Can i please get help with these journal entries?

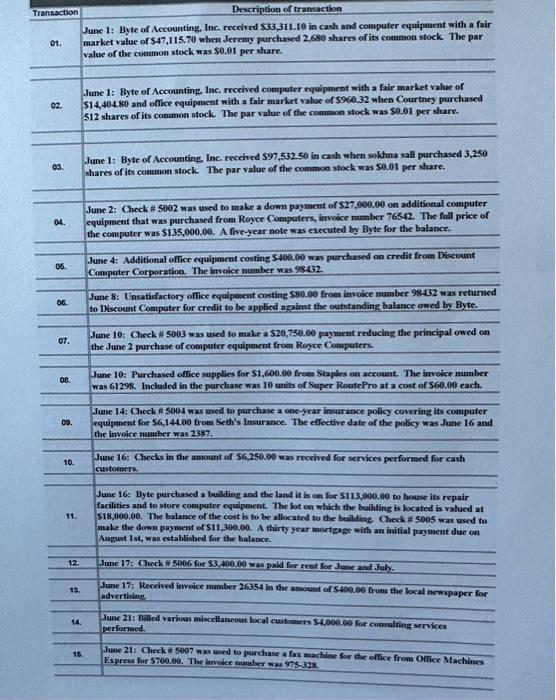

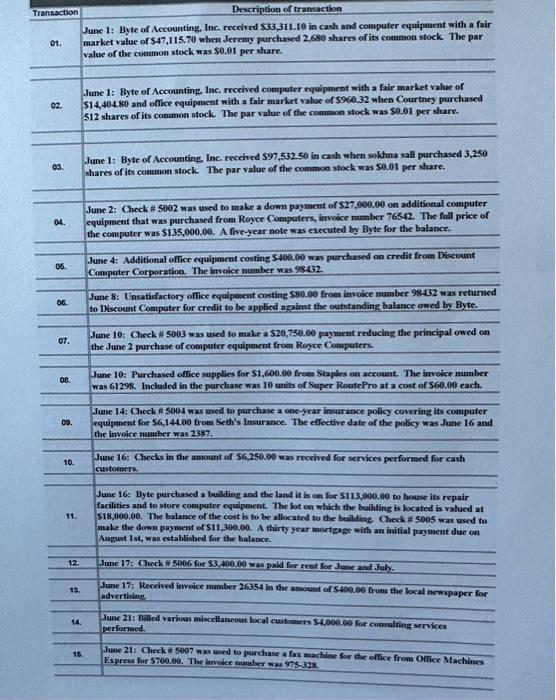

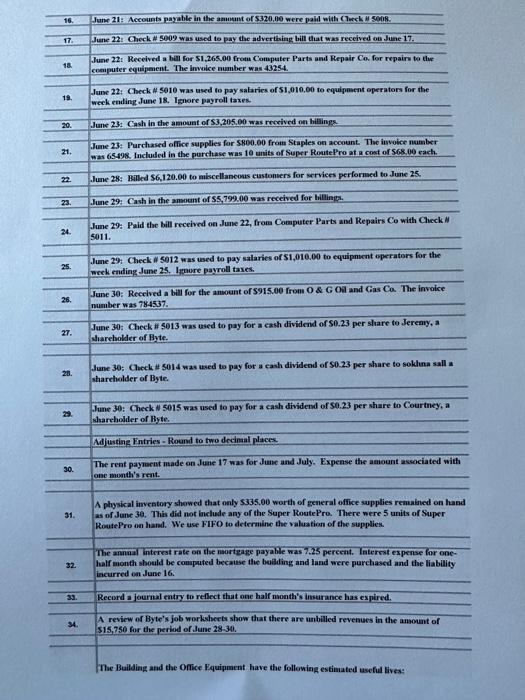

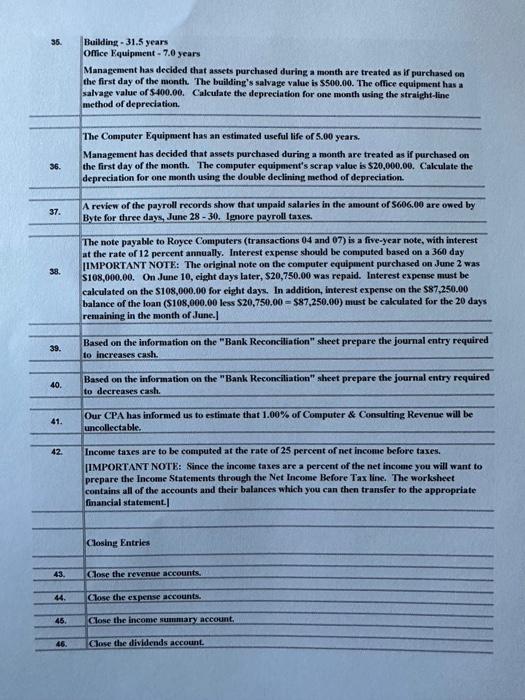

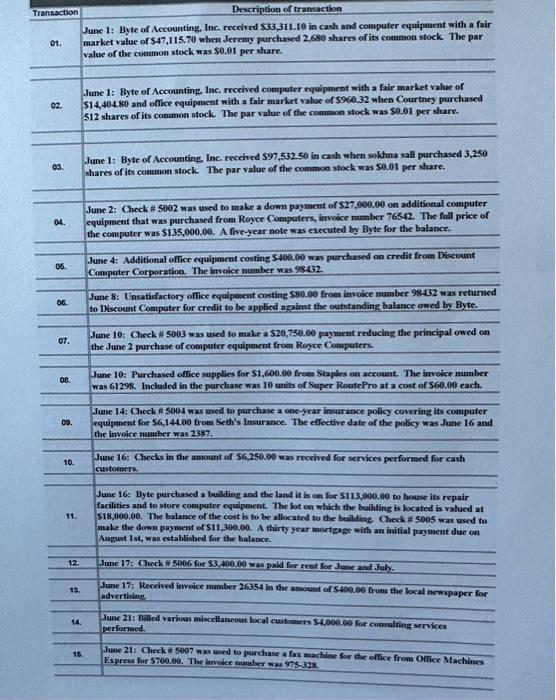

Transaction Description of transaction June 1: Byte of Accounting, Inc, received $33,311.10 in cash and computer equipment with a fair 01. market value of 547,115,70 when Jeremy purchased 2,690 shares of its conmon stock. The par value of the common stock was $0.01 per share. June 1: Byte of Accounting, Inc. received computer equipment mith a fair market value of 02.$14,404.80 and office equipment with a fair market value of $960.32 when Courtney purchased 512 shares of its common stock. The par value of the conmon stock was $0.01 per share. 05. June 1: Byte of Accounting, Ine, received 597,532.50 in cash when solduna sall purchased 3,250 chares of its common stock. The par value of the common stock was $0.01 per share. June 2: Check \# 5002 was used to make a down payment of $27,000.00 on additional computer 04. equipment that was purchased fron Royce Computers, imvoice number 76542 . The full price of the computer was $135,000.00. A five-year note was executed by Byte for the balance. Q5. June 4: Additional office equipment costing $400.00 was purchased on credit from Discount Computer Corporation. The invoice number was 98432. June 8: Unsatisfactory office equipment costing $80.00 from involce number 98432 was returned to Discoent Computer for credit to be applied against the outstanding balance owed by Byte. 66. 36. Building - 31.5 years Omice Equipment - 7.0 years Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's salvage value is $500.00. The office equipment has a salvage value of $400.00. Calculate the depreciation for one month using the straight-line method of depreciation. The Computer Equipment has an estimated useful life of 5.00 years. Management has decided that assets purchased during a month are treated as if purchased on 36. the first day of the month. The computer equipment's scrap value is $20,000,00. Calculate the depreciation for one month using the double declining method of depreciation. 37. A review of the payroll records show that unpaid salaries in the amount of $606.00 are owed by Byte for three days, June 28 - 30. Ignore payroll taxes. The note payable to Royce Computers (transactions 04 and 07 ) is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day [IMPORTANT NOTE: The original note on the computer equipuent purchased on June 2 was $108,000.00. On June 10, eight days later, $20,750.00 was repaid. Interest expense must be calculated on the $108,000,00 for eight days. In addition, interest expense on the $87,250.00 balance of the loan ($108,000.00 less $20,750,00=$87,250.00 ) must be calculated for the 20 days remaining in the month of June.] 38. 39. 40. 41.42. Based on the information on the "Bank Reconcliation" sheet prepare the journal entry required to increases cash. Based on the information on the "Bank Reconciliation" sheet prepare the journal entry required to decreases cash. Our CPA has informed us to estimate that 1.00% of Computer \& Consulting Revenue will be uncollectable. Income taxes are to be computed at the rate of 25 percent of net income before taxes. IIMPORTANT NOTE: Since the inconse taxes are a percent of the net incoanc you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.] Closing Entries 43. Close the revenue accounts. 44. Close the expense accounts. 45. Close the income summary account. 46. Close the dividends account. 17. June 22! Check \# S009 was used to pay the advertising bill that was received on June 17. 12. June 22: Received a bill for $1,265,00 frotu Compater Parts and Repair Co. for repairs to the coenputer equipaent. The imwoice aumber was 43254. 12. June 22: Check \# 5010 was used to pay sabries of 51,010,00 to equipment operators for the week ending, June 18. Ignore payroll taxes. 20. June 23. Cash in the amount of $3,205,00 was received on hillings. 21. June 23: Purchased affice supplies for $800,00 from Staples on account. The involee number was 65.98 . Included in the purchase was 10 units of Super RoutePro at a cost of 568.00 each. 22. June 28: Billed \$6,120.00 to miscellaneous customers for serviees performed to June 25 , 23. June 29: Cash in the amount of 55,799.00 was received for hillinga. 24. June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co with Check M 25. June 29: Check in 5012 was used to pay salaries of 51,010.00 to equipment operators for the week ending Jume 25. Iquore payroll taxes. 26. June 30: Received a bill for the anount of $915.00 from 0 \& 6 OA and Gas Ca. The invoice number was 784537. 27. June 30: Check \# 5013 was used to pay for a eash dividend of $0.23 per share to Jereary, a shareholder of Byte. 2a. June 30: Check \# 5014 was used to pay for a cash dividend of $0.23 per share to sokhna sall a sharcholder of Byte. 29. Sune 30: Check N5015 was used to pay for a cash dividend of 50.23 per share to Courtney, a slareholder of Byte. Mdusting Fntries - Round to two decinal places. 30. The rent payment made on June 17 was for June and July. Expense the anount associated with ane month's rent. A physical inventory showed that only $335.00 worth of general office supplies remained on hand as of June 30. This did not include any of the Super RoutePro. There were 5 units of Super RoutePro on hand. We use FIFO to determine the valuation of the supplies. The annal interest rate on the noortgage payable was 7.25 pereent. Intercst expense for one32. half month sbould be computed because the beiliding and land were purchased and the liability incurred on June 16. 32. Record a journal entry to reflect that one half nonth's instirance has expired. 34. A review of Byte's job workshects show that there are unbilied revenues in the amount of 515,750 for the period of June 28-30. The Buildiag and the Ofice Fquipment have the following estinated useful lives