Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can i please get the answer for part D and E Answer for part B is 74.19% and answer for part c is 25.81% Question

Can i please get the answer for part D and E

Answer for part B is 74.19% and answer for part c is 25.81%

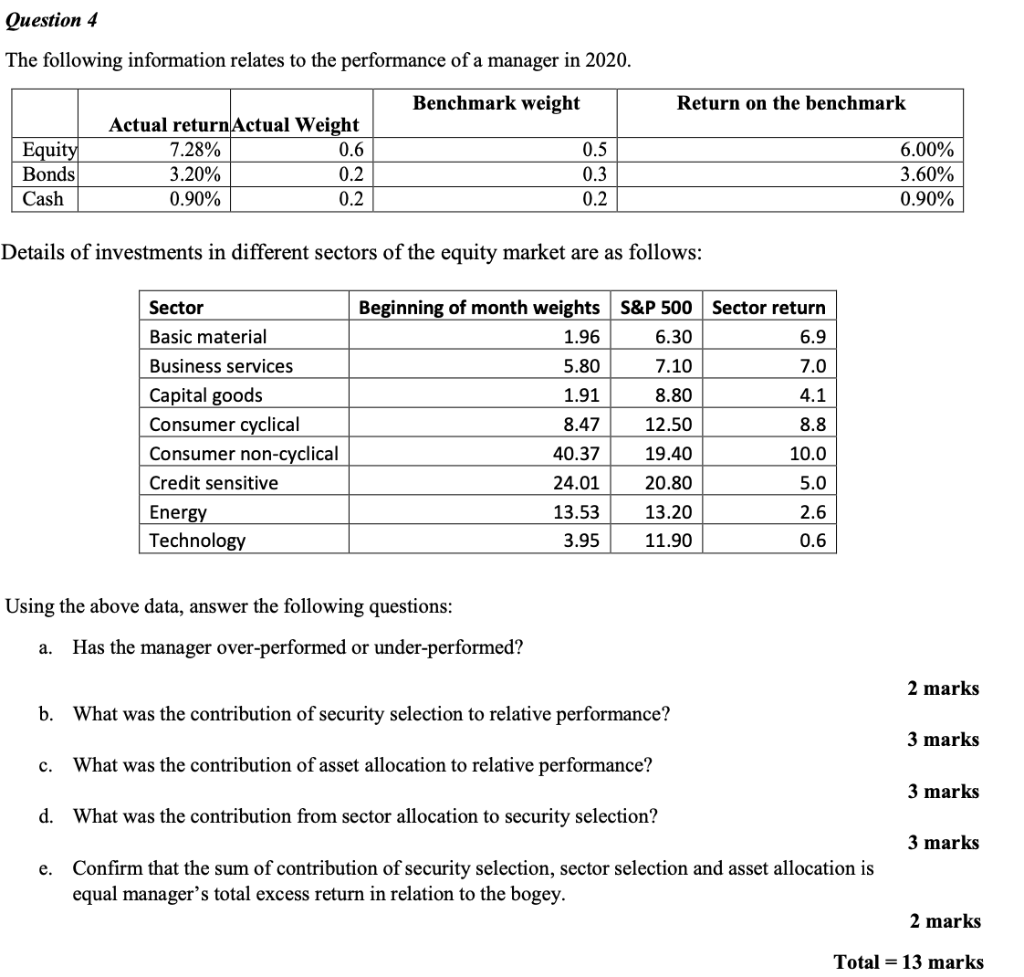

Question 4 The following information relates to the performance of a manager in 2020. Benchmark weight Return on the benchmark Equity Bonds Cash Actual return Actual Weight 7.28% 0.6 3.20% 0.2 0.90% 0.2 0.5 0.3 0.2 6.00% 3.60% 0.90% Details of investments in different sectors of the equity market are as follows: Sector Basic material Business services Capital goods Consumer cyclical Consumer non-cyclical Credit sensitive Energy Technology Beginning of month weights S&P 500 Sector return 1.96 6.30 6.9 5.80 7.10 7.0 1.91 8.80 4.1 8.47 12.50 8.8 40.37 19.40 10.0 24.01 20.80 5.0 13.53 13.20 2.6 3.95 11.90 0.6 Using the above data, answer the following questions: a. Has the manager over-performed or under-performed? 2 marks b. What was the contribution of security selection to relative performance? 3 marks c. What was the contribution of asset allocation to relative performance? 3 marks d. What was the contribution from sector allocation to security selection? 3 marks e. Confirm that the sum of contribution of security selection, sector selection and asset allocation is equal manager's total excess return in relation to the bogey. 2 marks Total = 13 marks Question 4 The following information relates to the performance of a manager in 2020. Benchmark weight Return on the benchmark Equity Bonds Cash Actual return Actual Weight 7.28% 0.6 3.20% 0.2 0.90% 0.2 0.5 0.3 0.2 6.00% 3.60% 0.90% Details of investments in different sectors of the equity market are as follows: Sector Basic material Business services Capital goods Consumer cyclical Consumer non-cyclical Credit sensitive Energy Technology Beginning of month weights S&P 500 Sector return 1.96 6.30 6.9 5.80 7.10 7.0 1.91 8.80 4.1 8.47 12.50 8.8 40.37 19.40 10.0 24.01 20.80 5.0 13.53 13.20 2.6 3.95 11.90 0.6 Using the above data, answer the following questions: a. Has the manager over-performed or under-performed? 2 marks b. What was the contribution of security selection to relative performance? 3 marks c. What was the contribution of asset allocation to relative performance? 3 marks d. What was the contribution from sector allocation to security selection? 3 marks e. Confirm that the sum of contribution of security selection, sector selection and asset allocation is equal manager's total excess return in relation to the bogey. 2 marks Total = 13 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started