Answered step by step

Verified Expert Solution

Question

1 Approved Answer

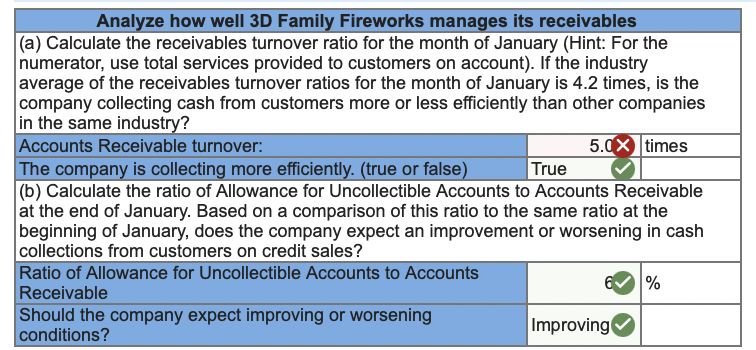

Can I please get some help with the last question part A. Thank you! Post-closi : During January 2024 , the following transactions occur: 1.

Can I please get some help with the last question part A. Thank you!

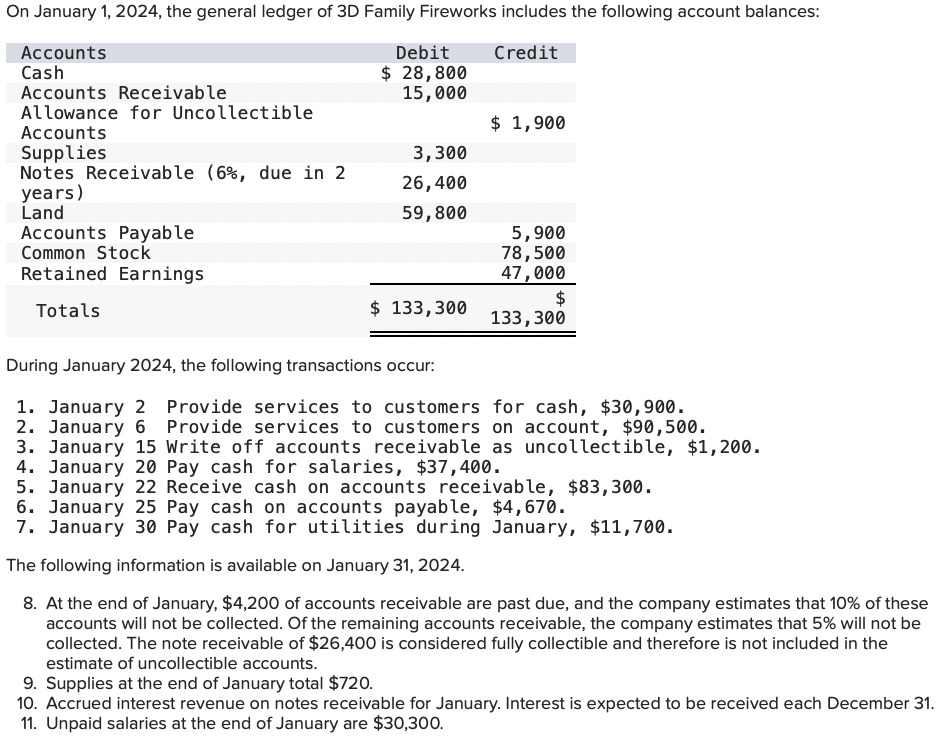

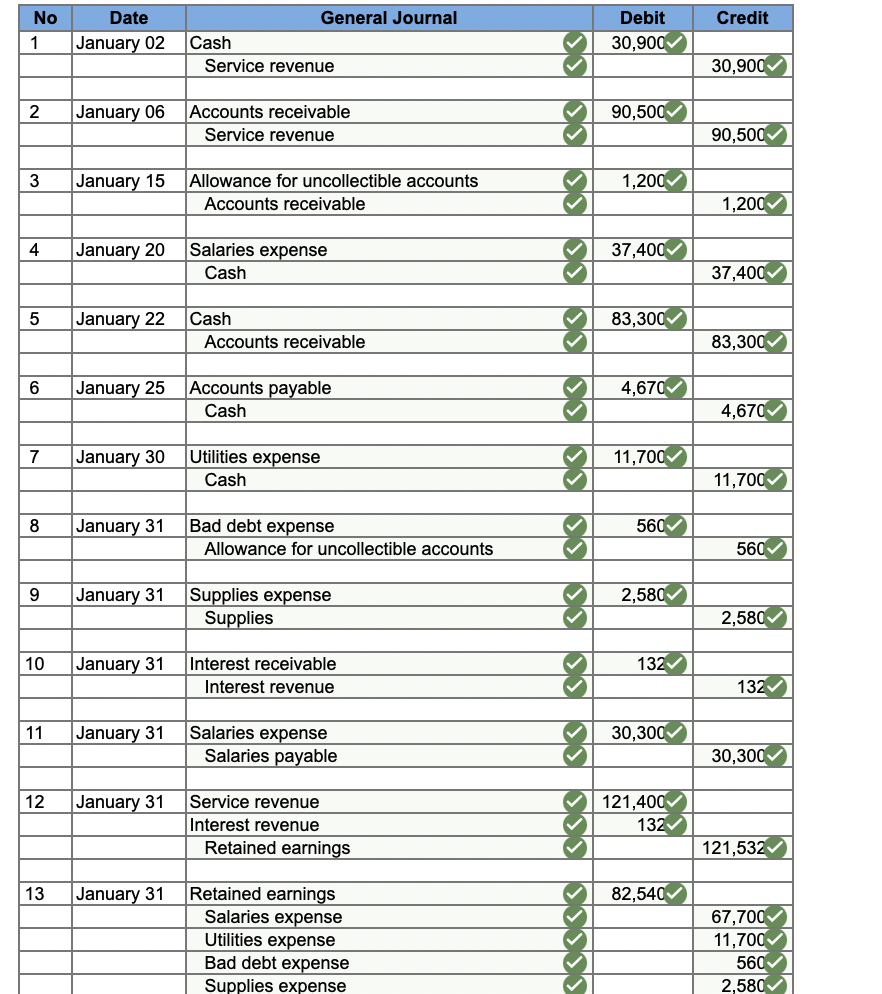

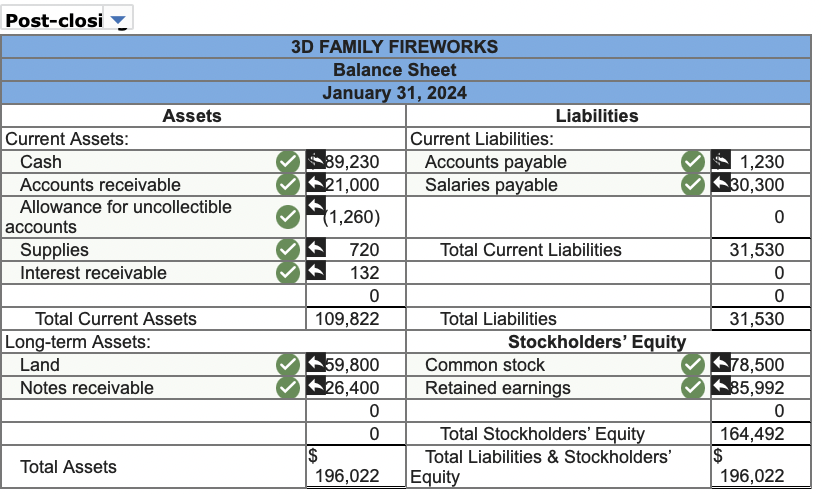

Post-closi : During January 2024 , the following transactions occur: 1. January 2 Provide services to customers for cash, $30,900. 2. January 6 Provide services to customers on account, $90,500. 3. January 15 Write off accounts receivable as uncollectible, $1,200. 4. January 20 Pay cash for salaries, $37,400. 5. January 22 Receive cash on accounts receivable, $83,300. 6. January 25 Pay cash on accounts payable, $4,670. 7. January 30 Pay cash for utilities during January, $11,700. The following information is available on January 31, 2024. 8. At the end of January, $4,200 of accounts receivable are past due, and the company estimates that 10% of these accounts will not be collected. Of the remaining accounts receivable, the company estimates that 5% will not be collected. The note receivable of $26,400 is considered fully collectible and therefore is not included in the estimate of uncollectible accounts. 9. Supplies at the end of January total $720. 10. Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 . 11. Unpaid salaries at the end of January are $30,300

Post-closi : During January 2024 , the following transactions occur: 1. January 2 Provide services to customers for cash, $30,900. 2. January 6 Provide services to customers on account, $90,500. 3. January 15 Write off accounts receivable as uncollectible, $1,200. 4. January 20 Pay cash for salaries, $37,400. 5. January 22 Receive cash on accounts receivable, $83,300. 6. January 25 Pay cash on accounts payable, $4,670. 7. January 30 Pay cash for utilities during January, $11,700. The following information is available on January 31, 2024. 8. At the end of January, $4,200 of accounts receivable are past due, and the company estimates that 10% of these accounts will not be collected. Of the remaining accounts receivable, the company estimates that 5% will not be collected. The note receivable of $26,400 is considered fully collectible and therefore is not included in the estimate of uncollectible accounts. 9. Supplies at the end of January total $720. 10. Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 . 11. Unpaid salaries at the end of January are $30,300 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started