Question

The below information is all I have. Do not ask for more information. The case is in 2 attached pictures. 1. Can Office Smart do

The below information is all I have. Do not ask for more information. The case is in 2 attached pictures.

1. Can Office Smart do an annual cleanup? If not, if you price the credit as a working capital loan, do you underprice the loan? If the loan is not seasonal, what is it?

2. Do you want key man life insurance for Eric? In what amount? Keyman insurance is a life insurance policy purchased by a business to compensate for financial losses that would arise from the death or extended incapacity of an important member of the business, in this case, Eric Farland.

3. Should you require all operating accounts to be with your bank, and if so what advantages does this bring to the bank?

4. Do you want a personal guarantee from Eric Farland? Your bank could require his agreement to be liable for the debts of Office Smart. A personal guarantee signifies that the lender (oblige) can lay claim to the guarantor’s assets in case of the borrower’s (obligor) default.

5. What do you believe the outcome will be to this loan request?

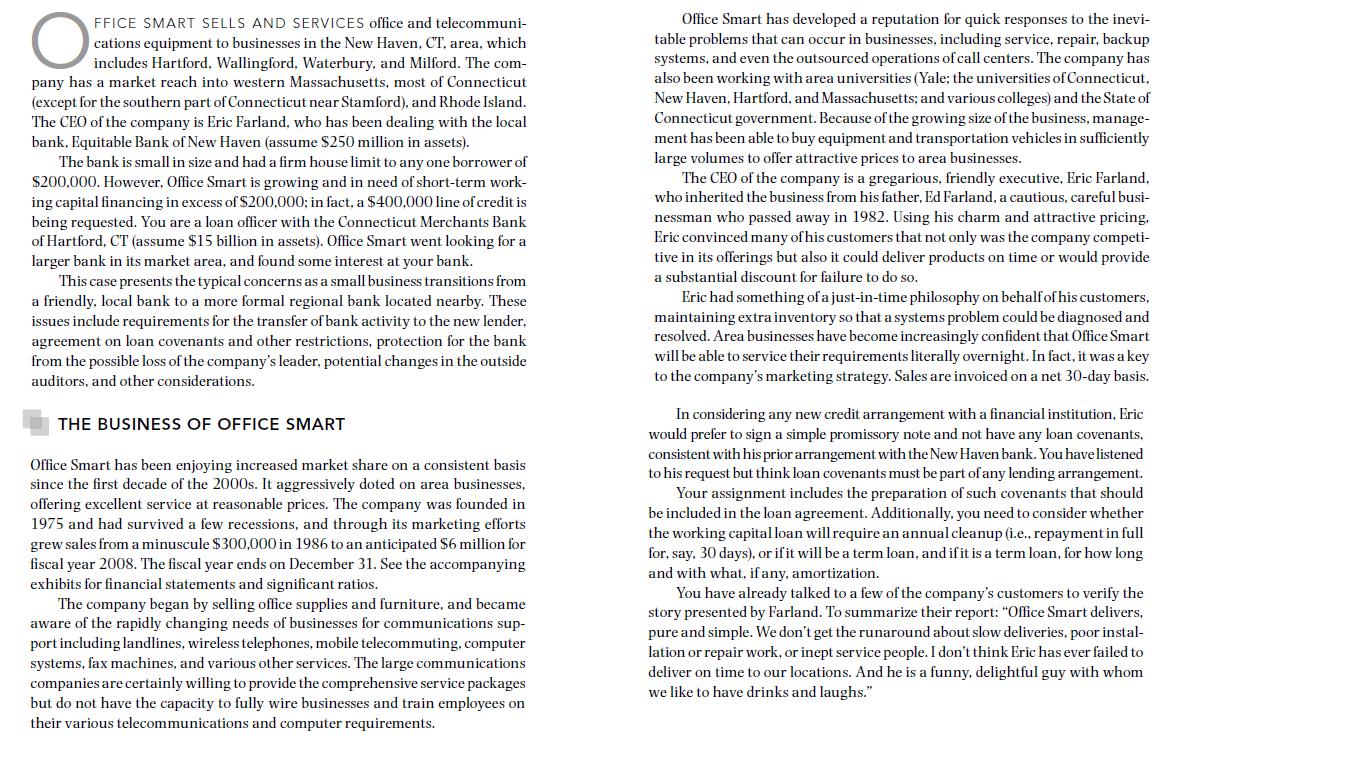

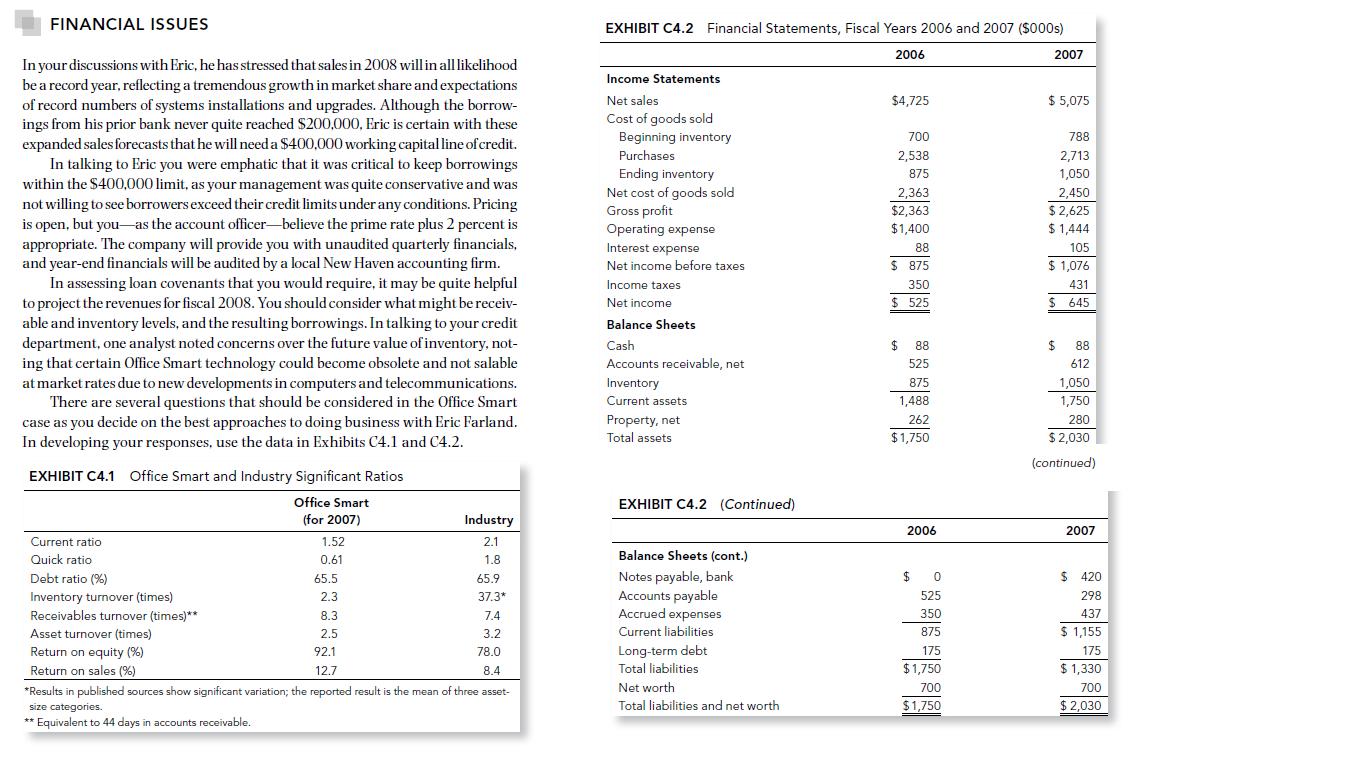

Office Smart has developed a reputation for quick responses to the inevi- table problems that can occur in businesses, including service, repair, backup systems, and even the outsourced operations of call centers. The company has also been working with area universities (Yale; the universities ofConnecticut, FFICE SMART SELLS AND SERVICES office and telecommuni- cations equipment to businesses in the New Haven, CT, area, which includes Hartford, Wallingford, Waterbury, and Milford. The com- pany has a market reach into western Massachusetts, most of Connecticut (except for the southern part of Connecticut near Stamford), and Rhode Island. The CEO of the company is Eric Farland, who has been dealing with the local bank, Equitable Bank of New Haven (assume $250 million in assets). The bank is small in size and had a firm house limit to any one borrower of $200,000. However, Office Smart is growing and in need of short-term work- ing capital financing in excess of $200,000; in fact, a $400,000 line of credit is being requested. You are a loan officer with the Connecticut Merchants Bank of Hartford, CT (assume $15 billion in assets). Office Smart went looking for a larger bank in its market area, and found some interest at your bank. This case presents the typical concerns as a small business transitions from a friendly, local bank to a more formal regional bank located nearby. These issues include requirements for the transfer of bank activity to the new lender, New Haven, Hartford, and Massachusetts; and various colleges) and the State of Connecticut government. Because of the growing size of the business, manage- ment has been able to buy equipment and transportation vehicles in sufficiently large volumes to offer attractive prices to area businesses. The CEO of the company is a gregarious, friendly executive, Eric Farland, who inherited the business from his father, Ed Farland, a cautious, careful busi- nessman who passed away in 1982. Using his charm and attractive pricing, Eric convinced many of his customers that not only was the company competi- tive in its offerings but also it could deliver products on time or would provide a substantial discount for failure to do so. Eric had something of a just-in-time philosophy on behalfof his customers, maintaining extra inventory so that a systems problem could be diagnosed and resolved. Area businesses have become increasingly confident that Office Smart will be able to service their requirements literally overnight. In fact, it was a key to the company's marketing strategy. Sales are invoiced on a net 30-day basis. agreement on loan covenants and other restrictions, protection for the bank from the possible loss of the company's leader, potential changes in the outside auditors, and other considerations. In considering any new credit arrangement with a financial institution, Eric would prefer to sign a simple promissory note and not have any loan covenants, consistent with his prior arrangement with the New Haven bank. You have listened to his request but think loan covenants must be part of any lending arrangement. Your assignment includes the preparation of such covenants that should be included in the loan agreement. Additionally, you need to consider whether the working capital loan will require an annual cleanup (i.e., repayment in full for, say, 30 days). or if it will be a term loan, and if it is a term loan, for how long and with what, if any, amortization. You have already talked to a few of the company's customers to verify the story presented by Farland. To summarize their report: "Office Smart delivers, pure and simple. We don't get the runaround about slow deliveries, poor instal- lation or repair work, or inept service people. I don't think Eric has ever failed to deliver on time to our locations. And he is a funny, delightful guy with whom we like to have drinks and laughs." THE BUSINESS OF OFFICE SMART Office Smart has been enjoying increased market share on a consistent basis since the first decade of the 2000s. It aggressively doted on area businesses, offering excellent service at reasonable prices. The company was founded in 1975 and had survived a few recessions, and through its marketing efforts grew sales from a minuscule $300,000 in 1986 to an anticipated $6 million for fiscal year 2008. The fiscal year ends on December 31. See the accompanying exhibits for financial statements and significant ratios. The company began by selling office supplies and furniture, and became aware of the rapidly changing needs of businesses for communications sup- port including landlines, wireless telephones, mobile telecommuting, computer systems, fax machines, and various other services. The large communications companies are certainly willing to provide the comprehensive service packages but do not have the capacity to fully wire businesses and train employees on their various telecommunications and computer requirements.

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The quality of accounts receivables is the likelihood that the cash flows that are owed to a company in the form of receivables are going to be collected Analyzing the quality of accounts receivables ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started