Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can i please get help with this question The information given below was extracted from the accounting records of Blade Traders, a partnership business with

can i please get help with this question

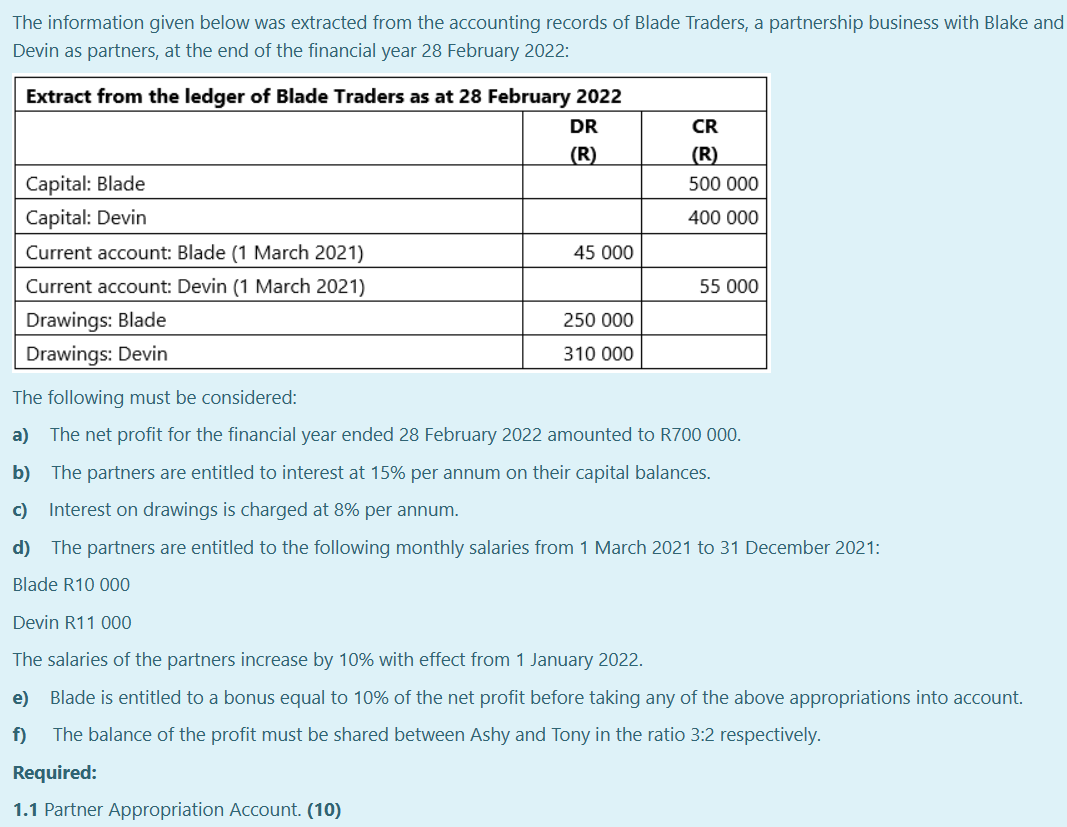

The information given below was extracted from the accounting records of Blade Traders, a partnership business with Blake and Devin as partners, at the end of the financial year 28 February 2022: The following must be considered: a) The net profit for the financial year ended 28 February 2022 amounted to R700 000. b) The partners are entitled to interest at 15% per annum on their capital balances. c) Interest on drawings is charged at 8% per annum. d) The partners are entitled to the following monthly salaries from 1 March 2021 to 31 December 2021: Blade R10 000 Devin R11 000 The salaries of the partners increase by 10% with effect from 1 January 2022. e) Blade is entitled to a bonus equal to 10% of the net profit before taking any of the above appropriations into account. f) The balance of the profit must be shared between Ashy and Tony in the ratio 3:2 respectively. Required: 1.1 Partner Appropriation Account. (10) The information given below was extracted from the accounting records of Blade Traders, a partnership business with Blake and Devin as partners, at the end of the financial year 28 February 2022: The following must be considered: a) The net profit for the financial year ended 28 February 2022 amounted to R700 000. b) The partners are entitled to interest at 15% per annum on their capital balances. c) Interest on drawings is charged at 8% per annum. d) The partners are entitled to the following monthly salaries from 1 March 2021 to 31 December 2021: Blade R10 000 Devin R11 000 The salaries of the partners increase by 10% with effect from 1 January 2022. e) Blade is entitled to a bonus equal to 10% of the net profit before taking any of the above appropriations into account. f) The balance of the profit must be shared between Ashy and Tony in the ratio 3:2 respectively. Required: 1.1 Partner Appropriation Account

The information given below was extracted from the accounting records of Blade Traders, a partnership business with Blake and Devin as partners, at the end of the financial year 28 February 2022: The following must be considered: a) The net profit for the financial year ended 28 February 2022 amounted to R700 000. b) The partners are entitled to interest at 15% per annum on their capital balances. c) Interest on drawings is charged at 8% per annum. d) The partners are entitled to the following monthly salaries from 1 March 2021 to 31 December 2021: Blade R10 000 Devin R11 000 The salaries of the partners increase by 10% with effect from 1 January 2022. e) Blade is entitled to a bonus equal to 10% of the net profit before taking any of the above appropriations into account. f) The balance of the profit must be shared between Ashy and Tony in the ratio 3:2 respectively. Required: 1.1 Partner Appropriation Account. (10) The information given below was extracted from the accounting records of Blade Traders, a partnership business with Blake and Devin as partners, at the end of the financial year 28 February 2022: The following must be considered: a) The net profit for the financial year ended 28 February 2022 amounted to R700 000. b) The partners are entitled to interest at 15% per annum on their capital balances. c) Interest on drawings is charged at 8% per annum. d) The partners are entitled to the following monthly salaries from 1 March 2021 to 31 December 2021: Blade R10 000 Devin R11 000 The salaries of the partners increase by 10% with effect from 1 January 2022. e) Blade is entitled to a bonus equal to 10% of the net profit before taking any of the above appropriations into account. f) The balance of the profit must be shared between Ashy and Tony in the ratio 3:2 respectively. Required: 1.1 Partner Appropriation Account Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started