Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can i please get help with this it is due at 11.59 On January 1, 2024, Wright Transport sold four school buses to the Eimira

can i please get help with this it is due at 11.59

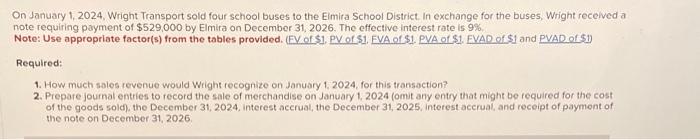

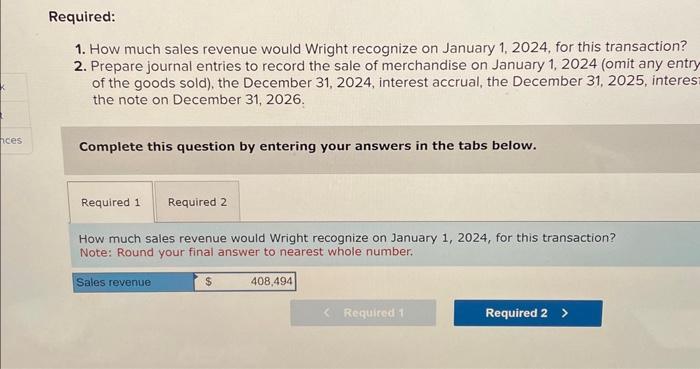

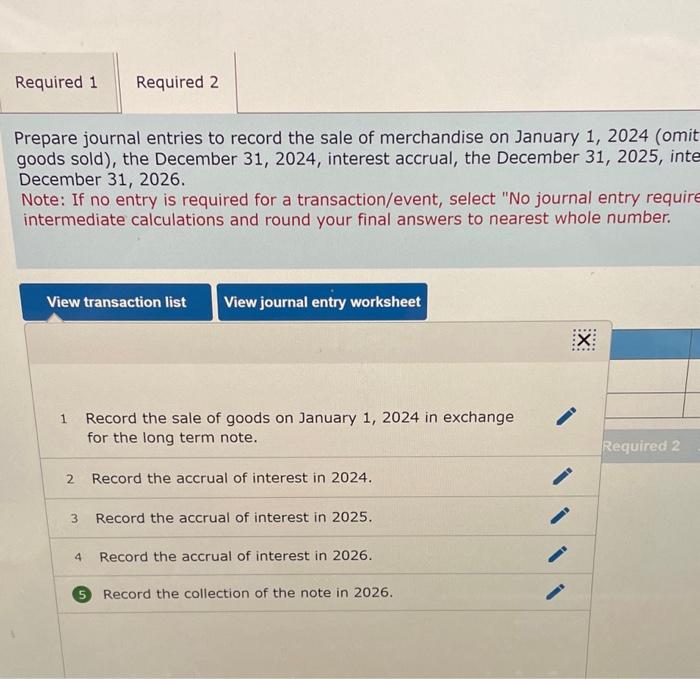

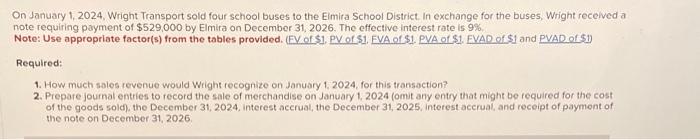

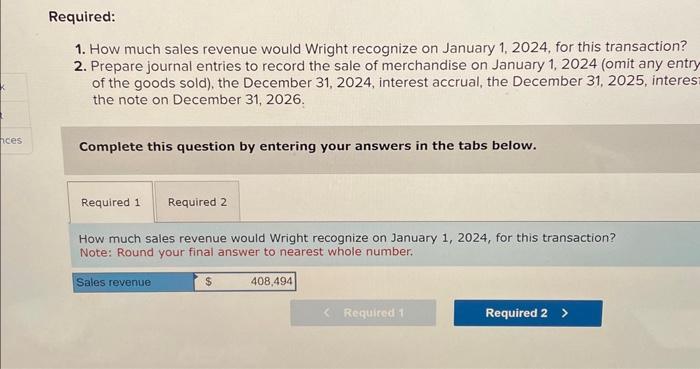

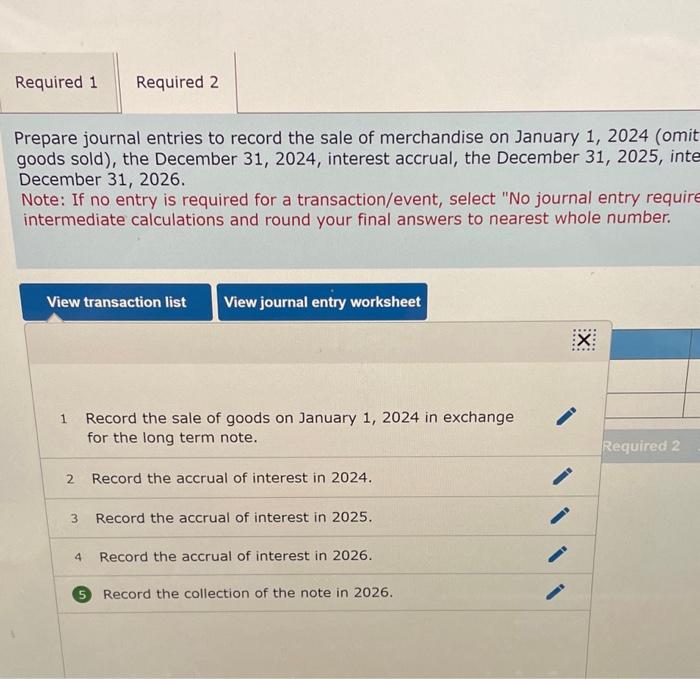

On January 1, 2024, Wright Transport sold four school buses to the Eimira School District. In exchange for the buses, Wright recelved a note requiring payment of $529,000 by Elmira on December 31, 2026. The effective interest rate is 9%. Note: Use appropriate factor(s) from the tables provided. (EV of \$1. PV of S1. EVA of S1. PVA of S1. EVAD of S1 and PVAD of S1) Required: 1. How much sales revenue would Wright recognize on January 1, 2024, for this transaction? 2. Prepare journal entries to record the sale of merchandise on January 1,2024 (omit any entry that might be required for the cost of the goods sold), the December 31, 2024, interest accrual, the December 31, 2025, interest accrual, and receipt of payment of the note on December 31, 2026. 1. How much sales revenue would Wright recognize on January 1,2024 , for this transaction? 2. Prepare journal entries to record the sale of merchandise on January 1, 2024 (omit any entr) of the goods sold), the December 31, 2024, interest accrual, the December 31, 2025, interes the note on December 31, 2026. Complete this question by entering your answers in the tabs below. How much sales revenue would Wright recognize on January 1, 2024, for this transaction? Note: Round your final answer to nearest whole number. Prepare journal entries to record the sale of merchandise on January 1, 2024 (omit goods sold), the December 31, 2024, interest accrual, the December 31, 2025, inte December 31, 2026. Note: If no entry is required for a transaction/event, select "No journal entry requir intermediate calculations and round your final answers to nearest whole number. 1 Record the sale of goods on January 1, 2024 in exchange for the long term note. Required 2 2 Record the accrual of interest in 2024. 3 Record the accrual of interest in 2025. 4 Record the accrual of interest in 2026. Record the collection of the note in 2026

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started