Answered step by step

Verified Expert Solution

Question

1 Approved Answer

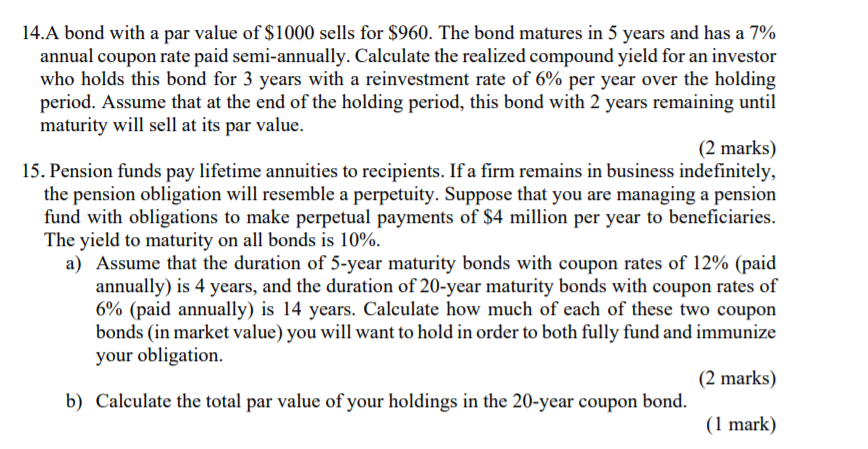

Can i please get an answer on the first one. 14.A bond with a par value of $1000 sells for $960. The bond matures in

Can i please get an answer on the first one.

14.A bond with a par value of $1000 sells for $960. The bond matures in 5 years and has a 7% annual coupon rate paid semi-annually. Calculate the realized compound yield for an investor who holds this bond for 3 years with a reinvestment rate of 6% per year over the holding period. Assume that at the end of the holding period, this bond with 2 years remaining until maturity will sell at its par value. (2 marks) 15. Pension funds pay lifetime annuities to recipients. If a firm remains in business indefinitely, the pension obligation will resemble a perpetuity. Suppose that you are managing a pension fund with obligations to make perpetual payments of $4 million per year to beneficiaries. The yield to maturity on all bonds is 10%. a) Assume that the duration of 5-year maturity bonds with coupon rates of 12% (paid annually) is 4 years, and the duration of 20-year maturity bonds with coupon rates of 6% (paid annually) is 14 years. Calculate how much of each of these two coupon bonds (in market value) you will want to hold in order to both fully fund and immunize your obligation. (2 marks) b) Calculate the total par value of your holdings in the 20-year coupon bond. (1 mark)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started