Answered step by step

Verified Expert Solution

Question

1 Approved Answer

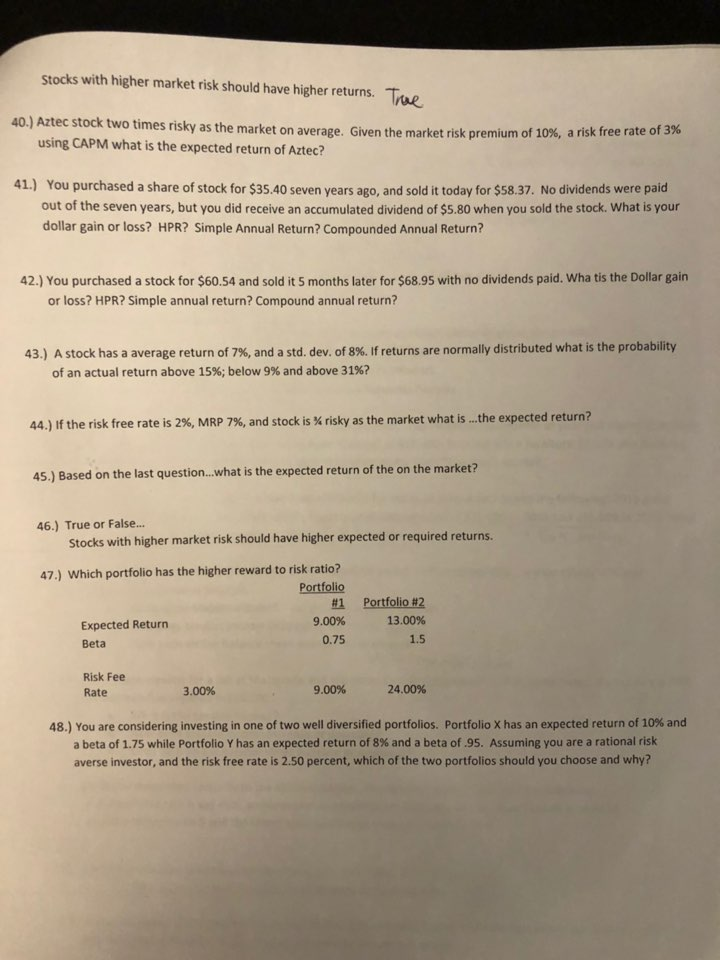

can I please have answer with solutions? thank you! Stocks with higher market risk should have higher returns. True 40.) Aztec stock two times risky

can I please have answer with solutions? thank you!

Stocks with higher market risk should have higher returns. True 40.) Aztec stock two times risky as the market on average. Given the market risk premium of 10%, a risk freera using CAPM what is the expected return of Aztec? 41.) You purchased a share of stock for $35.40 seven years ago, and sold it today for $58.37. No dividends were paid out of the seven years, but you did receive an accumulated dividend of $5.80 when you sold the stock. What is your dollar gain or loss? HPR? Simple Annual Return? Compounded Annual Return? 42.) You purchased a stock for $60.54 and sold it 5 months later for $68.95 with no dividends paid. Whatis the Dollar gain or loss? HPR? Simple annual return? Compound annual return? 43.) A stock has a average return of 7%, and a std. dev. of 8%. If returns are normally distributed what is the probability of an actual return above 15%; below 9% and above 31%? 44.) If the risk free rate is 2%, MRP 7%, and stock is % risky as the market what is ...the expected return? 45.) Based on the last question...what is the expected return of the on the market? 46.) True or False... Stocks with higher market risk should have higher expected or required returns. 47.) Which portfolio has the higher reward to risk ratio? Portfolio #1 Expected Return 9.00% Beta 0.75 Portfolio #2 13.00% 1.5 Risk Fee Rate 3.00% 9.00% 24.00% 48.) You are considering investing in one of two well diversified portfolios Portfolio X has an expected return of 10% and a beta of 1.75 while Portfolio Y has an expected return of 8% and a beta of 95. Assuming you are a rational risk averse investor, and the risk free rate is 2.50 percent, which of the two portfolios should you choose and whyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started