Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can I please have help with answering these 3 questions 18 Preferred stock is different from common stock a because preferred stock is only available

Can I please have help with answering these 3 questions

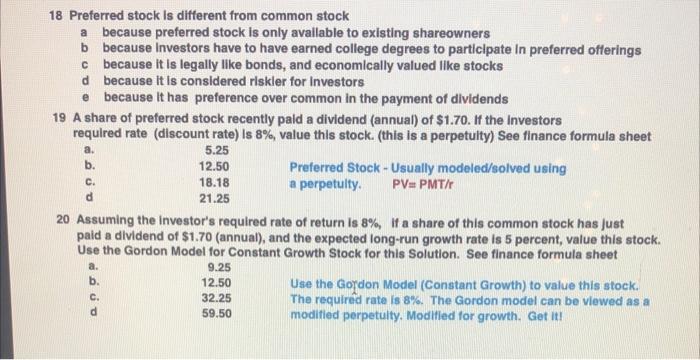

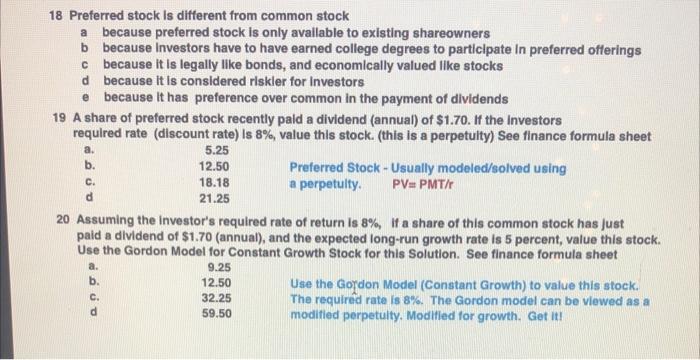

18 Preferred stock is different from common stock a because preferred stock is only available to existing shareowners b because Investors have to have earned college degrees to participate in preferred offerings because it is legally like bonds, and economically valued like stocks because it is considered riskler for Investors because it has preference over common in the payment of dividends d e 19 A share of preferred stock recently paid a dividend (annual) of $1.70. If the investors required rate (discount rate) is 8%, value this stock. (this is a perpetulty) See finance formula sheet a. 5.25 b. C. d 12.50 18.18 21.25 a. b. C. 20 Assuming the investor's required rate of return is 8%, if a share of this common stock has just paid a dividend of $1.70 (annual), and the expected long-run growth rate is 5 percent, value this stock. Use the Gordon Model for Constant Growth Stock for this Solution. See finance formula sheet 9.25 Preferred Stock - Usually modeled/solved using a perpetulty. PV=PMT/r 12.50 32.25 59.50 Use the Gordon Model (Constant Growth) to value this stock. The required rate is 8%. The Gordon model can be viewed as a modified perpetuity. Modified for growth. Get it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started