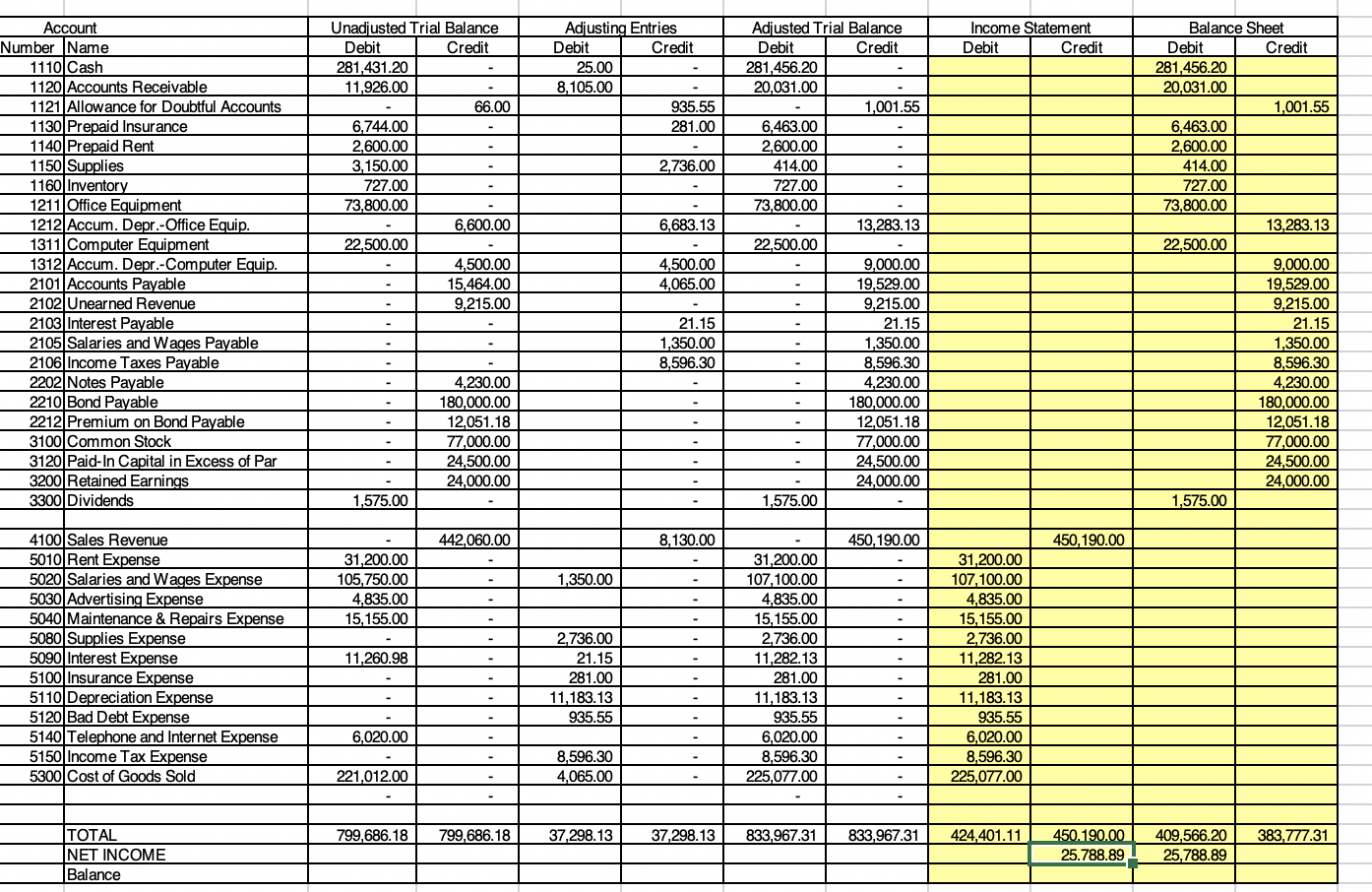

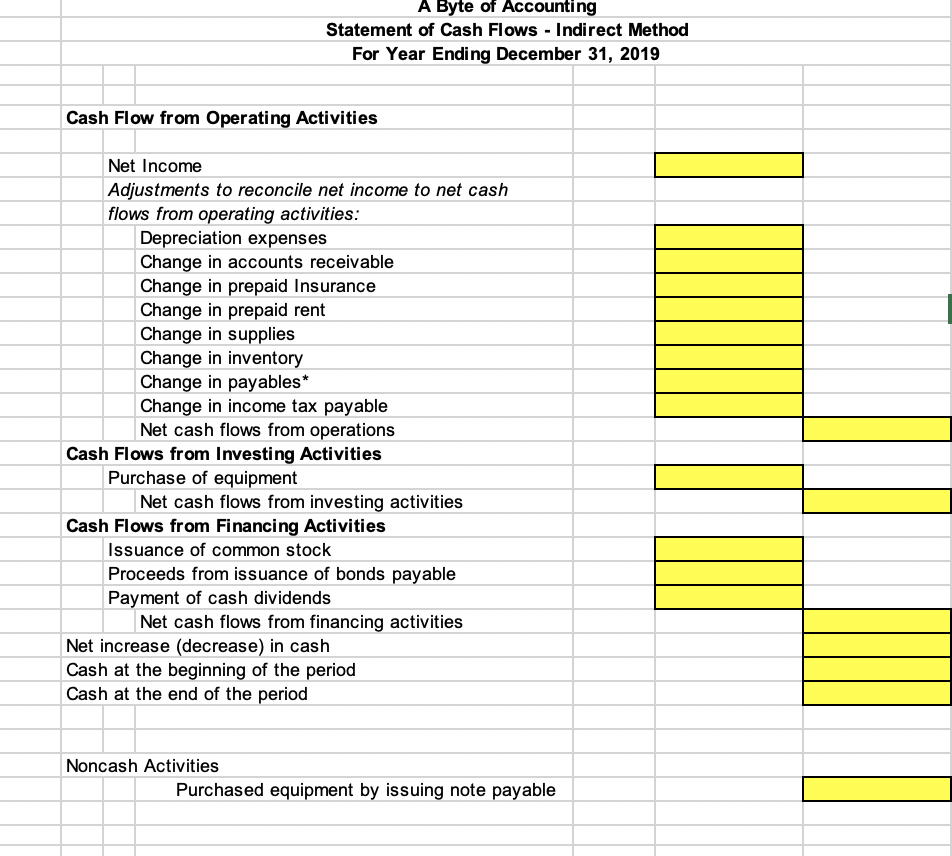

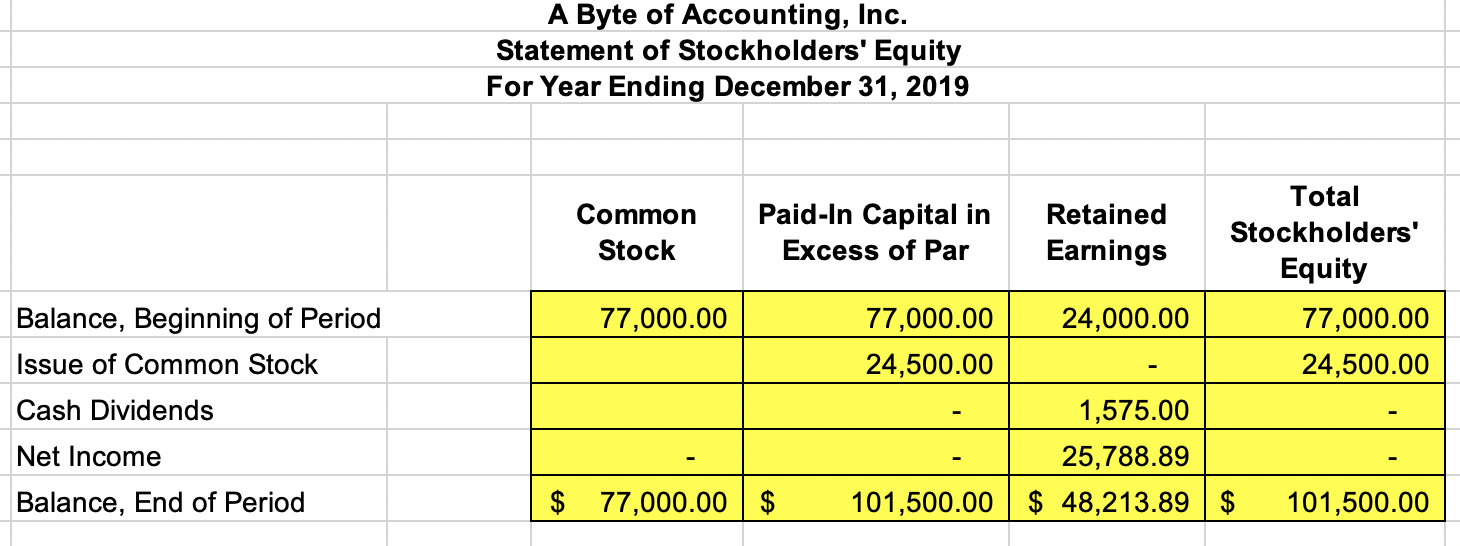

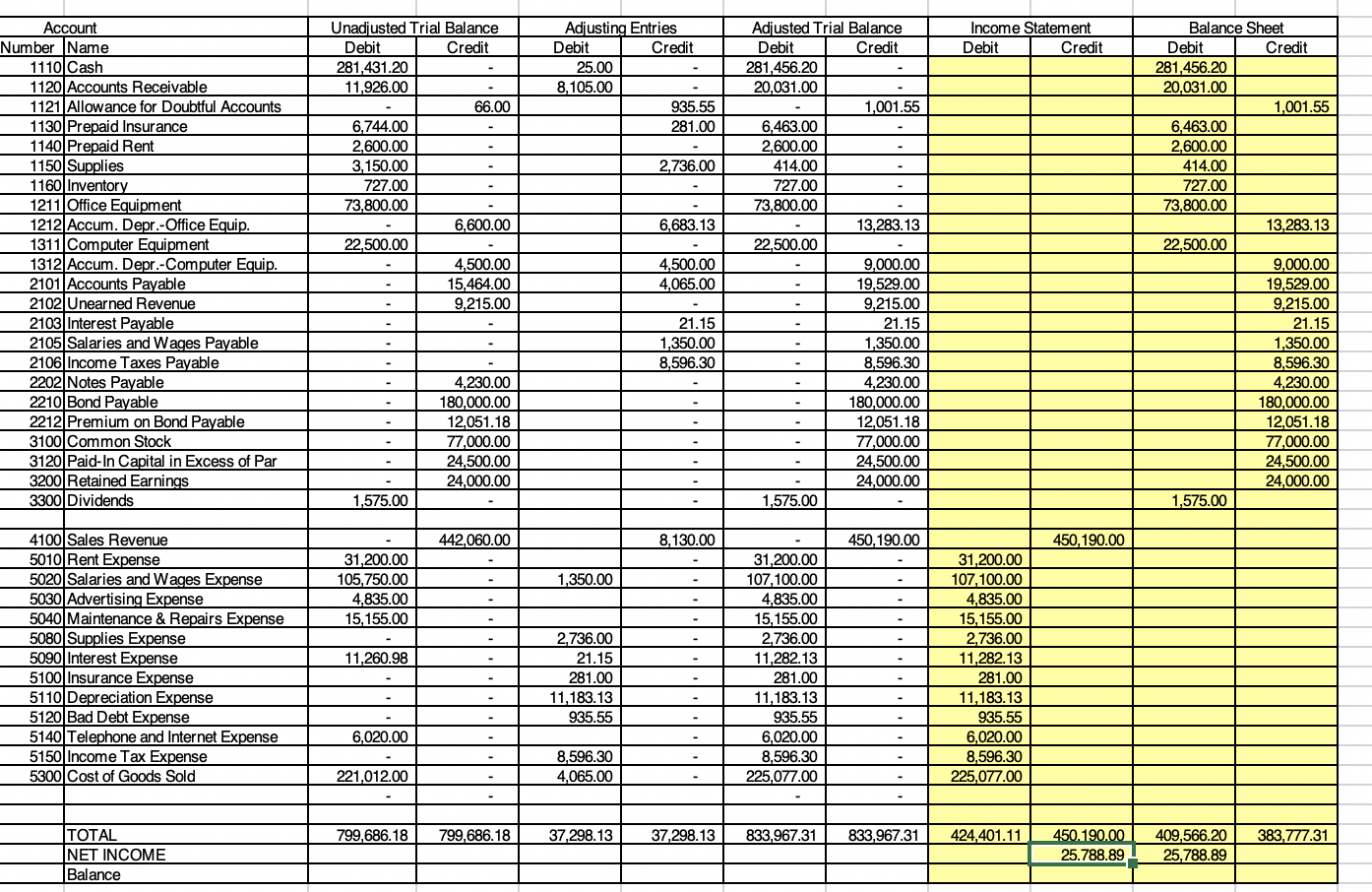

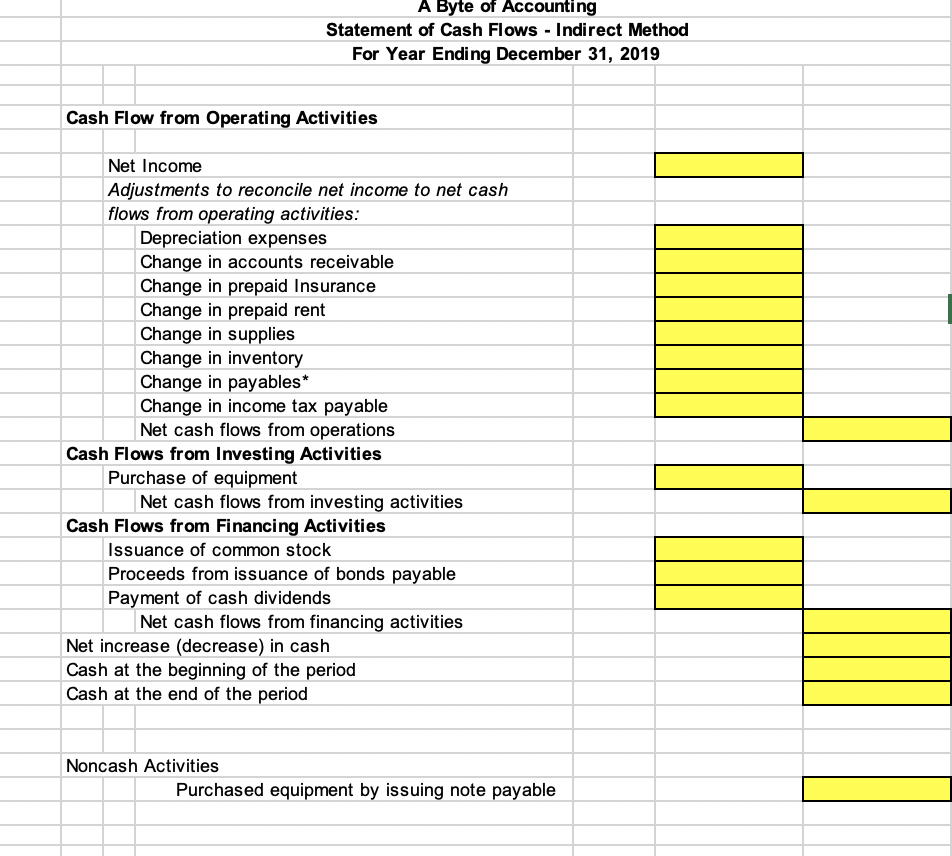

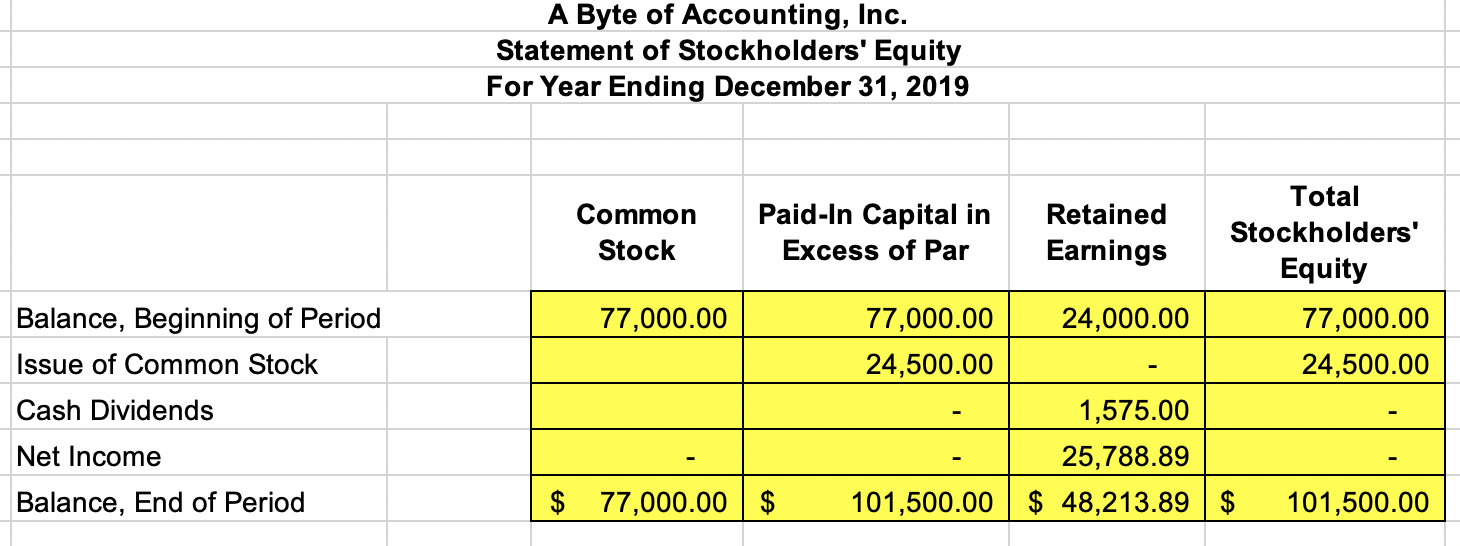

Can i please have some help filling these out ? On S.E only retained earnings is correct?

What is missing ?

Thank you!

Income Statement Debit Credit Credit Adjusting Entries Debit Credit 25.00 8,105.00 935.55 281.00 Unadjusted Trial Balance Debit Credit 281,431.20 11,926.00 66.00 6,744.00 2,600.00 3,150.00 727.00 73,800.00 6,600.00 22,500.00 4,500.00 15,464.00 9,215.00 2,736.00 Account Number Name 1110 Cash 1120 Accounts Receivable 1121 Allowance for Doubtful Accounts 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Supplies 1160 Inventory 1211 Office Equipment 1212 Accum. Depr.-Office Equip. 1311 Computer Equipment 1312 Accum. Depr.-Computer Equip. 2101 Accounts Payable 2102 Unearned Revenue 2103 Interest Payable 2105 Salaries and Wages Payable 2106 Income Taxes Payable 2202 Notes Payable 2210 Bond Payable 2212 Premium on Bond Payable 3100 Common Stock 3120 Paid-In Capital in Excess of Par 3200 Retained Earnings 3300 Dividends 6,683.13 4,500.00 4,065.00 Adjusted Trial Balance Debit Credit 281,456.20 20,031.00 1,001.55 6,463.00 2,600.00 414.00 727.00 73,800.00 13,283.13 22,500.00 9,000.00 19,529.00 9,215.00 21.15 1,350.00 8,596.30 4,230.00 180,000.00 12,051.18 77,000.00 24,500.00 24,000.00 1,575.00 Balance Sheet Debit 281,456.20 20,031.00 1,001.55 6,463.00 2,600.00 414.00 727.00 73,800.00 13,283.13 22,500.00 9,000.00 19,529.00 9,215.00 21.15 1,350.00 8,596.30 4,230.00 180,000.00 12,051.18 77,000.00 24,500.00 24,000.00 1,575.00 21.15 1,350.00 8,596.30 - - 4,230.00 180,000.00 12,051.18 77,000.00 24,500.00 24,000.00 1,575.00 442,060.00 8,130.00 450,190.00 450,190.00 1,350.00 31,200.00 105,750.00 4,835.00 15,155.00 4100 Sales Revenue 5010 Rent Expense 5020 Salaries and Wages Expense 5030 Advertising Expense 5040 Maintenance & Repairs Expense 5080 Supplies Expense 5090 Interest Expense 5100 Insurance Expense 5110 Depreciation Expense 5120 Bad Debt Expense 5140 Telephone and Internet Expense 5150 Income Tax Expense 5300 Cost of Goods Sold 11,260.98 2,736.00 21.15 281.00 11,183.13 935.55 31,200.00 107,100.00 4,835.00 15,155.00 2,736.00 11,282.13 281.00 11,183.13 935.55 6,020.00 8,596.30 225,077.00 31,200.00 107,100.00 4,835.00 15,155.00 2,736.00 11,282.13 281.00 11,183.13 935.55 6,020.00 8,596.30 225,077.00 6,020.00 221,012.00 8,596.30 4,065.00 799,686.18 799,686.18 37,298.13 37,298.13 833,967.31 833,967.31 424,401.11 383,777.31 TOTAL NET INCOME Balance 450.190.00 25.788.89 409,566.20 25,788.89 A Byte of Accounting Statement of Cash Flows - Indirect Method For Year Ending December 31, 2019 Cash Flow from Operating Activities Net Income Adjustments to reconcile net income to net cash flows from operating activities: Depreciation expenses Change in accounts receivable Change in prepaid Insurance Change in prepaid rent Change in supplies Change in inventory Change in payables* Change in income tax payable Net cash flows from operations Cash Flows from Investing Activities Purchase of equipment Net cash flows from investing activities Cash Flows from Financing Activities Issuance of common stock Proceeds from issuance of bonds payable Payment of cash dividends Net cash flows from financing activities Net increase (decrease) in cash Cash at the beginning of the period Cash at the end of the period Noncash Activities Purchased equipment by issuing note payable A Byte of Accounting, Inc. Statement of Stockholders' Equity For Year Ending December 31, 2019 Balance, Beginning of Period Issue of Common Stock Cash Dividends Net Income Balance, End of Period Total Common Paid-In Capital in Retained Stockholders' Stock Excess of Par Earnings Equity 77,000.00 77,000.00 24,000.00 77,000.00 24,500.00 24,500.00 1,575.00 25,788.89 $ 77,000.00 $ 101,500.00 $ 48,213.89 $ 101,500.00