Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can I please have answer with solutions? thank you! 17.) We know that...breakeven EBIT is...EPS = (EBIT - Debt Interest) x (1 - Tax Rate)

can I please have answer with solutions? thank you!

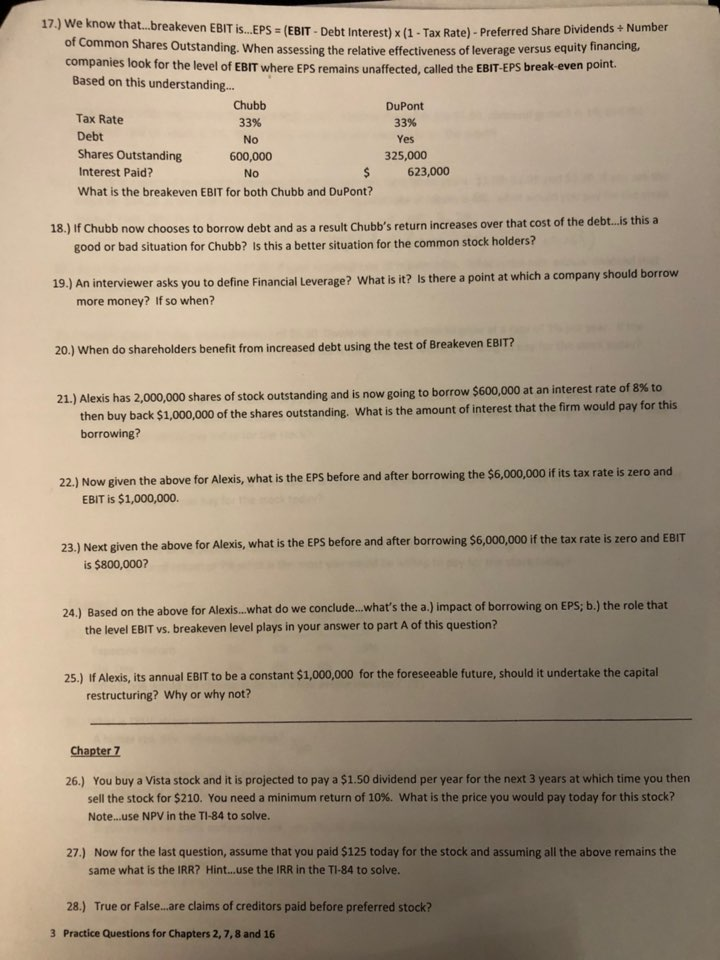

17.) We know that...breakeven EBIT is...EPS = (EBIT - Debt Interest) x (1 - Tax Rate) - Preferred Share Debt Interest) x (1 - Tax Rate) - Preferred Share Dividends + Number of Common Shares Outstanding. When assessing the relative effectiveness of leverage versus the relative effectiveness of leverage versus equity financing. companies look for the level of EBIT where EPS remains unaffected, called the EBIT-EPS break even Based on this understanding... Chubb DuPont Tax Rate 33% 33% Debt No Yes Shares Outstanding 600,000 325,000 Interest Paid? No 623,000 What is the breakeven EBIT for both Chubb and DuPont? 18.) If Chubb now chooses to borrow debt and as a result Chubb's return increases over that cost of the debt...Is this a good or bad situation for Chubb? Is this a better situation for the common stock holders? 19.) An interviewer asks you to define Financial Leverage? What is it? Is there a point at which a company should borrow more money? If so when? 20.) When do shareholders benefit from increased debt using the test of Breakeven EBIT? 21.) Alexis has 2,000,000 shares of stock outstanding and is now going to borrow $600,000 at an interest rate of 8% to then buy back $1,000,000 of the shares outstanding. What is the amount of interest that the firm would pay for this borrowing? 22.) Now given the above for Alexis, what is the EPS before and after borrowing the $6,000,000 if its tax rate is zero and EBIT is $1,000,000 23.) Next given the above for Alexis, what is the EPS before and after borrowing $6,000,000 if the tax rate is zero and EBIT is $800,000? 24.) Based on the above for Alexis...What do we conclude...what's the a.) impact of borrowing on EPS; b.) the role that the level EBIT vs. breakeven level plays in your answer to part A of this question? 25.) If Alexis, its annual EBIT to be a constant $1,000,000 for the foreseeable future, should it undertake the capital restructuring? Why or why not? Chapter 7 26.) You buy a Vista stock and it is projected to pay a $1.50 dividend per year for the next 3 years at which time you then sell the stock for $210. You need a minimum return of 10%. What is the price you would pay today for this stock? Note...use NPV in the TI-84 to solve. 27.) Now for the last question, assume that you paid $125 today for the stock and assuming all the above remains the same what is the IRR? Hint...use the IRR in the T1-84 to solve. 28.) True or False...are claims of creditors paid before preferred stock? 3 Practice Questions for Chapters 2, 7, 8 and 16 17.) We know that...breakeven EBIT is...EPS = (EBIT - Debt Interest) x (1 - Tax Rate) - Preferred Share Debt Interest) x (1 - Tax Rate) - Preferred Share Dividends + Number of Common Shares Outstanding. When assessing the relative effectiveness of leverage versus the relative effectiveness of leverage versus equity financing. companies look for the level of EBIT where EPS remains unaffected, called the EBIT-EPS break even Based on this understanding... Chubb DuPont Tax Rate 33% 33% Debt No Yes Shares Outstanding 600,000 325,000 Interest Paid? No 623,000 What is the breakeven EBIT for both Chubb and DuPont? 18.) If Chubb now chooses to borrow debt and as a result Chubb's return increases over that cost of the debt...Is this a good or bad situation for Chubb? Is this a better situation for the common stock holders? 19.) An interviewer asks you to define Financial Leverage? What is it? Is there a point at which a company should borrow more money? If so when? 20.) When do shareholders benefit from increased debt using the test of Breakeven EBIT? 21.) Alexis has 2,000,000 shares of stock outstanding and is now going to borrow $600,000 at an interest rate of 8% to then buy back $1,000,000 of the shares outstanding. What is the amount of interest that the firm would pay for this borrowing? 22.) Now given the above for Alexis, what is the EPS before and after borrowing the $6,000,000 if its tax rate is zero and EBIT is $1,000,000 23.) Next given the above for Alexis, what is the EPS before and after borrowing $6,000,000 if the tax rate is zero and EBIT is $800,000? 24.) Based on the above for Alexis...What do we conclude...what's the a.) impact of borrowing on EPS; b.) the role that the level EBIT vs. breakeven level plays in your answer to part A of this question? 25.) If Alexis, its annual EBIT to be a constant $1,000,000 for the foreseeable future, should it undertake the capital restructuring? Why or why not? Chapter 7 26.) You buy a Vista stock and it is projected to pay a $1.50 dividend per year for the next 3 years at which time you then sell the stock for $210. You need a minimum return of 10%. What is the price you would pay today for this stock? Note...use NPV in the TI-84 to solve. 27.) Now for the last question, assume that you paid $125 today for the stock and assuming all the above remains the same what is the IRR? Hint...use the IRR in the T1-84 to solve. 28.) True or False...are claims of creditors paid before preferred stock? 3 Practice Questions for Chapters 2, 7, 8 and 16Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started