Answered step by step

Verified Expert Solution

Question

1 Approved Answer

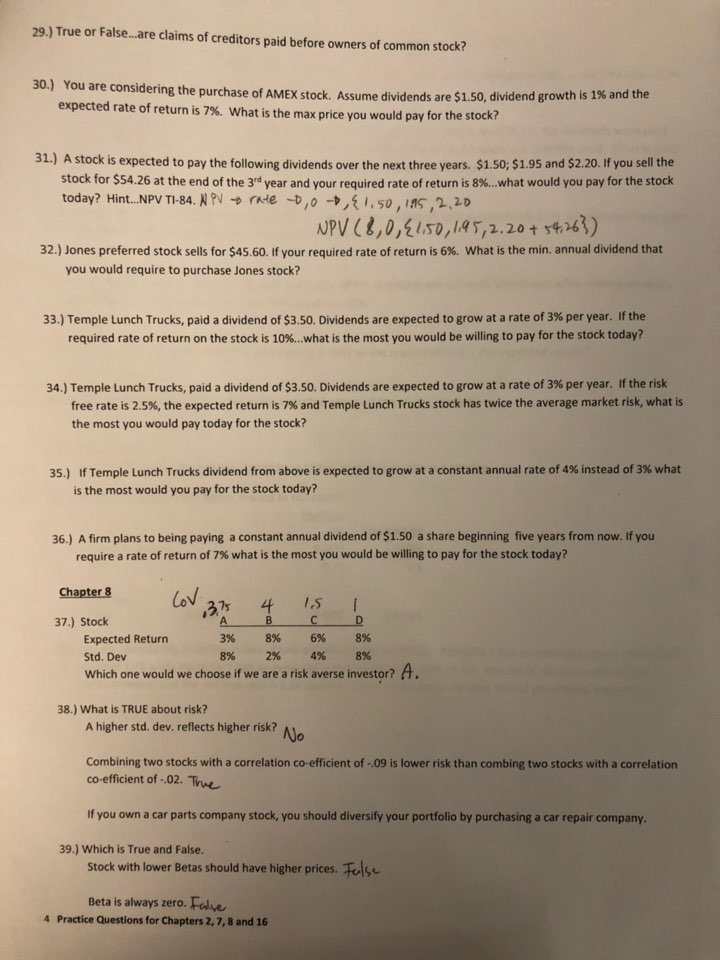

can I please have answer with solutions? thank you! 29.) True or False...are claims of creditors paid before owners of common stock? 30.) You are

can I please have answer with solutions? thank you!

29.) True or False...are claims of creditors paid before owners of common stock? 30.) You are considering the purchase of AMEX stock. Assume dividends are $1.50, dividend grow expected rate of return is 7%. What is the max price you would pay for the stock 31. A Stock is expected to pay the following dividends over the next three vears. $1.50: $1.95 and $2.20. If you sell the stock for $54.26 at the end of the 3rd year and your required rate of return is 8%...what would you pay for the stock today? Hint...NPV TI-84. NPV rate -0,0 ,1,50,195, 2,20 NPV (8,0, 4150, 195, 2.20 + 54,263) 32.) Jones preferred stock sells for $45.60. If your required rate of return is 6%. What is the min. annual dividend that you would require to purchase Jones stock? 33.) Temple Lunch Trucks, paid a dividend of $3.50. Dividends are expected to grow at a rate of 3% per year. If the required rate of return on the stock is 10%...what is the most you would be willing to pay for the stock today? 34.) Temple Lunch Trucks, paid a dividend of $3.50. Dividends are expected to grow at a rate of 3% per year. If the risk free rate is 2.5%, the expected return is 7% and Temple Lunch Trucks stock has twice the average market risk, what is the most you would pay today for the stock? 35.) If Temple Lunch Trucks dividend from above is expected to grow at a constant annual rate of 4% instead of 3% what is the most would you pay for the stock today? 36.) A firm plans to being paying a constant annual dividend of $1.50 a share beginning five years from now. If you require a rate of return of 7% what is the most you would be willing to pay for the stock today? Chapter 8 LOV 37 4 1.5 L 37.) Stock A B C D Expected Return 3% 8% 6% 8% Std. Dev 8% 2% 4% 8% Which one would we choose if we are a risk averse investor? A. 38.) What is TRUE about risk? A higher std. dev.reflects higher risk? A Combining two stocks with a correlation co-efficient of -.09 is lower risk than combing two stocks with a correlation co-efficient of -.02. True If you own a car parts company stock, you should diversify your portfolio by purchasing a car repair company 39.) Which is True and False. Stock with lower Betas should have higher prices. Teise Beta is always zero. Falve 4 Practice Questions for Chapters 2, 7, 8 and 16Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started