $1.500 Jon 1 2024 530,000 $4,000 $3.000 54000 S1000 Jan 12025 $30,000 14,000 $8,000 $1,000 $1,000 Jan 1 2020 $30,000 15,000 $3,500 $3,500 $2,000 50 SO 30 30 What is the NPV of the proposed project your recommendation? (15 points) Your company has been considering Introducing a four year long computer hardware On January 11 2022. Gloss in is considering implementing a recently developed recycling process ramed EnviroClean Ors original Ultra-Cycle process cost $20.000,000 to implement on January 1st 2019, in the old Ultra-Cycle process, gloss is crushed, melted, and then recycled to news products in the proposed EnviroClean proces crushing the loss is unnecessary. Using new technology in the EnviroClean process, gloss is directly melted and then recycled into new gone products. Olves some similarities in the two processes, it is estimated that 10% of the cost of the original Ultra-Cycle process is attributed to the cost of developing the proposed EnviroClean process As a financial assistant with ol, you have been asked by G CFO to provide her with the information she needs to decide whether or not to take on the proposed Environ project. I the one is in favor of newly developed process, the new project will start of the beginning of next year Lanuary 1st 2022). Given the rapid development in recycling technology, it is anticipated that the EnviroClean process will be viable only for years. You are told that are fiscal year-end is December 31, and that the required return for the project is an annual effective role of 20% and its corporate tax role is 40% The proposed project would require the use of one of Gr's abandoned warehouses os of January 1 2022. Similar warehouses are rented out for $1,000/month old at the beginning of each month The cost of partially automoting the operations of the warehouse will require thot new machinery, valued at $35.000 is purchased. This machinery will be depreciated using the year depreco whedule Upon completion of the proposed project, the new machinery will be sold for a value equvalent to its indepeciated Capitol Cost (UCC) of the time of the sale 10 employees for the proposed project will be red to begin work on January 1 2072 Toch will work one hundred ondervonly hours per month. They will be pod at the end of every month to wage of 18,00 per hour for the duration of the groject. Given the current lobor shortage, this wage will certainly impact wages of workers currently employed in other operations of the time anticipated that the impact on current wages will increase expenses of or's other operations by $20,000 per yerindefinitely Aware that the new service offered by the EnviroCleon project will partially replace the old Utro-Cycle process, you estimate that reduced Ultra-Cycle output wil reduce ai's revenues w $200,000 each year. However, you are certain that the new EnviroClean products will increase revenues by 1560,000 coch year. The CFOsteom predicts that the proposed Envirocion project will partially replace the old Ultra-Cycle process, you estimate that reduard Utro-Cycle output will reduce or revenues by $200,000 each year. However, you mountain that the new EnviroClean products will increase revenues by $550,000 each year The CFOsteom predicts that the proposed EnviroClean project will require the following levels of current assets and current lotilities itens during the Ife of the project Inventory Cash Accounts Receivable Accounts Payable Tones Payable on 1 2022 10 115,000 10 $12,000 10 on 12023 530,000 14,000 14,000 55.000 $1,500 Jon 12024 $30,000 14,000 53,000 54,000 $1,000 Jon 12025 130.000 14.000 5,000 $1,000 11000 Jon 1 2020 $30,000 $5,000 13,000 15:00 12.000 Jan 1 2022 10 30 10 10 10 What is the NPV of the proposed project your recommendation? (15 points) 6) Your company has been considering introducing a four-year long computer hardware On January 1st 2022, Gloss the con la considering inplementing a recently developed recycling process nomed EnviroClean on original Uitra-Cycle process cost $20,000,000 to implement on January 1st 2019, in the old Vitra-Cycle processos is crushed, melted, and then recycled into new lost products. In the proposed Evroleon process crushing the glass is unnecessary. Using new technology, in the EnviroClean process, gloss is directly melted and then recycled into new gloss products. Oiven some simlarities in the two processes, it is estimated that 10% of the cost of the original Ultra-Cycle process is attributed to the cost of developing the proposed EnviroClean process As a financial assistant with ol, you have been asked by US CFO to provide her with the information she needs to decide whether or not to take on the proposed ErwioClean project. If the analysis e in favor of this newly developed process, the new project will start of the beginning of next year January 1st, 2022) Given the rapid development in recycling technology, it is anticipated that the EnviroClean process will be viable only for 5 years. You are told that is tool year-end is December Stat and that the required return for the project is an annual effective rate of 25% and its corporate tax rate is 40% The proposed project would require the use of one of Orobandoned warehouses as of Joruary 1st 2022. Similar worehouses are rented out for $1,000/month old at the beginning of each month The cost of partially automoting the operations of the warehouse will require that new machinery, value of $35,000 is purchased. This machinery will be depreciated using the 7-year deoreciation schedule. Upon completion of the proposed project the new machinery will be sold for a value to its capital Cost (UCC) at the time of the 10 employees for the proposed project will be hired to begin work on January 1st 2022. Each will work one hundred and seventy hours per month. They will be paid at the end of every month of wage of $15.00 per hour for the daration of the probet Given the current lobor shortage, this wage will certainly impact wage of workers currently employed in other operations of the firm it anticipated that the impact on current wages will increase expenses of or other operations by $20,000 per year indefinitely wore that the new service offered by the EnviroClean project will partially lace the old Utro-Cycle process you estimate that reduced Utro-Cycle tout will reduces revenues by $200,000 each year. However, you are certain that the new EnviroClean products will increase revenues by $650,000 coth year The CFOs tem predicts that the proposed EnviroCheon project wit portioly ploce ne old Vitra-Cyce process your estimate that reduced Vitra-Cycle output will reduce or even y $200,000 each year. However you are certain that the new EnviroClean products will increase revenues by $550,000 each year The CFOs team predict that the proposed EnviroClean project will require the following levels of current ovets and current abilities items during the of the project Jan 1 2022 10 on 1 2022 10 Inventory Accounts Receivable Accounts Payable Taxes Payable Jan 12023 330.000 $4,000 14.000 $5.000 $1500 316,000 10 $12,000 50 Jan 1 2024 630,000 14,000 $3,000 $4,000 $1,000 Jan 12026 130,000 $4,000 $8.000 $1,000 $1,000 Jan 1 2020 $30,000 16.000 $3,600 $3,500 $2.000 10 30 30 I What is the NPV of the proposed project your recommendation? (15 points) 6) Your company has been considering introducing a four-year long computer hardware On January 1st 2022, Glass in ) is considering Implementing a recently developed recycling process named EnviroClean Grs original Ultra-Cycle process cost $20,000,000 to implement on January 1st 2019, in the old Ultra-Cycle process, gloss is crushed, melted, and then recycled into now 018 products. In the proposed EnviroClean process crushing the glass is unnecessary. Using new technology. In the wroClean proces gjess is directly melled and then recycled into new less products Given some similarities in the two processes, it is estimated that 10% of the cost of the original Vitra-Cycle process is attributed to the cost of developing the proposed EnviroClean process As a financial assistent with ot, you have been asked by ons CFO to provide her with the information she needs to decide whether or not to take on the proposed EnviroClean project. If the analysis is in favor of this newly developed process, the new project will start at the beginning of next year January 1st 2022). Given the rapid development in recycling technology. It is anticipated that the EnviroClean process will be viable only for 5 years You are told that Giscal year-endis December 31, and that the required return for the project is an annual efective rate of 26% and its corporate tax fotels 40% The proposed project would require the use of one of Gr's abandoned warehouses as of January 1 2032. Similar worehouses are rented out for $1,000/month paid of the beginning of each month The cost of partially automating the operations of the worehouse will require thot new machinery, volue of $35.000 purchased. This machinery will be depreciated using the year depreciation schedule. Upon completion of the proposed project, the new machinery will be sold for a value tuve to its indersited Copital Con (UCC) at the time of the 10 employees for the proposed project will be hired to begin work on January 1st 2022. Each will work one hundred and severity hours per month. They will be nold at the end of every month oto wage of $15,00 per hour for the duration of the project. Given the current lobor shortage, this wage will certainly impact wages of workers currently employed in the operations of the firm. It is anticipated that the impact on current wages will increase expenses of or other operations by 320,000 per year indefinitely Aware that the new service offered by the EnviroClean project will partially replace the dita Cycle process, you estimate that reduced Ufo-Cycle wil reduces revenues by $200,000 each year. However, you are certain that the new EnviroClean products will increase revenues by 5560,000 each year, The CFOs team predicts that the proposed to trochon project will partially replace the old UltroCyela process, vou estimate that reduced two-Cycle output will reduce al revenues by $200,000 each year. However, you are certain that the new Enviolon products will increase revenues by $550.000 och year The CFO team predicts that the proposed EnviroClean project will require the following levels of current assets and current liabilities tones during the life of the project Jon 1 2022 10 Inventory Cost Accounts Receivable Accounts Payable Toxes Payohle Jon 1 2022 30 $15,000 SO $12,000 30 Jon 1 2023 $30,000 14,000 $4,000 $5,000 $1.500 Jon 1 2024 530,000 $4,000 $3.000 54000 S1000 Jan 12025 $30,000 14,000 $8,000 $1,000 $1,000 Jan 1 2020 $30,000 15,000 $3,500 $3,500 $2,000 50 SO 30 30 What is the NPV of the proposed project your recommendation? (15 points)