Answered step by step

Verified Expert Solution

Question

1 Approved Answer

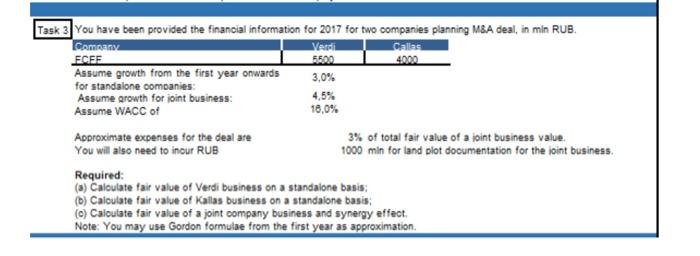

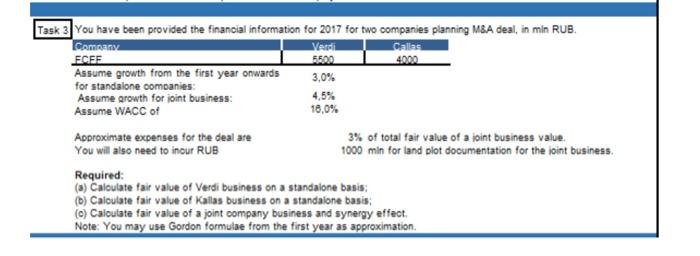

can not be more clear :( Task 3 You have been provided the financial information for 2017 for two companies planning MBA deal in min

can not be more clear :(

Task 3 You have been provided the financial information for 2017 for two companies planning MBA deal in min RUB. Camna Vedi Callas ECFE 5.500 4000 Assume growth from the first year onwards 3,0% for standalone companies Assume growth for joint business: Assume WACC of 18,0% Approximate expenses for the deal are 3% of total fair value of a joint business value. You will also need to inour RUB 1000 min for land plot documentation for the joint business. Required: (3) Calculate fair value of Verdi business on a standalone basis: (6) Calculate fair value of Kallas business on a standalone basis (C) Calculate fair value of a joint company business and synergy effect Note: You may use Gordon formulae from the first year as approximation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started