Answered step by step

Verified Expert Solution

Question

1 Approved Answer

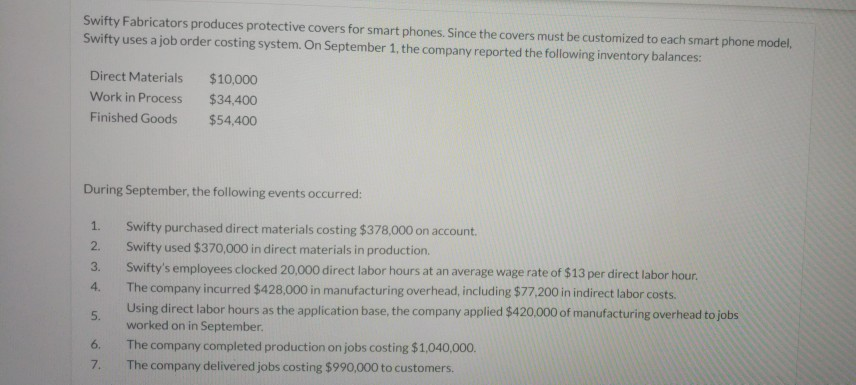

Can I receive help on this problem? Can I recieve help on the total manufacturing costs? Swifty Fabricators produces protective covers for ur phone. Since

Can I receive help on this problem?

Can I recieve help on the total manufacturing costs?

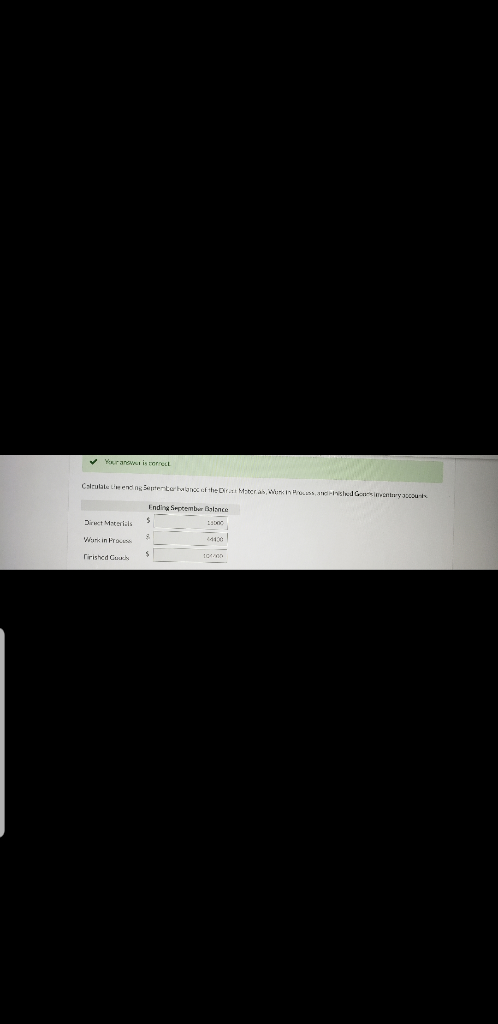

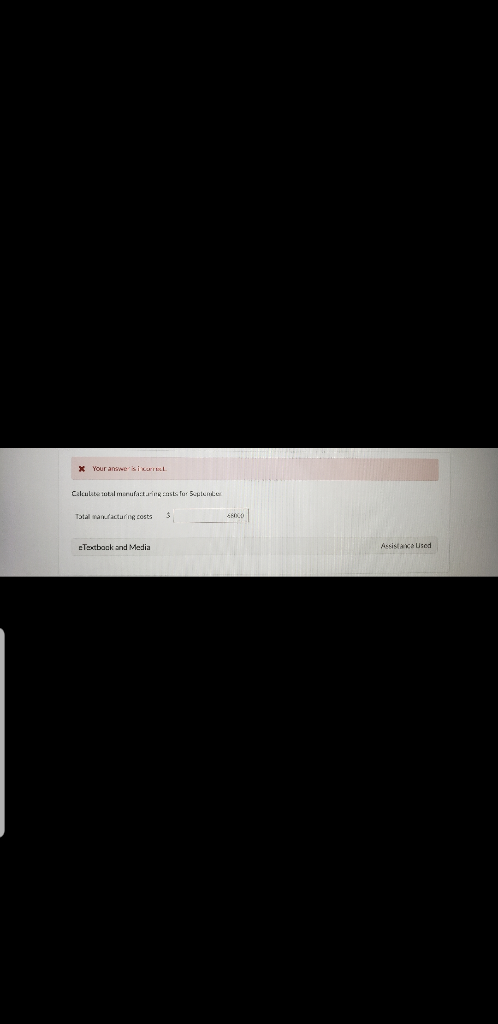

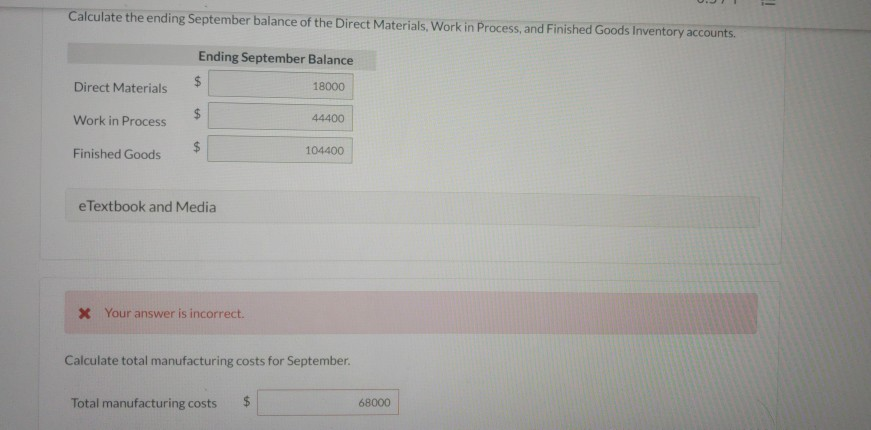

Swifty Fabricators produces protective covers for ur phone. Since the covers must customized to achsmartphone model Swifty uses a job order costing system. On Septuinber 1, the bany reported the followida entry balances Direct Materials Work in Process Finished Goods $10.000 $34.400 $54,400 During September, the following events occurred 1. 2. 4. Swifty purchased direct materials casting $370,000 1xccount Swifty used $370,000 in direct materials in production. Swifty's employees clocked 20,000 direct labor hours at a wipe rate of $13 per direct labor hour. The company incurred $425,000 in manufacturing overhead, including $7/2010 in indirect labor costs. Usirg direct labor hours as the application base, the company applied $420,000 of manufacturing overhead to jobs worked on in September. The company completed production on jos casting 51.040000 The compary delivered job cestire $90,000 to customers 5. 6 7. Womancis L Callend ng SanoftheDira Mobcrab, Wund in den very co Ending September stance Diwt Mis Work in Pro Finished Guy X Your awesi Calculate total manufattast. Tur 5L Total van.acturing costs 5 6000 Textbook and Media ASSISK Used Swifty Fabricators produces protective covers for smart phones. Since the covers must be customized to each smart phone model, Swifty uses a job order costing system. On September 1, the company reported the following inventory balances: Direct Materials Work in Process Finished Goods $10,000 $34,400 $54,400 During September, the following events occurred: 1. 2. 3. 4. Swifty purchased direct materials costing $378,000 on account. Swifty used $370,000 in direct materials in production Swifty's employees clocked 20,000 direct labor hours at an average wage rate of $13 per direct labor hour. The company incurred $428,000 in manufacturing overhead, including $77,200 in indirect labor costs. Using direct labor hours as the application base, the company applied $420,000 of manufacturing overhead to jobs worked on in September The company completed production on jobs costing $1,040,000 The company delivered jobs costing $990,000 to customers. 5. 6. 7. - Calculate the ending September balance of the Direct Materials, Work in Process, and Finished Goods Inventory accounts. Ending September Balance $ 18000 Direct Materials $ Work in Process 44400 $ Finished Goods 104400 e Textbook and Media * Your answer is incorrect. Calculate total manufacturing costs for September. Total manufacturing costs 68000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started